Trillion Energy (CSE: TCF) is expanding its multi-well development program following early success seen by the company. The firm is adding three wells to the program, which will bring the number of wells to be developed under the program to twenty.

Expansion of the program follows lessons learned from the first wells drilled in 2022. The additions consist of three side-track wells, which take less time to develop than long reach directional wells. They also have a cost benefit, in that they cost approximately $3.0 million less to develop than the directional wells, thanks in part to utilizing an existing section of well bore, from which a window is milled out from the casing to create a new well.

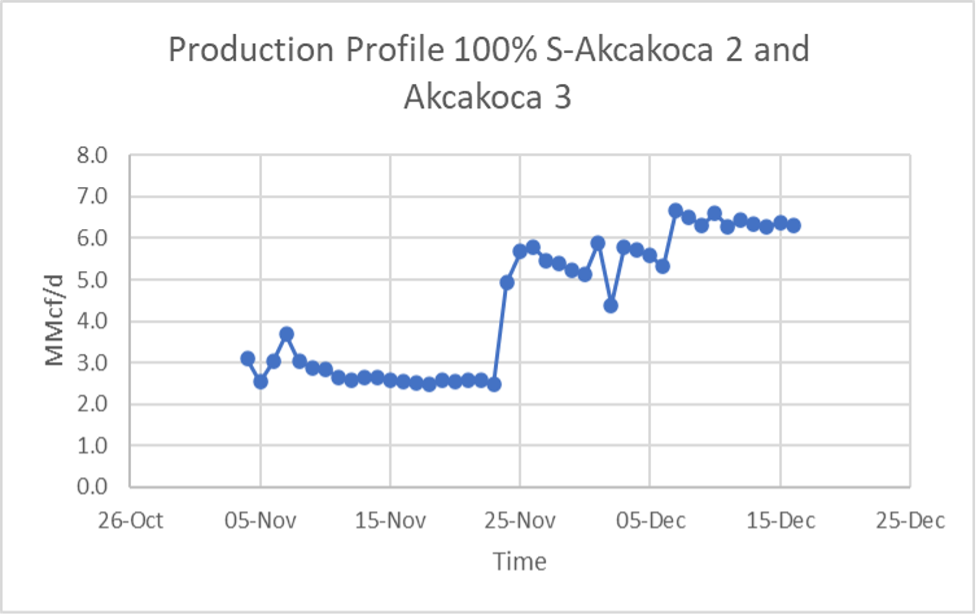

The firms previously developed South Akcakoca-2 well, one of the first wells put into production under the current multi-well program, was a side-track well, demonstrating that Trillion has the ability to conduct such well development.

The method typically takes 10-30 days to put a new well into production, versus 45-48 days for a new drill. As such, the firm now anticipates to complete eleven drill holes in 2023, increasing the firms production profile on a faster than previously expected timeline.

“During 2023 we are focusing on using the Uranus rig to increase production through new wells, sidetracks and workovers. An added benefit of drilling side-tracks from existing well boreholes is that they are already tied into the pipeline and production facility, so once drilled and completed the wells are immediately put on production. We are currently in the process of getting our partner’s feedback on the proposed side-tracks,” commented Trillion CEO Arthur Halleran.

As a result, the firm currently anticipates 13 wells to be producing natural gas within the SASB gas field by the end of 2023. Current pricing within the region is said to be at US$27/MCF, which represents some of the highest prices historically seen in the region.

The addition of three wells to the development program follows the late December announcement that the firm is expected to have generated $1.2 million in revenue during the month of November from gas sales. With the increasing production profile, December was then expected to see US$2.1 million in revenue, which is net to Trillion after royalties.

The two wells currently in production are said to be producing 451 boe/d after royalties net to Trillion, and are expected to generate between US$20 and US$24 million in revenue during 2023. The Guluc-2 and West-Akcokoca wells are also expected to come online in the current quarter, with the former expected to enter production at the end of the month, and the latter slated to come online in March, further enhancing the firms production profile.

“Trillion’s execution of the SASB development program and the immediate well production captured the highest gas prices seen in Turkiye and increased Trillion’s share of SASB production from almost zero to over 500 boe/d* in just a few months. We are confident that Trillion can execute its program in a timely and efficient manner,” commented Halleran at the time of announcement.

Halleran recently stated in an interview with The Deep Dive that production is slated to double in the first quarter following the Guluc-2 and West-Akcokoca wells coming online, with that development then set to fund further drilling.

“Every well we produce, we put on production, will give us another $1.0 – $1.5 million dollars per month, which then means we start generating a lot of revenue,” commented Halleran.

“The revenue from those wells [developed under program A], as we put them on [to production] will allow us to be self funding for additional drilling for program B, so another ten wells. Because it works out to about US$3.4 .. to US$4.0 million a month to drill wells, and when we start producing US$4.0 – $5.0 million from our existing revenue we’ll be self funding and we’ll keep using that money to keep drilling. We have enough locations to keep going until about 2024.”

The company has stated that it expects production volumes from the additional sidetracks added to the program to compare to other wells being developed under the current program. Production volume, log evaluations, perforation intervals and gas production behaviour is said to have been evaluated in coming to this conclusion, which was also evaluated to calculate the remaining gas reserves within the Akkaya and East Ayazli gas fields.

It is currently unclear where these additional wells will be located within the SASB gas field, or when specifically Trillion intends to begin their development this year.

Trillion Energy last traded at $0.385 on the CSE.

FULL DISCLOSURE: Trillion Energy is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Trillion Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.