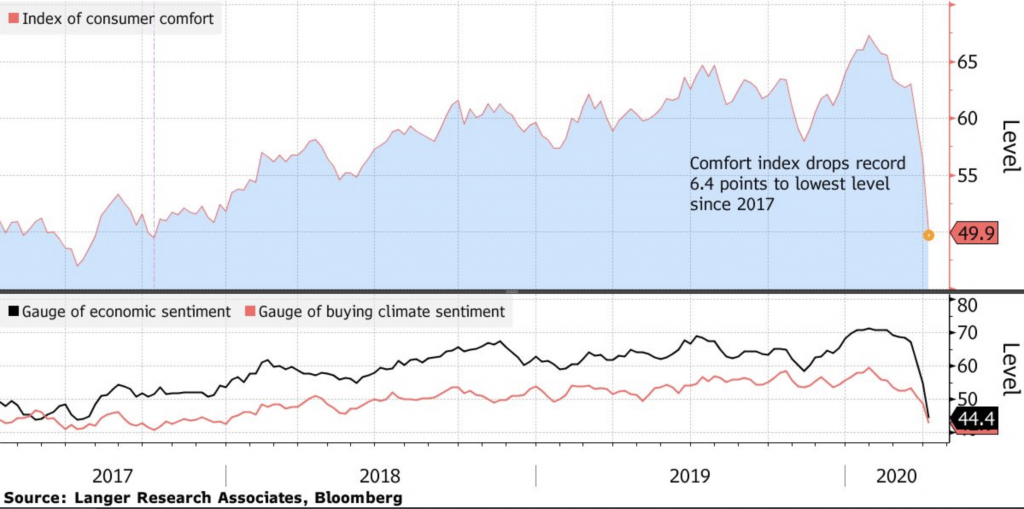

The Consumer Comfort Index (CCI) has plummeted in excess of 13 points over the last three weeks- an alarming observation regarding the state of the economy, since such a drastic drop has not been recorded since 1985.

The Bloomberg Consumer Comfort Index is an economic wellness indicator that measures how optimistic consumers are with respect to the economy, and their own personal financial situation. The consumer’s intertemporal choices affect their future spending habits, and if said consumer has an optimistic view of the economy, they will spend more and save less, or even borrow against future consumption. If on the other hand, optimism is low, then consumers will save more in the current consumption period.

Just in the week ending on April 4, the index dropped by 6.4 points to 49.9, which is the lowest it has been since October of 2017. The CCI’s subset measuring consumer’s confidence in the economy dropped by 10.6 points- the lowest the measure has been since July 2017. Moreover, the index’s second measure, which gauges consumer’s attitude towards the buying climate, has decreased 5.9 points, meanwhile consumer’s view of their own personal finances has slumped to the lowest rating in four months.

The CCI tells a story of the economy’s wellbeing; when consumer confidence is increasing, it means the economy is expanding and doing well. On the contrary however, when the consumer confidence decreases, that means the economy is contracting- which is suggestive of a looming recession.

Information for this briefing was found via ZeroHedge and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.