Consumers continued to pay substantially more for goods and services in November, as persistent inflationary pressures put more strain on central bank policy makers to raise interest rates ahead of forecasts.

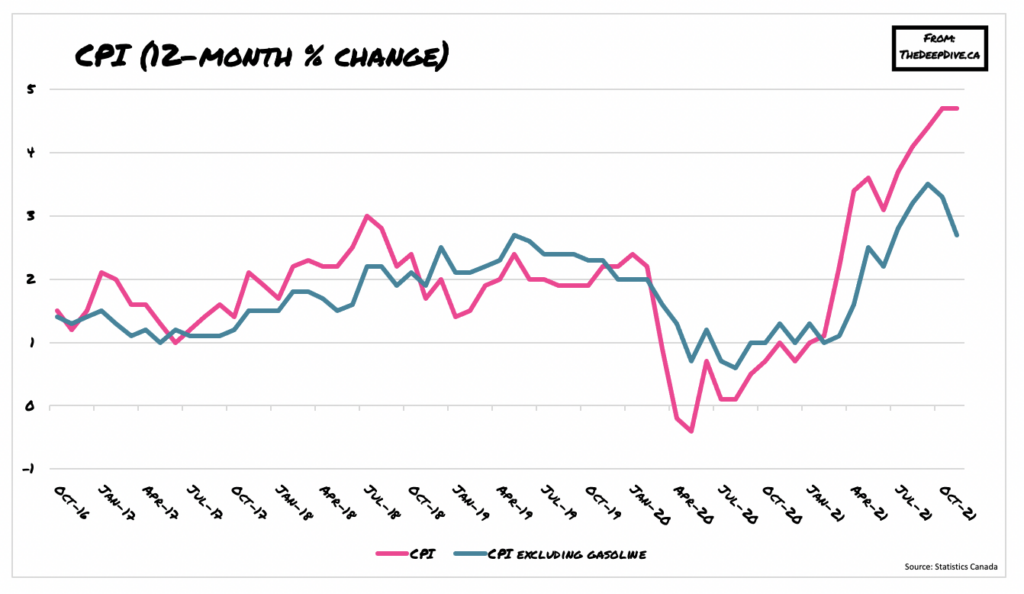

Annual inflation held steady at 4.7% in November, Statistics Canada reported on Wednesday, marking a gain of 0.2% from the prior month, and the highest level since 2003. Core inflation, which does not account for energy prices, hit 2.73% last month.

Last month’s report showed that prices increased across all eight major components, with gasoline prices rising by 43.6% from November 2020, marking the ninth consecutive month of annual gains above 20%. The price of food was up from 3.9% in October to 4.7%— the sharpest increase in almost seven years.

Inflation levels have now surpassed the Bank of Canada’s control range for the eighth consecutive month, as ongoing global supply chain bottlenecks and labour shortages continue to put added strain on consumer prices. The latest CPI print will likely bolster expectations that the Bank of Canada will raise interest rates in early 2022, with markets pricing in at least 5 rate hikes throughout next year.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Choke Points: The War on Inflation is Getting Pretty Selective

Inflation is too high, so central banks are raising interest rates to try and bring...