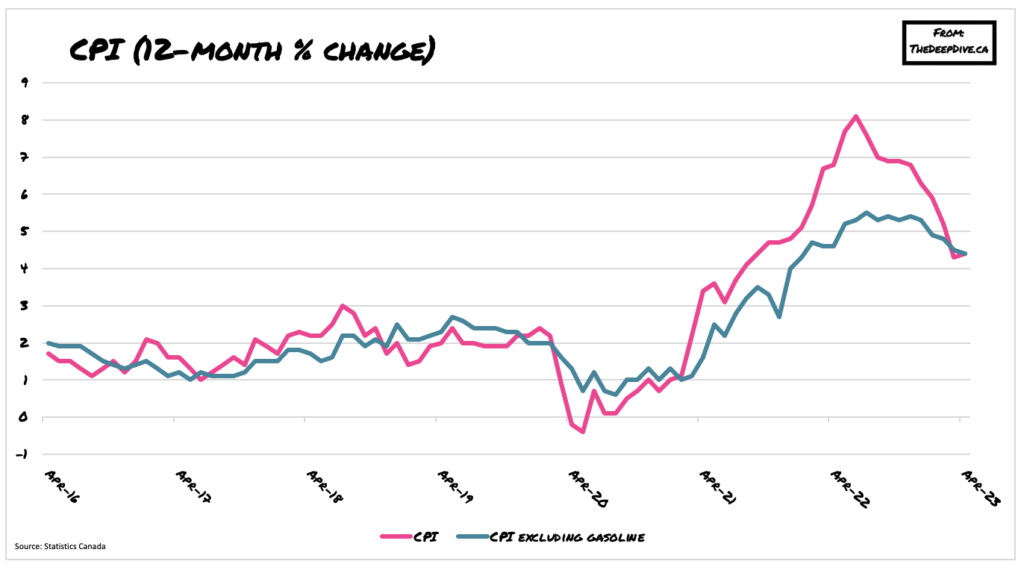

After showing signs of abating for several consecutive months even amid a Bank of Canada policy rate hike pause, consumer prices unexpectedly increased in April.

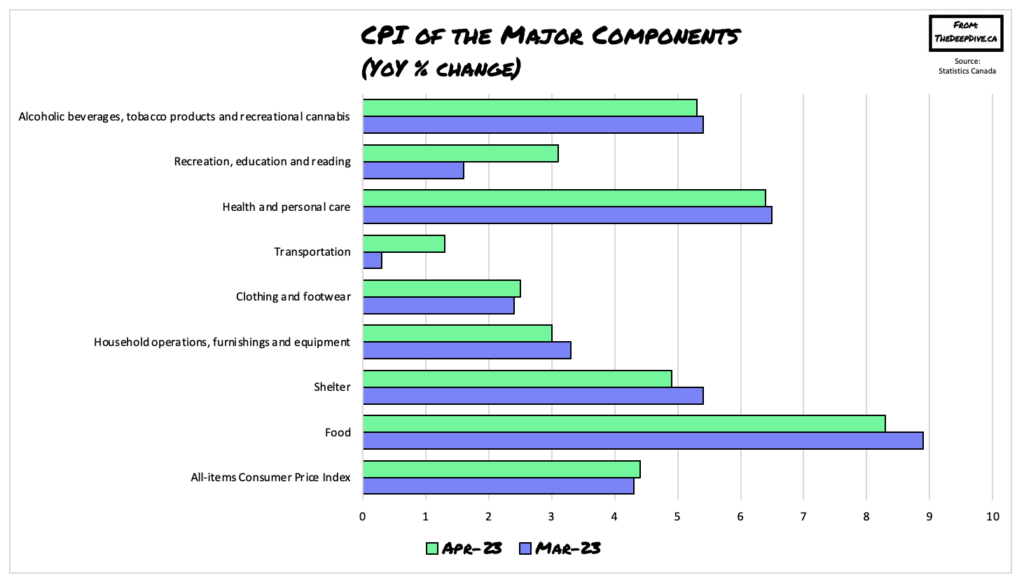

Latest figures from Statistics Canada showed that the CPI rose another 0.7% month-over-month in April, following a 0.5% increase in March. Over the past 12 months, consumer prices are up 4.4%, after registering an annual 4.3% gain in the prior month. April’s unexpected increase comes in substantially higher than forecasts calling for an increase of only 4.1%, and is largely due to elevated rent prices and higher mortgage interest costs.

Core CPI, which doesn’t account for food and energy, was in line with forecasts and and also stood at 4.4% in April, but, too, failed to show signs of slowing down.

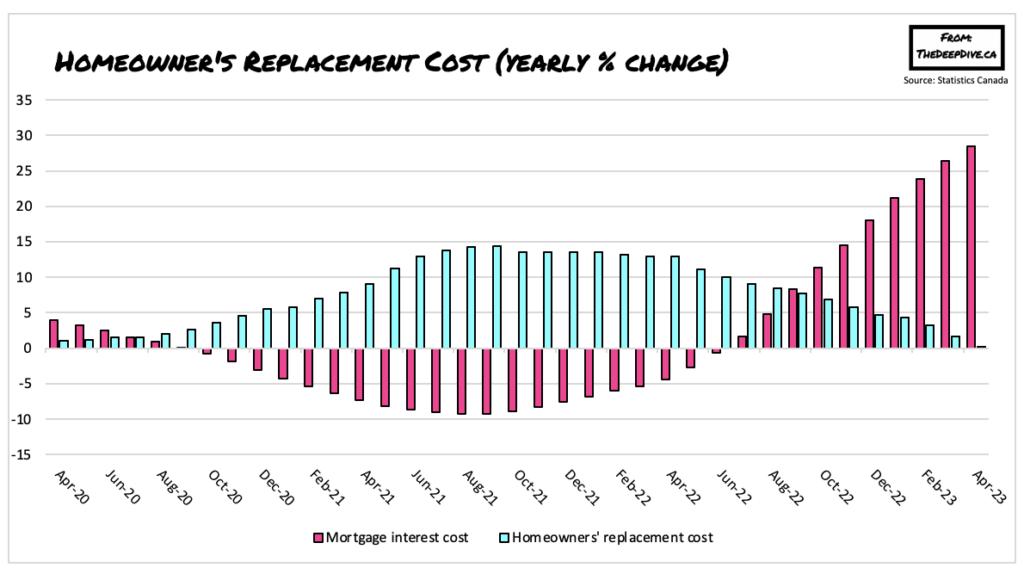

Shelter costs also continued rising last month, jumping 4.9% year-over-year following a 5.4% increase in March. Canadian homeowners paid 28.5% more in mortgage interest costs compared to April 2022, as more mortgages are renewed in a higher interest rate environment.

Gasoline prices rose 6.3% between March and April, but are still 7.7% lower compared to 12 months ago during heightened geopolitical turmoil in Ukraine and Russia. Food prices, meanwhile, are still historically high across Canada, rising another 9.1% in April following a 9.7% increase in March.

Information for this briefing was found via StatCan. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.