According to recent data compiled by the Commerce Department, consumer spending in the US dropped by the highest percentage on record for the month of April. Given the widespread lockdowns across the country as well as soaring unemployment rates, it is no wonder that consumers have been weary to spend their income on non-essential goods.

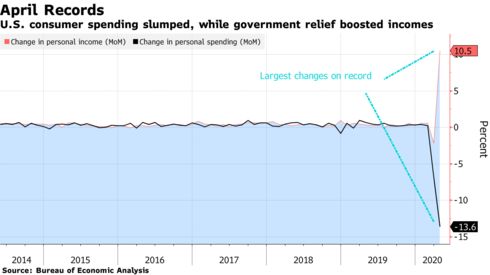

Household spending has declined by 13.6% in April, which attributes to largest single drop on a record that spans back 60 years, despite a previous Bloomberg estimate of only a 12.8% decrease. A significant portion of the decline is largely due to the fact that Americans have opted out of allocating their income towards restaurants, hospitality services, and food and beverages amid the coronavirus pandemic.

Although consumer spending has drastically fallen, the average disposable income has increased during the pandemic. It was previously estimated that incomes would drop by 5.9%; instead however, incomes in the US increased by 10.5%. Correspondingly, the personal savings rate has hit the highest on record at 33%. With respect to these numbers, a unique postulation therefore becomes evident: is the sudden increase in consumer savings a result of the economic shutdowns which thus temporarily hindered the availability of non-essential goods, or there a new shift in consumer habits that could contribute to structural changes beyond the elimination of lockdown restrictions?

As once postulated by John Maynard Keynes, the paradox of thrift describes an economic phenomenon where the increase in consumer savings actually further hinders the economy in question from recovering. The more aggregate consumer spending there is, the further the economy is pushed into a recession; then the worse the recession becomes, the more consumers want to save. Thus, the paradox of thrift creates a sort of negative reinforcing feedback loop – which makes a U-shaped economic recovery more and more likely as opposed to a V-shaped recovery that is touted by the likes of the US Federal Government.

Information for this briefing was found via CNBC, Bloomberg, Department of Commerce, and the Bureau of Economic Analysis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.