On October 13th, Cormark Securities initiated coverage on Royal Helium (TSXV: RHC) with a $0.80 and a Buy rating. Michael Mueller, Cormark’s analyst headlines the initiation note stating, “The Heir Apparent To A Revitalized Western Canadian Helium Industry.”

Royal Helium is an early stage helium exploration company with a strong foothold of land in southern Saskatchewan with almost 1 million acres of helium lands under lease or permit.

Mueller says that “Royal stands out as the “heir apparent” atop this emerging Western Canadian industry,” and Royal Helium is, “a rare opportunity for investors to gain exposure to the emerging helium industry in a region with proven helium production and known concentrations.”

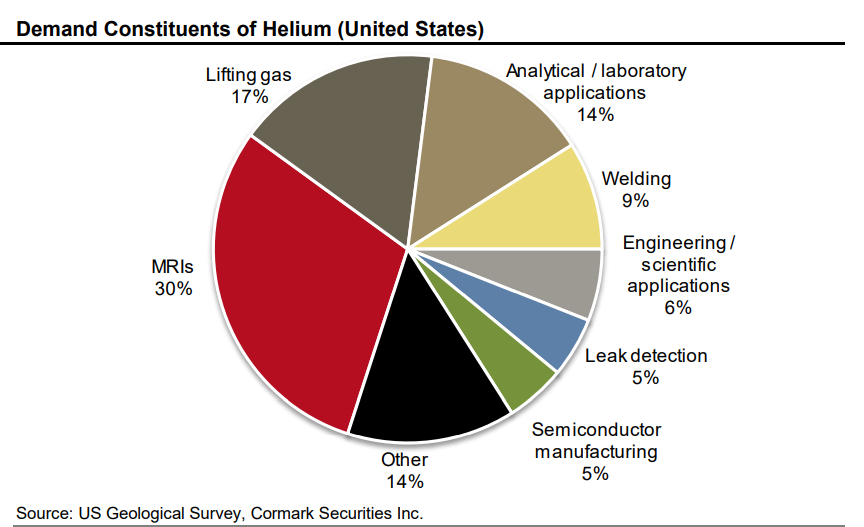

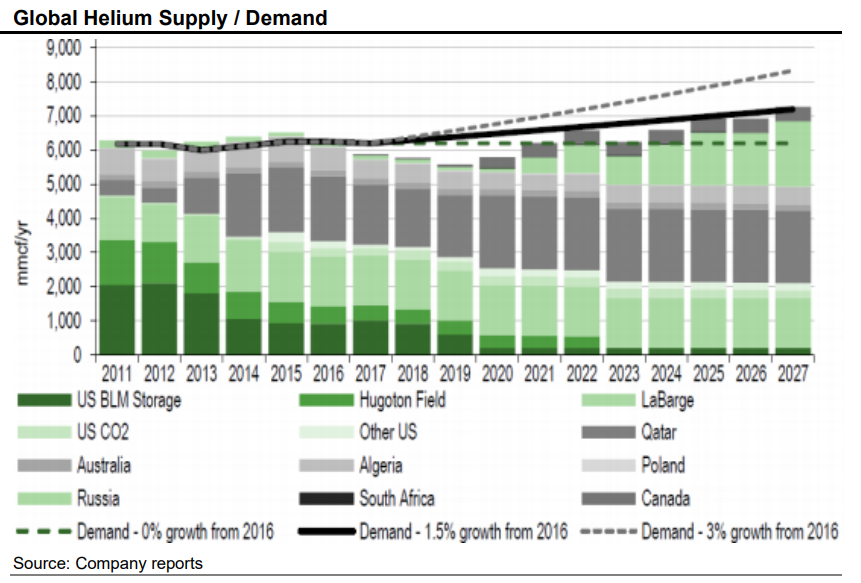

Mueller adds, “the current landscape for new entrants into this emerging industry has never been better.” Currently there is a global helium supply shortage that is being multiplied by the growing demand, which “has driven renewed interest into securing reliable sources.” This growing demand in part is responsible for the US Federal Helium Reserve depleting its resources.

Mueller says that Royal Helium has the “The Saskatchewan Advantage.” As Saskatchewan has known concentrations of helium and a long history of production in the province. Saskatchewan also has a stable regulatory environmen,t “with an attractive royalty regime and a largely idle, but knowledgeable, workforce currently redundant to the local O&G sector.”

Mueller touches on the need for Royal Helium to raise further funds for operations. The company is currently assessing different funding methods, as a 3-5 well program would require between $4.5 and $7.5 million to commence drilling. Mueller believes that the whole lot of $0.07c warrants will be exercised, giving the company $1.4 million. This will be on top of Royal’s roughly $2.5 million in cash already on hand. Mueller has modeled an issuance of $0.36, which is their 30-day VWAP.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.