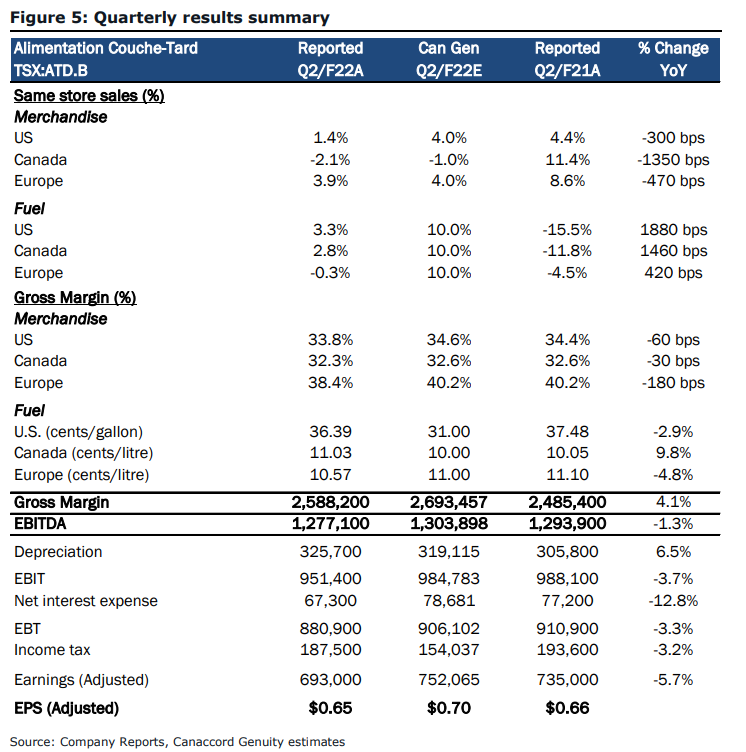

On November 23rd, Alimentation Couche-Tard Inc. (TSX: ATD.B) announced its fiscal second quarter results. The company announced $14.22 billion in revenue, growing 4.7% quarter over quarter, while the company gross profits decreased by 1% to $2.26 billion. The company reported $694.8 million of net income, down 9.1% quarter over quarter, and earnings per share of $0.65.

Of the $14.22 billion in revenues, total merchandise and service revenue was $4.0 billion and the gross margin for this line item was 33.8%. Same-store road transportation fuel volume increased 3.3%, 2.8%, and 0.3% in the U.S, Canada, and EU, respectively.

Alimentation Couche-Tard currently has 17 analysts covering the stock with an average 12-month price target of C$57.88, or a 21% upside to the current stock price. Out of the 17 analysts, 3 have strong buy ratings, 11 have buys and the last 3 have hold ratings. The street high sits at C$73.17 while the lowest price target is $45.

In Canaccord’s second quarter review, they reiterate their C$51 price target and hold rating, saying that increased margins helped the company report in-line results while near-term headwinds continue to persist.

For the quarterly results, the company’s $1.28 billion in adjusted EBITDA came in slightly below Canaccord’s $1.3 billion estimate, while earnings per share of $0.65 came in slightly below their $0.70 estimate. All wasn’t that bad though, with US fuel margins coming in at 36.4 cents per gallon, higher than the 31 cents per gallon Canaccord estimated. While Canada fuel margins came in 1 cent higher than their estimates at 11 cents per gallon while EU missed by 0.4 cents per gallon. There is still a gap between 2019 and 2022 fuel volumes but Canaccord writes, “The gap between current and pre-pandemic levels is attributable to ongoing work-from-home trends.”

Canaccord says that the companies merchandise operations are slowly returning to normal as same-store sales increased in both the US and EU while in Canada it decreased. Merchandise gross margins also came in better than Canaccord expected, as they say “customers opted in for higher-margin, smaller-sized products.”

Lastly, Canaccord says that “the labour market remains one of the most challenging the company can recall,” even with the company hiring 20,000 employees over the summer, it is still facing difficulties with finding workers. The company has started to hire part-time non-customer-facing gig workers and has spent $24 million during the second quarter for employee retention.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.