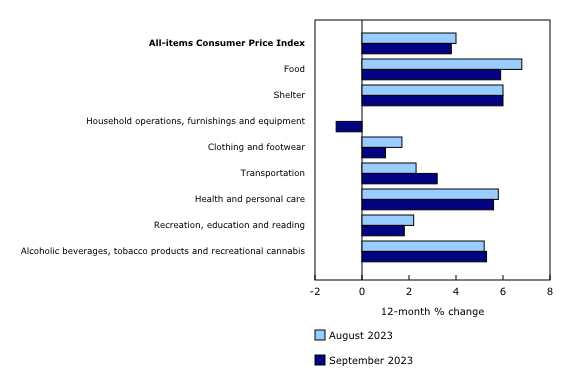

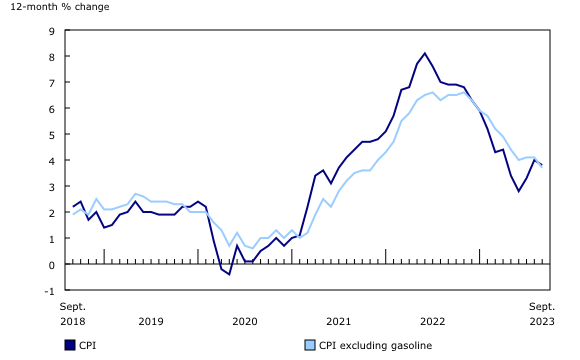

The Consumer Price Index (CPI) in September reported a 3.8% rise year-over-year, marking a deceleration from August’s 4.0% increase. This slowdown was influenced by a dip in prices across travel-related services, groceries, and durable goods.

Despite the overall CPI deceleration, gasoline prices experienced a significant uptick. In September, gasoline prices surged by 7.5%, a stark contrast from the modest 0.8% growth in August. If gasoline prices are excluded from the calculation, the CPI for September stands at 3.7%, down from August’s 4.1%.

In a monthly comparison, September’s CPI dipped by 0.1%, a shift from the 0.4% increase observed in August. This monthly deceleration was primarily driven by a month-over-month 1.3% decrease in gasoline prices. However, when adjusted for seasonality, the CPI for September saw a 0.2% rise, largely attributed to travel-related services.

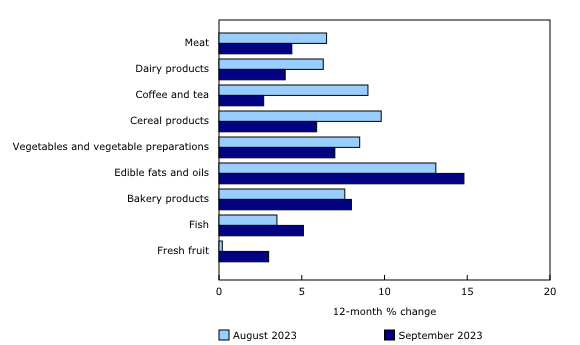

While grocery prices have been on a decline, they remain notably high. September reported a 5.8% year-over-year growth, a drop from August’s 6.9%. Noteworthy was the price slowdown in meat, dairy products, and coffee and tea.

In contrast, some items like bakery products and edible fats and oils observed faster price growth in September, with the latter jumping 14.8%.

Air transportation witnessed a significant 21.1% year-over-year price drop in September, reflecting the increased number of flights being offered.

Durable goods like new passenger vehicles, furniture, and household appliances experienced a price deceleration in September, with the most substantial slowdown observed in the new passenger vehicles segment, which gained 1.7%, compared to 3.1% in August.

Gasoline prices, which were up by 7.5% year-over-year in September, were primarily influenced by a base-year effect. This effect was emphasized by a 7.4% drop in prices in September 2022 due to increased global crude oil supply.

From a regional perspective, all provinces reported price increases in September, with six provinces witnessing a slower growth rate than in August.

Information for this briefing was found via Statistics Canada and Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.