Bringing inflation down to more palatable levels is beginning to cause economic pain in both the U.S. and Canada, and considerable further pain in the form of interest rate hikes and a consequent slowdown in the economies of each country is a near certainty. However, the inflation-related problems faced by government leaders and central banks in North America look fairly easy versus those in Europe, and the depth of these issues may force all central banks to be tougher for longer than investors expect.

We note several key considerations:

- European inflation is escalating at a much faster pace than it is on the other side of the Atlantic and shows few signs of slowing. Rising energy costs related to the Russia-Ukraine conflict are a key factor in Europe’s inflation data.

| Jan-22 | Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | |

| European Union | 5.1% | 5.9% | 7.4% | 7.4% | 8.1% | 8.6% |

| United States | 7.5% | 7.9% | 8.5% | 8.3% | 8.6% | (A) |

| Canada | 5.1% | 5.7% | 6.7% | 6.8% | 7.7% | (B) |

- While the U.S. and Canada began to take their first steps to combat inflation months ago, the European Central Bank (ECB) is not expected to implement its initial rate hike until late July. Furthermore, at that meeting the ECB is expected to raise its benchmark rate by only 25 basis points (bp) to a rate of negative 25 bp. The ECB has maintained negative rates since 2014.

A further increase is expected in September which may bring the interest rate to zero or above. Such extraordinarily low rates seem unlikely to make much of a dent in a concerted pattern of rising prices.

- One reason for the ECB’s reticence to increase rates to this point is the relative sluggishness of the European Union (EU) economy. While the economies of the U.S. and Canada are now larger than they were before the pandemic, Europe’s economy remains smaller than it was before the early 2020 discovery and onset of COVID-19. Raising rates in Europe under such circumstances must be considered a risky endeavor.

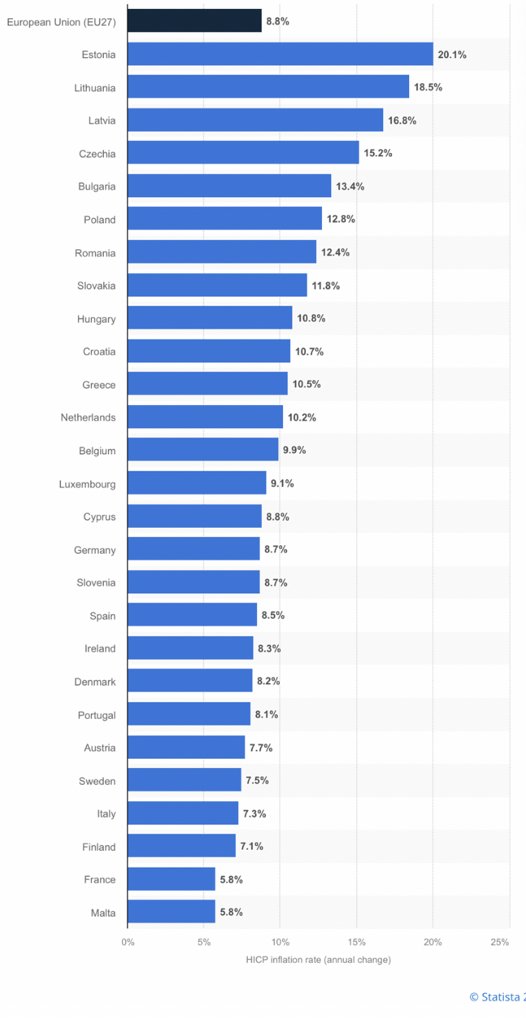

- Another reason for the ECB’s slowness to act is the wide disparity in inflation rates in the various EU countries. Inflation rates range from around 6% in some of the least affected countries to 20% in Estonia. Implementing one unified policy in countries with widely different fundamentals is an enormous challenge.

It would seem that the fairly modest interest rate increases planned by the ECB will have limited success. Much stricter monetary policy appears to be required to impact the world’s third biggest economy (to the U.S. and China). The EU’s GDP represents about one-sixth of the global economy.

Information for this briefing was found via the ECB, StatsCan and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.