On December 16th, Curaleaf Holdings (CSE: CURA) announced the closing of US$425 million 8% senior secured notes due 2026. Curaleaf said that the proceeds will be used to refinance existing debt, working capital, and to pay transaction fees and expenses.

Then on December 21, Curaleaf announced that they closed an additional US$50 million worth of their 8% senior secured debt due 2026, bringing the total raised to US$475 million.

Curaleaf currently has 15 analysts covering the stock with an average 12-month price target of C$24.80, or a 117% upside to the current stock price. Out of the 15 analysts, 5 have strong buy ratings, 9 have buy ratings and 1 analyst has a hold rating on Curaleaf. The street high sits at C$31 from Stifel-GMP while the lowest sits at C$20.

In Canaccord’s note, they reiterate their C$22 12-month price target and buy rating saying that the majority of the cash raised will go towards its US$342 million >12% debt, while the excess will allow the company to help execute its growth initiatives in its existing markets where it has a leading presence and will help fuel growth in upcoming adult-use markets.

Lastly, Canaccord says that the softer third quarter 2021 print leads to them believing that the company will meet the lower end of its revenue guidance of US$1.2 – US$1.3 billion for the year, and believes that the third-quarter margin headwinds to be transient and not be an issue in the fourth quarter.

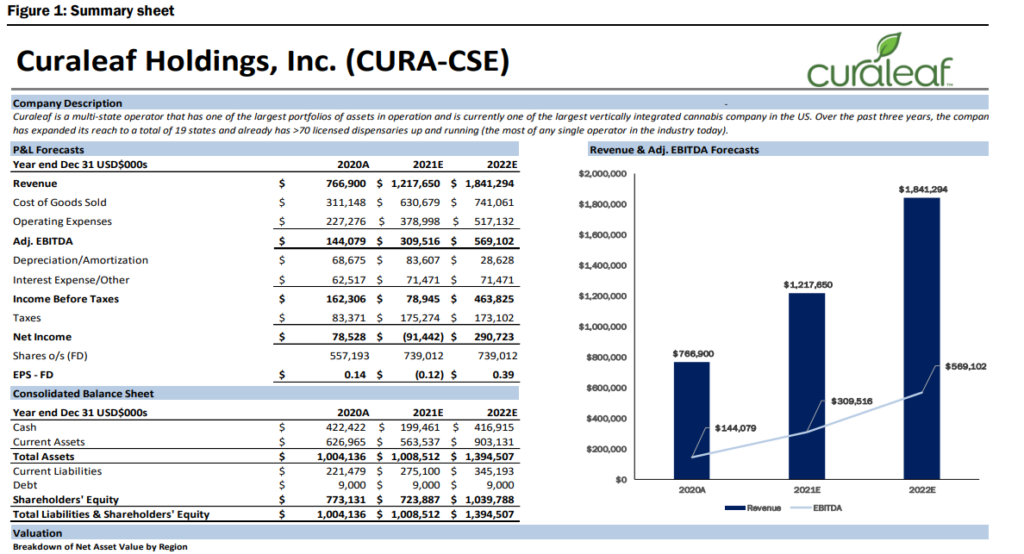

Below you can see Canaccord’s forecasts.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.