What’s the value of a metaverse that no one cares about?

That’s the question that is seemingly being asked repeatedly by crypto-space followers as it pertains to Decentraland, which in recent days has become the subject of several posts online focusing on its daily active users – or lackthereof. The metaverse, despite its token having a market capitalization of roughly US$1.3 billion, appears to effectively be dead.

As per DappRadar, a platform focused on tracking the use of crypto coins, tokens, and other related assets, at the time of writing Decentraland has had just 19 active users over the last 24 hours. That’s down from 30 users just days ago when the platform was the focal point of a story by CryptoSlate, wherein the gap between its active users and valuation was first highlighted. The data for active users is reportedly based on the raw on-chain activity of the tracked smart contracts related to the metaverse.

Unsurprisingly, the data being highlighted by CryptoSlate was not overly appreciated by the metaverse, whom on Twitter the following day tried to calm users by stating that the data was inaccurate. They claimed that tracking “only specific smart contract transactions” and then reporting them as daily active users was the wrong way to go about tracking. Instead, they pulled data from dci-metrics.com, rather than DappRadar, to try to make things look a bit better.

Funnily enough, the data provided doesn’t exactly make things look much rosier. For instance, at 56,697 reported MAU, or monthly active users, that equates to 1,890 per day. Of those, only 35.8 smart contracts are being executed per day, bringing into question just how many of those active users are actually real, or even doing anything when they log in each day. Wearables are reportedly being sold at an average rate of 210 per day meanwhile, while 57.7 emotes are being minted on average each day, as per the data provided.

Let's have a look at some of September's data:

— Decentraland (@decentraland) October 7, 2022

56,697 MAU

1,074 Users interacting with smart contracts

1,732 minted Emotes

6,315 sold Wearables

300 Creators received royalties

161 created Community Events

148 DAO Proposals

DCL-Metrics.com meanwhile is indicating that the metaverse has averaged 7,698 unique visitors per day over the last 30 days, but this data doesn’t jive the best with what was provided directly by the metaverse. That number is also on the decline, with the last seven days averaging just 7,039 unique visitors per day.

The impact here, is that the token – and the metaverse itself – appears to be quite overvalued based on how much it is actually used. While this won’t matter to many crypto enthusiasts, it does matter to some – such as the user that paid $2.42 million on the purchase of fashion street estate 11 months ago, marking the most expensive purchase on the platform by a long shot. Given it was related to a public company, Tokens.com Corp (NEO: COIN), their investors might care to.

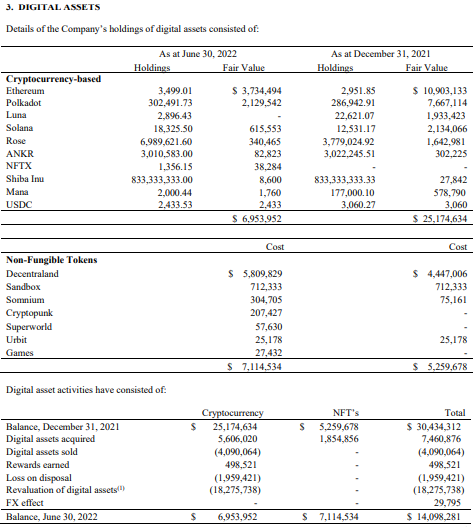

The small cap Canadian company in fact has much of its digital assets tied up in the metaverse, which it may never actually get out. As of June 30, the company had on its books a total of US$14.1 million in digital assets. Of those, Decentraland amounted to $5.8 million of that value, while MANA added $1,760 more to that figure in terms of assets connected to the metaverse, or roughly 41% of the firms digital assets. Due to the assets being classified as an NFT, the company has yet to adjust their value to reflect current market conditions.

The company has a history of paying high prices for these assets as well, given that it topped the market with its first purchase on the platform, while the second purchase at $681,620 amounts to the #15 most expensive transaction on the platform, and its third purchase at $709,920 for the MusicHub took the #13 spot in terms of largest transactions.

MANA, the token associated with Decentraland meanwhile has continued to fall as well. After being as high as $5.19 on November 25, 2021, it is now trading at just $0.69 per token as of today, as it continues to fade.

Information for this briefing was found via Sedar, DappRadar, CoinMarketCap and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.