Yesterday, Tokens.com (NEO: COIN) had something that I would refer to as a landmark announcement. While it was not earth-shattering by any stretch, it certainly caught me off guard, to the point that I had to call Steve to discuss the matter.

What had happened, is Tokens.com announced perhaps one of the largest land purchases in the metaverse to date, or so they claim. The firm acquired 116 parcels of “land” in a metaverse referred to as Decentraland, the so-called first “decentralized virtual world.” What caught me off guard, quite simply, is the price paid.

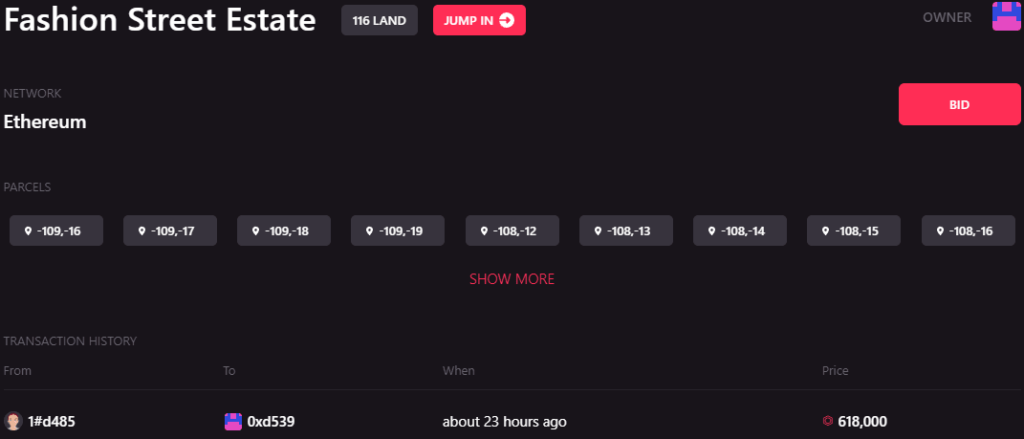

You see, the company paid a total of 618,000 MANA for the property. MANA is an Ethereum-based token, that at the time of writing this morning, traded for about US$4.10 per each – making the transaction valued at approximately US$2.52 million as of the time of writing this morning.

The “land” is undeveloped. After spending far more time trying to understand this virtual world than I care to admit, I finally managed to stumble upon the parcels in question that were acquired, which are effectively blank space on the map. The land is located on what is labeled as the “Fashion Street District”, despite the fact that there is literally nothing at this location to suggest anything even exists here yet. The “estate” has simply been labeled this.

The company claims that it intends to develop the virtual property into an area that will “facilitate fashion shows and commerce within the exploding digital fashion industry.” The firm will then obtain sponsors to drive revenue generation in this digital realm.

But here’s the problem.

First, its unclear exactly whom the company even purchased the “land” from. Yes, it’s on the blockchain so allegedly its traceable. I spent the better part of an hour this afternoon trying to understand tracing such blockchains, and the short of it, is that unless you’re an expert in the stuff, you’re wasting your time. The search just leads to more random letters and numbers that doesn’t actually tell you anything.

For what it’s worth, the land was acquired by ETH address 0xd539e935c56ad662f33b27b1546fdc325fd2a1d1 from ETH address 0x5cb6f3299374cf1ddc268c9336573aa7fe64d485 which may or may not be the main account for Decentraland. It’s entirely unclear. Using EtherScan.io lead me down a rabbit hole of trying to understand things that ultimately saw me come up empty. NonFungible.com meanwhile indicates that the land has had four unique owners, but is short on further details. At this point, I’m uncertain what to believe.

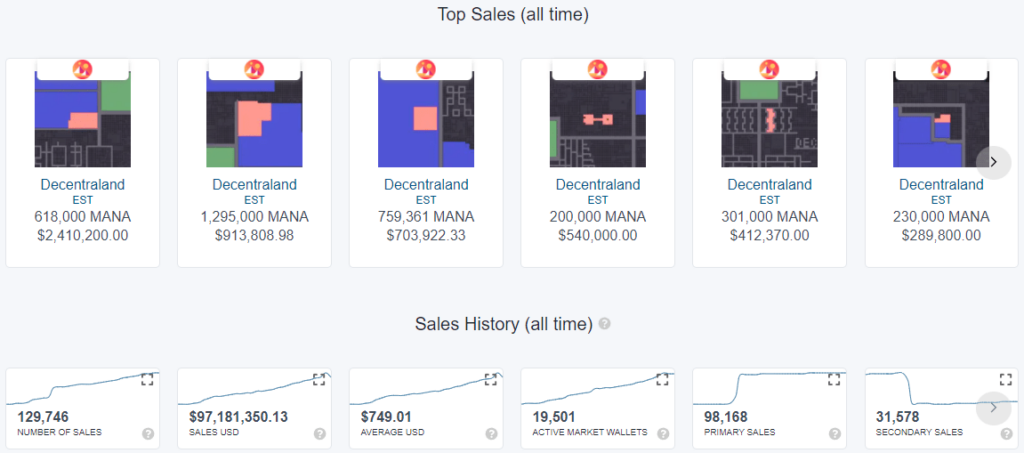

Second, its unclear if the firm paid “fair market value” for the asset by any means. Coincidentally (or not) the transaction is the top sale in the last 7 days – by nearly a factor of ten. It’s also the largest transaction on the platform in its history in terms of dollar value by a factor of 2.64x. That being said, it’s one of the larger “parcel” purchases, but still. The single transaction alone accounts for 43.75% of all sales volume in the last seven days as well – another red flag.

Third, the asset was allegedly purchased by Metaverse Group, whom also claims to own land in the virtual world where they are building a “Tokens.com Tower.” Yet the asset announced today was acquired by an account whose only landholdings consist of what was announced this morning.

And the final issue I take with the matter – is who is actually playing in this virtual world? The graphics are outdated, the world itself appears to be rather sparse, and from what I can see, is that there is rolling advertisements everywhere you look. Quite frankly, outside of twelve-year-olds, I’m not certain who the addressable market consists of. Personally, there’s a thousand ways I’d rather spend my time before spending it on this platform.

Maybe I just don’t get it. Or it’s too early to judge the tech. The execs at Tokens.com will surely be either geniuses for acquiring this “property” or failures for doing so. But from this vantage point, I know what my bet is on.

Originally published in the SmallCapSteve Substack. Want a different take on the markets? We’re working to put out a Substack on the daily to get you a dose of what’s hot in the market. It’s chock-full of hot-takes, market commentary, and more. What’s more, is great content like this can be found there first. You can subscribe to the SCS Substack here.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.