In its Q4 2022 financials, KB Home (NYSE: KBH) reported a cancellation rate of 68%–meaning around two-thirds of its orders backed out. So, maybe that’s why the homebuilder is looking to go virtual?

The US homebuilder touted on Tuesday that it has unveiled its first virtual new-home community in the metaverse. The property is located in the Decentraland platform, complete with a three-dimensional welcome pavilion and with three architecturally distinct model homes.

“KB Home has a long-standing history of groundbreaking innovation. Today, we’re creating opportunities with an eye toward the future, so next-gen homebuyers can experience a new KB Home community virtually,” said CEO Jeffrey Mezger.

To create and build its Decentraland community, KB Home collaborated with The Metaverse Group, a subsidiary of Tokens.com (NEO: COIN). Because of the platform’s broad accessibility and ease of use, the company chose Decentraland, a 3D browser-based platform and the first fully decentralized virtual world in the metaverse, as the site of its virtual community.

Customers can modify parts of KB Home’s model homes to their preferences, from changing the architectural style to personalizing the interior design, through the company’s virtual community. The move comes only days after the company revealed in its fourth-quarter earnings that its cancellation rate has grown to 68%, up from 13% in Q4 2021.

“Reflecting sharply lower demand stemming from higher mortgage interest rates, inflation and other macroeconomic and geopolitical concerns, fourth quarter net orders of 692 and net order value of $362.7 million decreased from 3,529 and $1.77 billion, respectively,” the company said.

This is scary. 😬

— Nick Gerli (@nickgerli1) January 17, 2023

KB Homes, a large home builder, just reported a 68% CANCEL RATE.

Meaning that over 2/3 of Homebuyers walked away from their contracts in the quarter. Leaving KB Homes with a massive pile-up of inventory.

Last year the Cancel Rate was only 13%. pic.twitter.com/4O9OaWO8K0

Cancellations have been a nuisance for all types of homebuilders in the last year, as rising mortgage rates have prompted many potential homeowners to wait and see if they can get a better bargain later.

Lennar Corporation (NYSE: LEN), a Florida-based homebuilder specializing in single-family houses, announced in its Q4 2022 earnings in December 2022 that its cancellation rate increased to 26% from 12% the previous year.

The same is true for Toll Brothers in Pennsylvania and Taylor Morrison in Arizona, where cancellations increased from 4.6% to more over 20% and from roughly 6% to 15.6%, respectively, year on year.

Cancellations are especially risky for KB Home because the firm specializes in built-to-order construction, which allows KB clients to customise their homes before they are completed.

During the company’s fourth-quarter earnings call, Mezger stated that the company witnessed an increase in the number of cancellations of homes that were “close to or at completion” due to issues with installing utilities to completed homes and a lack of confidence among homebuyers. Hence, having a virtual interactive scale of their models might help address these issues.

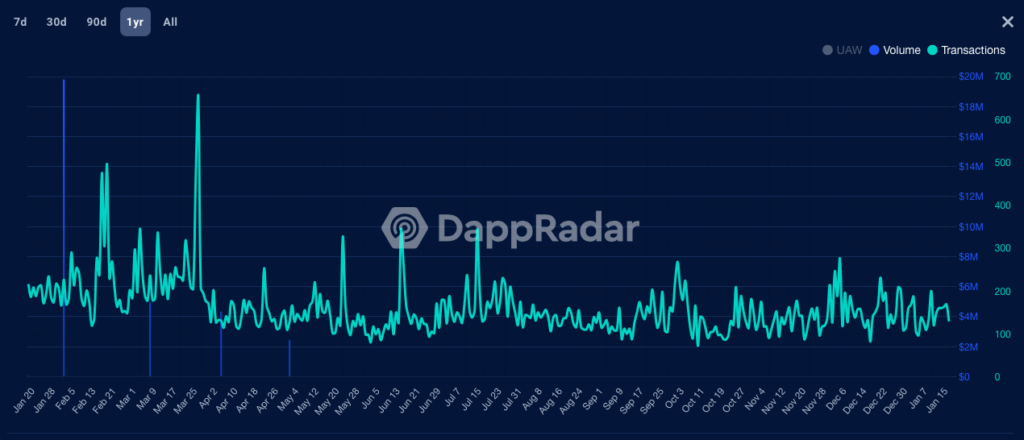

However, the purchase comes at a time when virtual land space has seen a sustaining decline in the recent month as the novel metaverse nook aims to transcend beyond being a fad. Transactions on Decentraland have been fluctuating on a downward trend while the daily volume has plummeted to less than $5,000 from its peak of $19 million in February.

At one point in October, the metaverse platform had just 19 active users in a 24-hour period, far from the 300 users transacting on Decentraland at its peak in 2022.

READ: Decentraland Sees Active Users Plummet To Just 19 A Day

One of the key “developers” in the space, Metaverse Group, has been purchasing virtual lands in the metaverse Decentraland through a digital currency called MANA. After initially buying land in the digital world’s so-called fashion district for $2.52 million, the company further increased its “real estate” with an additional $0.7-million purchase in the same district and another $0.7-million purchase in the so-called music district.

At the current MANA prices, the transaction that saw parcels of land initially purchased at $2.52 million or 618,000 MANA would now be worth around $395,000.

KB Home last traded at $35.29 on the NYSE.

Information for this briefing was found via Business Insider and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.