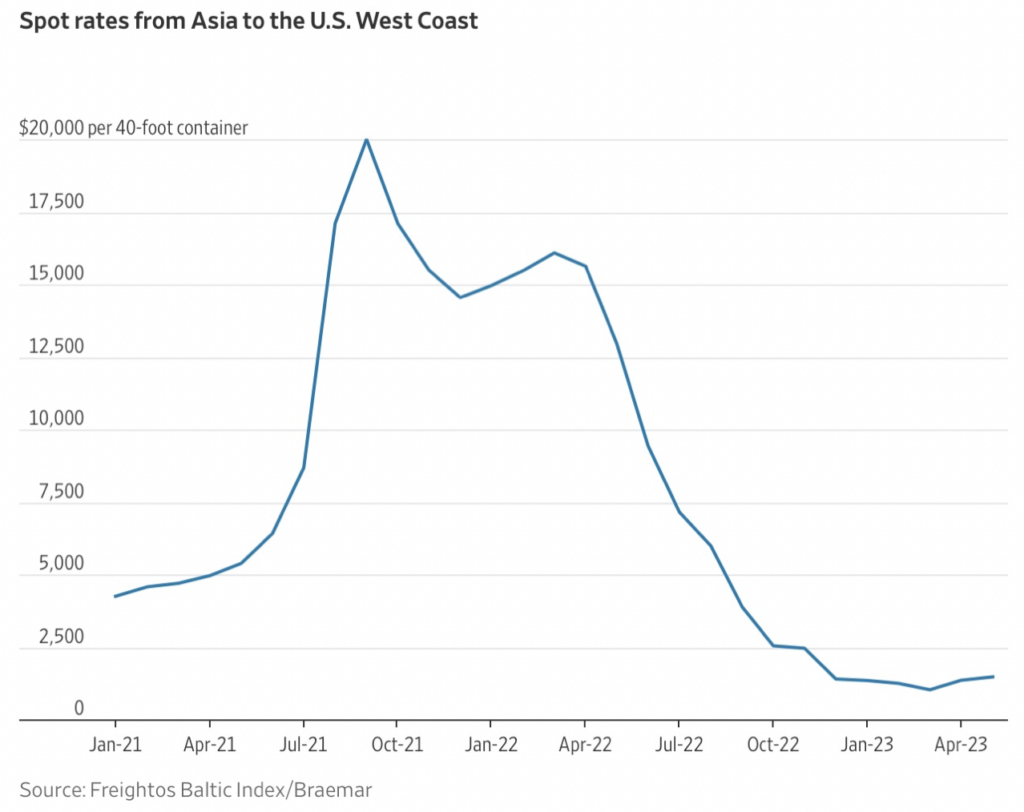

Stock market indices such as the S&P 500 (which stands at its highest level since August 2022) and the NASDAQ (currently at a 13-month high) seem to suggest an economic downturn is unlikely to occur anytime soon, but container shipping rates imply such optimism may be misplaced.

Average daily freight rates of ships which carry clothes, furniture and electronics from Asia across the Pacific Ocean to the U.S. west coast are down about 90% in the past year.

Specifically, data from the Freightos Baltic Index shows that the average day rate for a 40-foot container on that route is only about US$1,500, down from US$14,000+ a year ago. The current shipping rate from Asia to Europe is similar, around US$1,400 per day, which likewise represents a sharp downturn from around US$11,000 at this time last year.

The flattish trend in the price graph above is also concerning. In a typical year, demand starts to rise in early summer as retailers build inventory for the back-to-school and holiday seasons.

The weak current level of demand for imported consumer goods is perhaps best illustrated by declining activity at America’s busiest container port complex in Los Angeles and Long Beach, California. That port handled 1.74 million-equivalent containers in 1Q 2023, down 32% from 1Q 2022.

READ: China’s Debt Diplomacy About To Trap Dozen More Countries

Interestingly, container shipping rates have retraced to levels prevailing in 2019 even though fuel and labor costs have risen about 25% to 30% since then, according to the CEO of Hapag-Lloyd, a German box shipping company. On some voyages, available day rates do not cover a ship’s costs.

Moreover, weak shipping rates have not been confined to the shipping of consumer goods. The Baltic Exchange Dry Index, which reflects rates for shipping dry bulk commodities like iron ore, coal, grain, and steel coils declined 11.2% in the week ended May 20, 2023, representing the index’s worst weekly performance since late January.

The Baltic Index, which is prone to significant volatility, is down more than 50% over the last year.

Information for this briefing was found via Trading Economics and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.