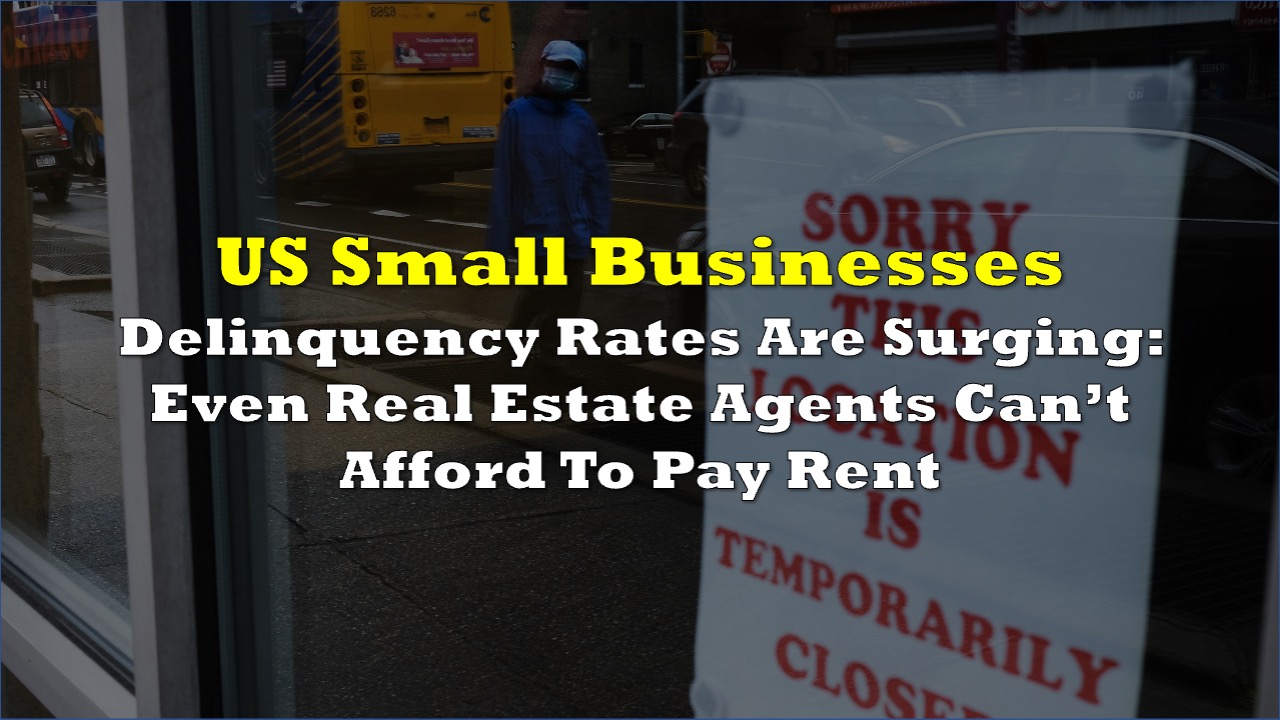

Small business owners in the United States are feeling the pain of rising prices. A poll saw a record surge in rent delinquency rate for this segment in October.

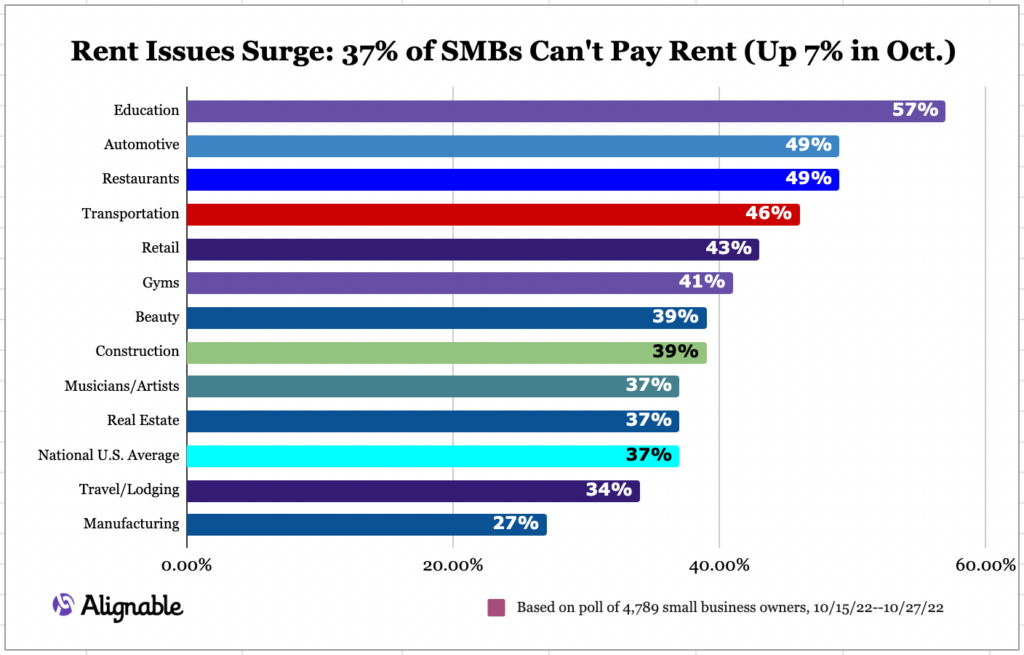

37% of small businesses were unable to pay their rent in full last month, coming from 30% in September, according to an Alignable poll that surveyed 4,789 small business owners between October 15 and 27.

These businesses, which typically are more resilient, employ about half of all Americans working in the private sector. Nothing’s ‘typical’ these days, it seems, as even these businesses are seeing their incomes get “eaten away by inflationary pressures,” according to Chuck Casto, head of research, at Boston-based Alignable.

Of those that were surveyed, 51% said their rent is up by at least 10% compared to six months ago. But more than this, small business owners are reporting an inflation-driven slowdown in consumer spending. 59% of those surveyed noted that consumers spent less in October than the month before.

Industry-wise, those that found it the most difficult to pay rent last month were from the education sector with about 57% delinquency rate, a sharp increase from the previous month’s 44%. The automotive and restaurant sectors are tied with 49%.

Inflation has cooled a little (or has it?), but about a third of these small businesses, according to Alignable, are at risk of shutting down if revenue doesn’t go up in the next few months.

Information for this briefing was found via Alignable and Bloomberg, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.