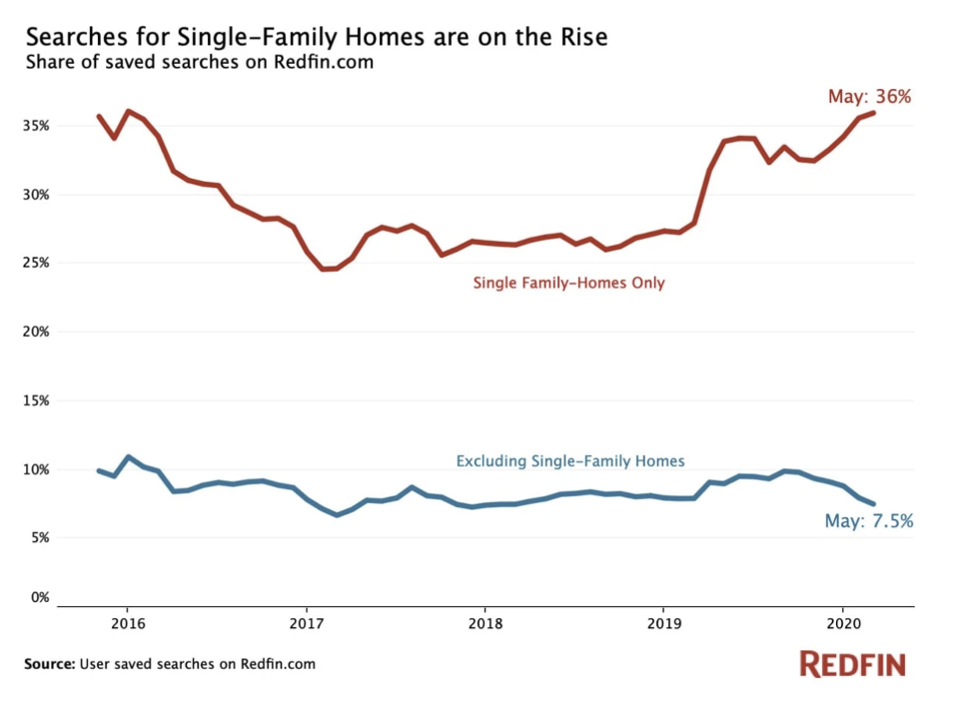

As coronavirus infection rates continue to increase across much of the US, coupled with vastly changing employment patterns and civil unrest, a new migration trend has emerged. What were once adamant city dwellers, have suddenly begun moving to the suburbs and rural communities as a means of hiding out from the growing health crisis.

As a result, this new trend has caught the attention of real estate executives. According to president and CEO of Marcus & Millichap Hessam Nadji, this recent spike in popularity among millennials for housing accommodations outside of downtown centers including those of New York City, Miami, and Seattle has also caused many businesses to follow suit.

Not only has an increase in demand for suburban residential real estate increased significantly, the demand for commercial real estate in the same areas has been mirroring the trend. Many businesses have been following their employees’ pursuit of a more peaceful and safer accommodations, and as a result have been setting up satellite campuses so workers do not have to commute to the densely populated metro centers.

However, Nadji predicts that such a trend will not be permanent. Over the next two years, there is certainly going to be a trend of what are predominantly city-dwelling businesses taking up suburban office vacancies, but eventually the demand for metro areas will begin to increase once again. Nonetheless, it is currently estimated that it will be at least three years before the bustling centers will be hopping with business of commuters rushing to work in skyscrapers once again.

Information for this briefing was found via CNBC, Forbes, and Redfin. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.