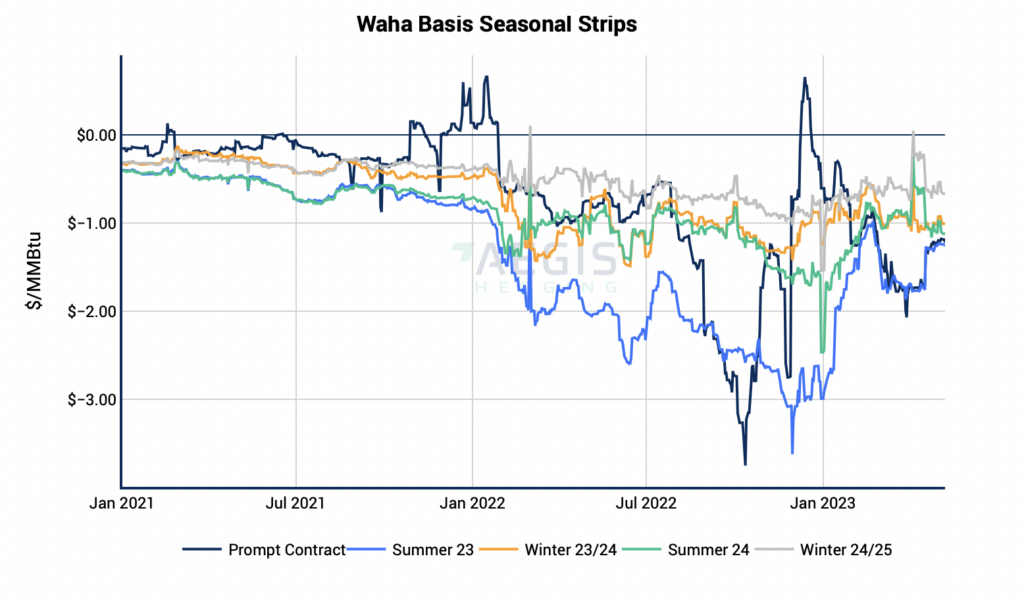

Natural gas prices, and particularly prices in the prodigious Permian Basin in west Texas and southeastern New Mexico, have plummeted over the past five months. And with the quantity of natural gas in underground storage facilities at historically high levels and the low-usage summer season beginning, it is difficult to find a reason to be bullish on the commodity.

Unfortunately, the unfavorable supply-demand situation could get even worse based on a May 8, 2023 letter to the Biden Administration signed by 44 congressional Democrats. The Democrats urge the White House to create a detailed (and presumably lengthy and tough) approval process for new liquefied natural gas (LNG) export terminals that would reflect the projects’ negative impact on the climate and nearby communities.

The critical issue here is that, according to the Environmental Defense Fund, methane, the main component of natural gas, has more than 80 times the warming power of carbon dioxide over its first twenty years in the atmosphere.

It appears the letter was timed to precede the U.S. Council on Environmental Quality’s upcoming report on how the federal government should analyze the environmental impacts of major infrastructure projects. There is already a hint that the Council will champion at least somewhat of an anti-business slant on this. In 2020, the Trump Administration ordered federal agencies not to consider the “indirect” environmental effects of major projects. In April 2023, the Council issued a rule which eliminated that directive, saying federal agencies must now consider the “direct, indirect, and cumulative” impacts of any infrastructure decisions.

The clause where the Democrats request that the impact of an LNG terminal on adjoining neighborhoods be considered sounds innocuous, but the likely Texas Gulf Coast locations of new export terminals — in low-income communities which are already heavily industrialized — could be problematic. The Washington Post reported that Port Arthur, Texas, where two new LNG terminals are currently planned, has a poverty rate of about 26%.

READ: New York Passes Law That Will Ban Gas Stoves, Natural Gas In New Buildings

The rub in all this: building LNG terminals is necessary to utilize all the gas being produced in the Permian Basin which accounts for nearly 15% of all natural gas produced in the U.S. (Only the Appalachian Basin, at 31%, accounts for more.) In simple terms, too much natural gas is currently produced in the Permian. Eastbound pipeline takeaway capacity (toward the Gulf Coast) is almost always full.

The best indicator of the present situation is that gas at the Waha natural gas hub in West Texas trades at about a US$1 per thousand cubic feet (Mcf) discount to the U.S. benchmark Henry Hub price, or at only about US$1.20 per Mcf. If the Biden Administration were to toughen the requirements and increase the time frame to build new LNG terminals on the Gulf Coast or make it tougher and less economic to build new gas pipelines linking west Texas and southeastern New Mexico gas to new terminals, the pressure on natural gas prices will only grow.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.