The last time the DJ-ing side of Goldman Sachs (NYSE: GS) CEO David Solomon made headlines was when he played at Lollapalooza in July last year. The time before that was when he was one of the featured musicians at a Covid-protocol-breaking Hamptons gig at the height of the pandemic.

These days, he’s back making headlines after The New York Times wrote a lengthy piece on whether he used his position at one of the world’s most prestigious investment banks to boost his career as an amateur DJ.

The situation in question was his access — as a relatively unknown, non-professional DJ — to the highly-coveted rights to remix Whitney Houston’s massive hit “I Wanna Dance with Somebody (Somebody Who Loves Me).” Solomon, with “apparent ease,” was able to get permission from Houston’s sister-in-law and executor Pat Houston through Larry Mestel, a long-term client at Goldman Sachs, and once part of the bank’s list of 100 Most Intriguing Entrepreneurs.

“Our business is in part to get artists to cover, sample, and or remix our legendary song catalog,” Mestel told The New York Times in an emailed statement, declining to discuss the terms of the deal with Houston’s estate and Sony Music Entertainment, the owner of the original recording of the song.

The Times story suggests that Solomon’s Whitney Houston remix — which also fortuitously dropped just six months before the Whitney Houston documentary with the same title was released — helped “fortify his presence as a DJ recently,” with his monthly average listeners at 600,000, “a very high number for a relatively unknown artist,” according to Serona Elton, a professor at the University of Miami and the director of the music industry program at the Frost School of Music.

The song, as of this writing, has been played almost 3.2 million times on Spotify and is currently Solomon’s most popular track — but it’s also only his third most played ever. Spotify automatically generates popular tracks based on all-time and recent streams and updates the rankings every 24 hours.

Solomon’s all-time most-played track “Rescue Me,” which was a collaboration with Alex Newell, is far ahead with over 11 million plays, followed by “Future In Your Hands,” featuring Aloe Blacc, with 3.3 million plays. He also already had over 630,000 monthly listeners on Spotify back in late March last year, months before the Whitney Houston remix was released in July.

“The reporting is trying to assert that there is overlap or intermingling of David’s music activities and his role as C.E.O. of Goldman Sachs,” Solomon’s spokesman, Tony Fratto said. “It’s clear that both David and Goldman Sachs have been scrupulous in keeping the relationship separate.”

The paper also reported that, according to people who asked not to be identified, Solomon has, in the past, brought in Goldman Sachs employees to help him with his gig schedule to ensure that they “did not interfere with his Goldman commitments.”

I'm really not one to poo poo accountability reporting but the the conflicts of interest issue here is whether David Solomon using his secretaries to schedule he DJ gigs in his calendar (of course he does; just like they would if he played a round of golf) or somesuch?

— Ben Walsh (@BenDWalsh) February 6, 2023

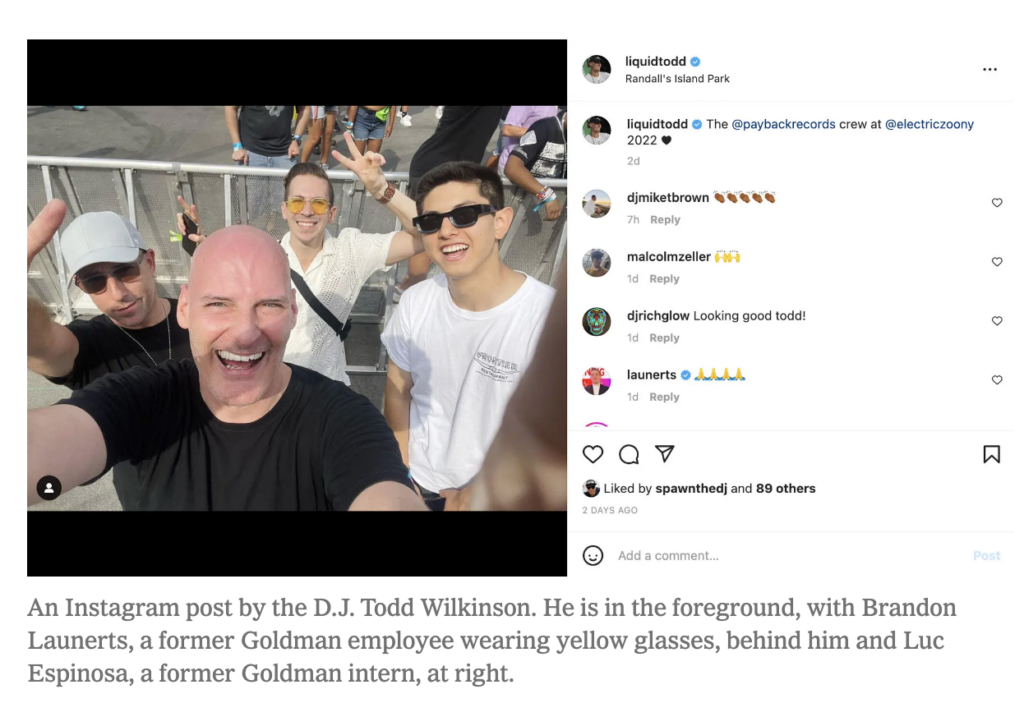

The paper also said that one former Goldman employee, Brandon Launerts, was involved in a few calls with Solomon’s recording company Payback Records. Launerts, who was a social media manager for the bank, reportedly helped review strategies by the marketing firm tasked to handle Solomon’s social media presence.

It’s unclear though whether the Goldman employees involved in some work for Payback Records were also, like Solomon, doing a little bit of moonlighting and were compensated for their work at the recording company. The New York Times included a photo of Launerts and a former Goldman intern being described by DJ Todd Wilkinson as “the Payback Records crew.”

Solomon, for his part, says that all proceeds of his music go to charitable institutions in the fight against addiction through Payback Records.

Given this setup, the relative unknown-ness, and maintaining that it’s a hobby that he does occasionally and not a second professional career, Solomon’s DJ-ing hobby has still posed some amount of headache for Goldman, particularly during the Hamptons fiasco in 2020. And of course, the unconventional choice of out-of-office passion creates opportunities for some unnecessary attention to what’s going on at one of Wall Street’s mightiest institutions.

Goldman Sachs recently cut 3,200 jobs following the announcement of a $3 billion loss that was largely driven by its consumer banking division, including $1.2 billion of losses from the Apple card just from January to September last year. The job cuts were the largest, in terms of scale, since the crisis of 2008.

Solomon has also taken a board-ordered 30% pay cut.

Goldman Sachs CEO David Solomon just had his pay cut 30% to only $25 million

— Grit Capital (@Grit_Capital) January 27, 2023

Luckily, he has a side hustle as a DJ to make up the difference pic.twitter.com/PAnOtdp1FK

Information for this story was found via The New York Times, Twitter, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.