Dollarama (TSX: DOL) is expected to report its third quarter financial results of 2023 this morning. The consensus estimate suggests that revenues will grow $15 million consecutively to $1.23 billion, with this estimate growing slightly over the last twelve months. Analysts expect this revenue growth to continue into gross margins, as they expect gross profits to come in at $543 million, or a 44.1% margin, a 0.5% margin improvement sequentially.

Operating profit is forecasted to come in at $315 million, up sequentially, representing an operating margin of 25.6%. Net income is expected to be $202 million, or earnings per share of $0.70. Once again, these estimates have slowly increased over the last twelve months.

There are 14 analysts covering Dollarama with an average 12-month price target of C$87. Out of the 14 analysts, one has a strong buy rating, eight analysts have buy ratings and the last five analysts have hold ratings on the stock. The street-high price target currently sits at C$95 and represents a 14% upside to the current price.

In Canaccord Genuity Capital Markets’ note on their expectations heading into the print, they reiterate both their hold rating and C$80 12-month price target, saying that they are looking for solid top-line trends to continue, which will help margins.

They expect the company to piggyback off the strong second quarter, where the company reported comparable sales growth of 13.2% year over year, which included a 20% increase in the number of transactions. Off the back of that, Dollarama increased its comparable same-store sales growth to 6.5%-7.5% from 4.0%-5.0%.

Canaccord expects the headwinds that management talked to during the first half of the year, including ongoing inflation, which has driven higher consumables sales, and a lack of health order-related operating restrictions. With Halloween sales being included in this quarter’s print, Canaccord is expecting some store sales to be up 5% year over year.

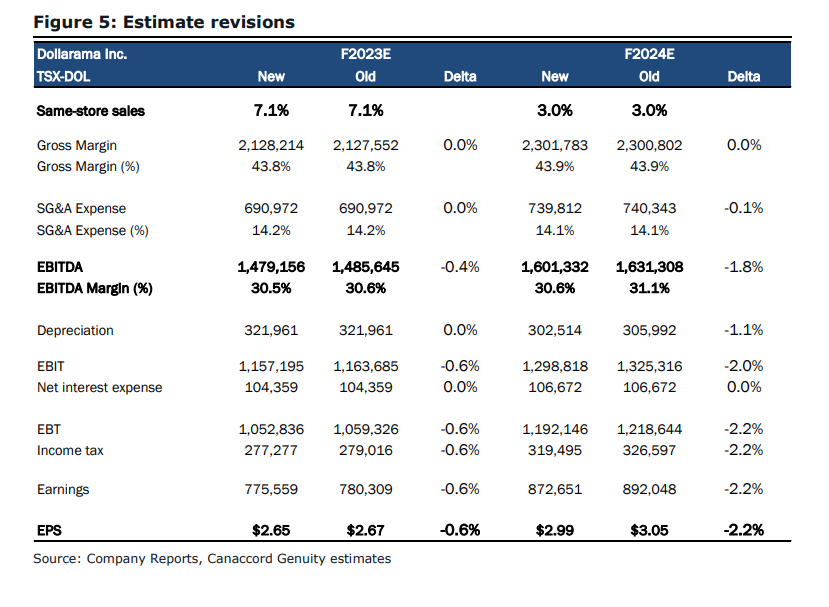

Additionally, they expect revenues to be $1.23 billion, in line with the consensus estimate. They expect EBITDA to be $382 million and earnings per share of $0.69. Canaccord also anticipates gross margins to be 44.2%, “given persistent consumer inflationary trends.” They expect people to continue to trade down to less expensive items, usually with a lower margin profile.

Lastly, Canaccord talks about SG&A costs, which they believe will stay relatively unchanged as a percent of revenue on a yearly basis. They expect increased wage expenses to offset any increase in operating leverage for the quarter.

Below you can see Canaccord’s updated estimates for Dollarama.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.