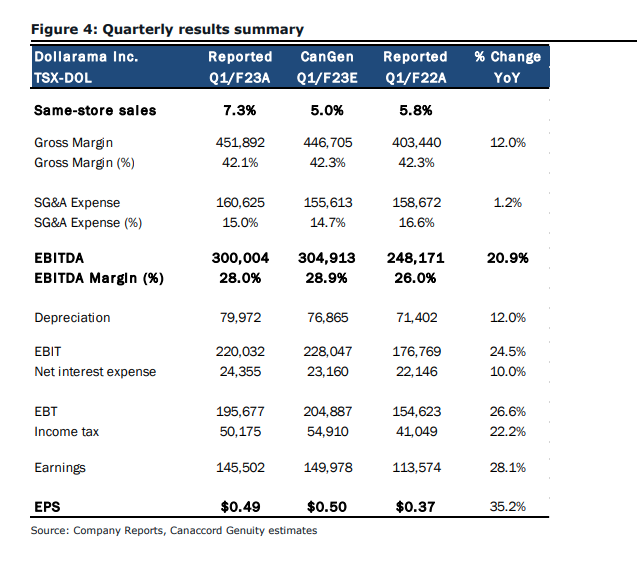

Dollarama Inc (TSX: DOL) recently reported its fiscal first-quarter financial results for 2023, ending May 1, 2022. The company saw its revenues grow almost 13% to $1.073 billion, while it saw its cost of sales grow roughly the same to $620.99 million. Though operating income grew almost 25% to $220 million.

The company also reported its EBITDA grew 21% to $300 million, or a margin of 28% of sales. While diluted earnings per share were up 33%. Comparable store sales grew 7.3% year over year.

The company ended the quarter with $71.57 million in cash and $646.7 million in inventory. Dollarama announced that they purchased 1,444,803 shares during the first quarter for a total consideration of roughly $107.3 million under their normal course issuer bid.

Dollarama currently has 15 analysts covering the stock with an average 12-month price target of C$78.71 ,or an upside of 10%. Out of the 15 analysts, 1 has a strong buy rating, 9 have buy ratings and 5 analysts have hold ratings on the stock. The street high price target comes in at C$82 from 3 analysts which represents an upside of about 13%.

In Canaccord’s note on the results, they reiterate their hold rating on the stock and raise their 12-month price target from C$70 to C$72, saying that the company reported “Solid top-line trend but shift towards consumables weighs on margins.”

On the results, Dollarama beat Canaccord’s revenue estimate of $1.057 billion, while adjusted EBITDA came in slightly below their $305 million estimate but beat the consensus estimate of $287 million. Earnings per share came in-line with Canaccord’s estimate of $0.50.

On revenue, Canaccord says that the growth of 12.4% year over year was reflecting higher consumer traffic which also included net new store openings over the last 12 months, with 10 new stores happening this quarter. While comparable sales growth grew 7.2% year over year, which beat Canaccord’s estimate of 5%.

Canaccord takes note of Dollarama’s gross margins, as they came in at 42.1%, down by about 0.2% year over year, and coming below Canaccord’s estimate of 42.3%. They estimate that this miss was primarily due to “unfavourable mix impacts associated with higher consumables sales.” Though management did note that lower logistic costs added between 0.2-0.3% to gross margins.

Lastly, Canaccord provided their outlook for Dollarama and says that the company will be comping “against a very noisy quarter in Q2/F22 of -5.1% given store closures related to COVID” and that the company is currently passing through pricing to help quell cost inflation.

They also believe that Dollarama’s product mix will continue to shift towards consumables for “a couple of quarters” due to high levels of food inflation as consumers switch from grocery stores to dollar stores.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.