On September 9, Dollarama Inc (TSX: DOL) reported their fiscal second quarter results for the period ending August 1, 2021. The company announced revenue growth of 1.6% year over year to $1,029.3 million. Gross profit grew 0.4% to $387.08 million. Gross margins for the quarter came in at 43.4% while the operating margin was 21.4%. Dollarama’s net income was $146 million or $0.05 earnings per share.

The company also announced that comparable-store sales came decreased 5.1% for the quarter, but for the 7.5 week period, after Ontario lifted the non-essential product ban, comparable store sales increased 5.1% year over year. EBITDA increased 5.7% to $293.7 million or 28.5% of sales.

Many analysts changed their ratings and price targets, bringing the average 12-month price target to $62.43, up from $61.50 last month. 15 analysts cover Dollarama with 2 analysts having strong buy ratings, 8 have buy ratings and the other 5 have hold ratings. The street high sits at $70 from 2 firms while the lowest sits at $54.

In Canaccord’s note, they reiterate their $57 price target and hold rating, which was increased a week before Dollarama’s earnings. They headline the note by saying, “Restrictions drive comparable sales decline; supply chain challenges suggest longer-term incremental cost pressure.” Dollarama’s $1,029 million in revenue was practically in line with the $1,050 million street/Canaccord estimate, and EBITDA came in in line with Canaccord’s $296 million estimate.

The main reason for Dollarama to slightly miss Canaccord’s estimates is due to same-store sales coming in worse than the -2% estimated by Canaccord. Dollarama, for the first 5.5 weeks, could only sell “essential items” in their Ontario stores, which make up 40% of their locations. The other 7.5 weeks, they were able to open up shop to sell all products.

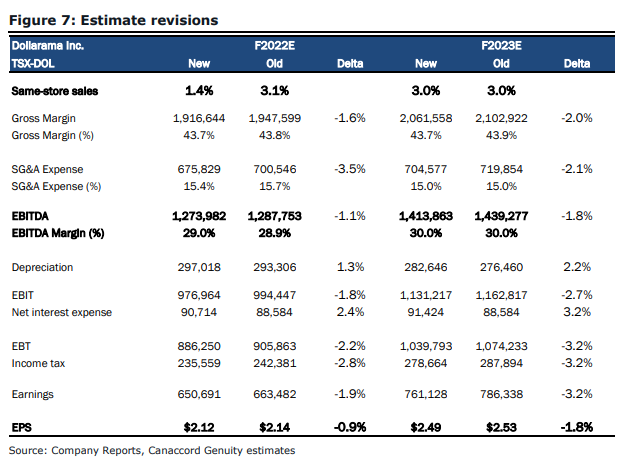

Canaccord tells investors that a key area they are looking at is shipping costs and labor costs. Below you can see Canaccord’s updated full year 2022 and 2023.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.