It appears that Robinhood daytraders have once again gotten the fuzzy end of the lollipop, except this time the embarrassment is centred around DraftKings (NASDAQ: DKNG), a fantasy sports betting provider.

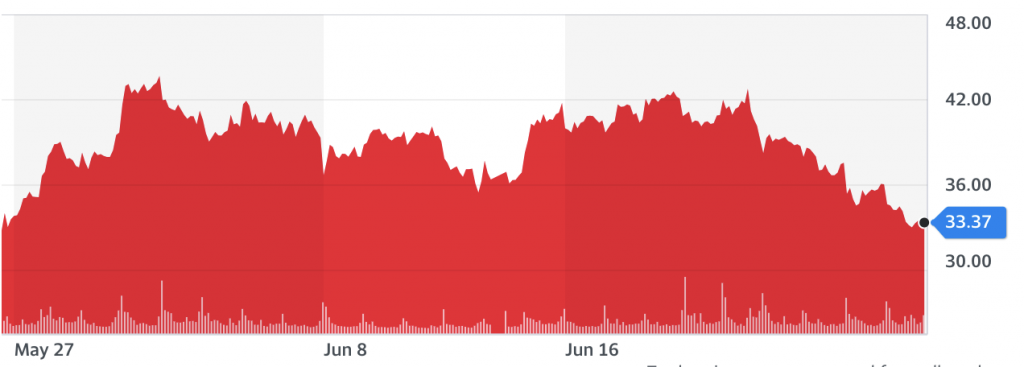

When DraftKings first went public on the Nasdaq in April, over 100,000 Ronbinhood retail investors flooded in to buy the company’s stock. the surge in purchases caused the stock to increase by 237% in just several months; however, what goes up must also eventually come down.

It appears the sudden increase in DraftKings stock price has taken on the dreaded parabolic curve. As the stock was doubling in price, DraftKings insiders including the company’s president Paul Liberman, CEO Jason Robin, and director Hany Nada took to the Securities and Exchange Commission to file a few Form 4s with respect to insider selling worth a total of $596 million shares.

So in essence, day traders have been taken advantage of, again. Now that the stock is on a downfall, it will be interesting to see the next new investing fad Robinhooders can throw their money at.

Information for this briefing was found via Bloomberg and Yahoo Finance. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.