Eguana Technologies (TSXV: EGT) has been given its first analyst recommendation. The first investment bank to cover this name is none other than Stifel-GMP, with a C$0.85 price target and buy rating. Ian Gillies, Stifel-GMP’s analyst headlines, “Initiating coverage with a BUY rating: Powering up and ready to distribute.”

One of the points Gillies talks about is the recent $20 million equity raise, plus an additional $7 million from warrant exercises in 2021. It makes the company cashed up and will have enough cash to fund new technology initiatives as well as cover its working capital requirements.

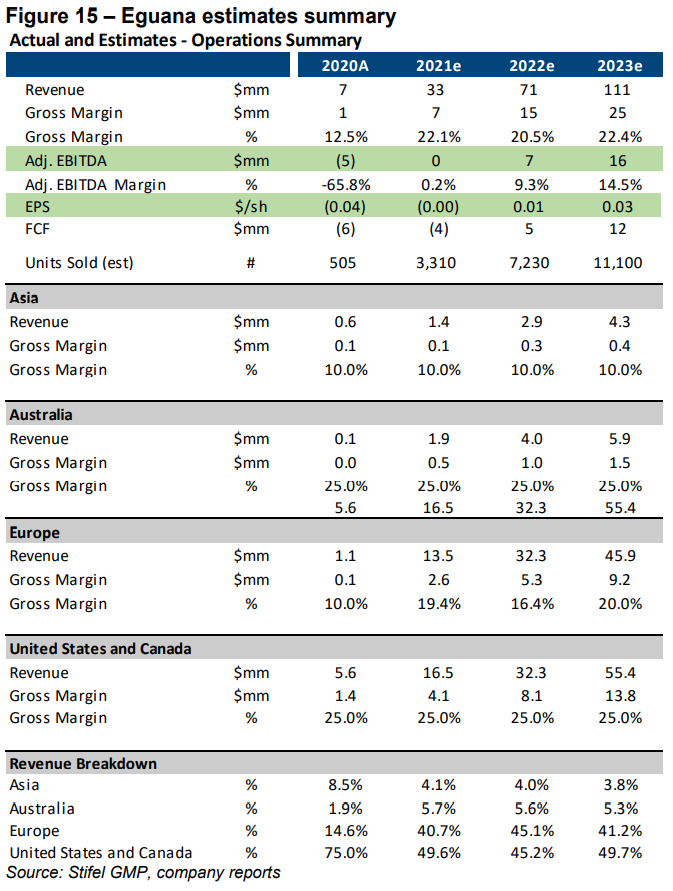

Below you can see the whole breakdown of Stifel-GMP’s estimates, including the geographic revenue breakdown. They expect Eguana to generate $33 million in revenue with EBITDA coming in at breakeven for 2021, only for revenue to more than double to $71 million in 2022. They also expect Europe, U.S, and Canada to be the largest revenue segments for the company.

Gillies says that Eguana is trading at 1.3x 2023 EV/Sales while the group is trading at an average of 8.1x. This makes Eguana, “an inexpensive way to gain exposure to trends in solar relative to its much larger peers.” What he means is that if any company wanted to pivot or add solar-related operations to their company, Eguana would be one of the best targets in a buyout. Below you can see the peer group.

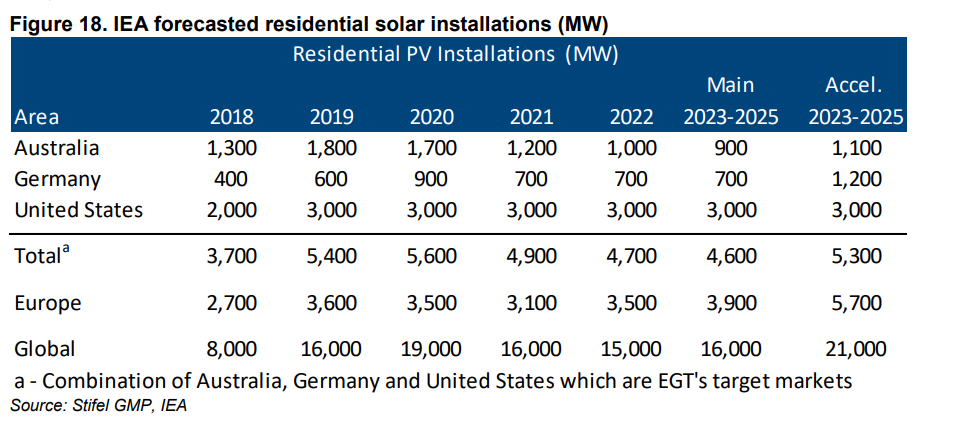

Gillies writes, “Residential solar is set to undergo transformational growth globally due to supportive government policy.” Below you can see the breakdown of the IEA’s forecasted residential solar installations

He believes that if Eguana is successful in operating its existing service line efficiently, then it will be relatively easy to replicate in other jurisdictions. He adds, “We believe these partners could also potentially provide avenues for EGT to get in business lines that have recurring revenue such as financing the purchase of its residential storage systems.”

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.