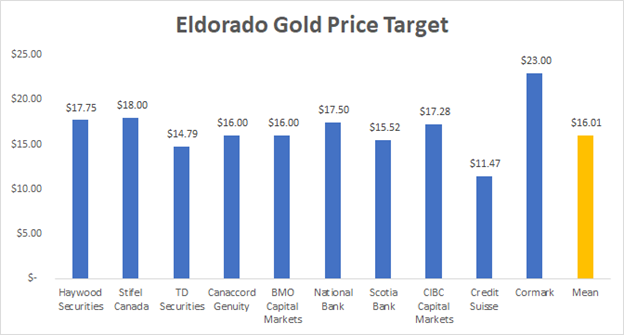

Eldorado Gold (TSX: ELD) released their Q2’20 preliminary results earlier this week, which included production results of 137,782 ounces of gold produced, a 50% increase year over year. Despite these preliminary results beating many of the estimates set out by analysts, no analyst has as of yet made significant changes to their estimates, price targets or ratings. Currently, the mean rating is C$16.01, which is only a ~10% upside, while the mean rating is a buy.

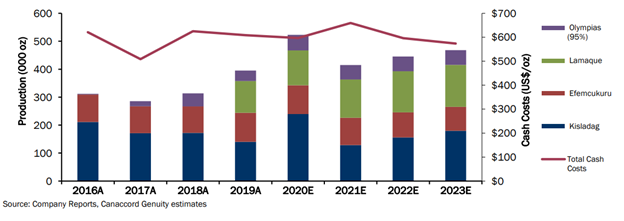

Canaccord sent out a note Friday morning with the headline “Solid Q2 production; continued improvement at Olympias,” stating that the preliminary production results of 137,782 ounces were higher than their estimate of 124,000 ounces. They mention that all four producing mines beat their expectations, with Olympias producing 17,900 ounces. In contrast, their estimate was 13,800 ounces, a 30% beat. The Lamaque mine produced 33,100 ounces, beating the 26,800 ounces Canaccord estimated, or a 23.6% beat. Canaccord is currently forecasting 523,000 ounces for FY2020, 415,000 ounces for FY2021, 446,000 ounces for FY2022, and 468,000 ounces for FY2023. The firm now has a C$16 price target for Eldorado, which signifies a ~10.6% upside and a hold rating on the stock.

Eldorado also beat Bank of Montreal’s estimate of 124,300 ounces due to the higher-than-expected production at Lamaque. Bank of Montreal had originally estimated 12,000 gold ounces of production for Eldorado’s Olympias mine, and 23,600 ounces for Lamaque, both of which saw significant beats. In their note they mention that Olympias’ and Lamaque’s results were much better than expected, Efemcukuru was slightly better and Kisladag was in line with their estimates.

BMO only slightly changed FY2020 estimates, increasing revenue to C$968 million, up from C$954 million and changing their earnings per share estimate to C$1.05 from C$1.01. Currently, BMO has a C$16 price target for Eldorado, which is only a ~10.6% upside, while having an outperform rating on the stock.

Stifel Canada’s note echo’s similar reactions; once again, Olympias and Lamaque came in above Stifel’s estimates while Kisladag and Efemcukuru either slightly beat or under performed estimates. Stifel also states that they were “positively surprised” to see this strong quarter given COVID-19, which caused a temporary suspension of operations at Lamaque in April. Even with this strong quarter Stifel did not change their FY2020 estimate of 520,000 – 550,000 ounces of production.

Currently, Stifel has maintained their C$18 price target, which is a ~24.4% upside to the stock while also having a buy rating on the stock.

Information for this briefing was found via Sedar, Refinitiv, and Eldorado Gold. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.