Could any serious takeover of Twitter Inc. (NYSE: TWTR) ever be anything but hostile?

Last week, noted attention fiend and super-poster Elon Musk was steadily acquiring shares in the world’s foremost microblogging platform, until the company offered him a board seat to knock it off. Since committee meetings and not being allowed to do things are two of his least favorite pastimes, Elon turned the board seat down and came over the top with an all-cash offer of $54.20/share that values the company at $43 billion.

It isn’t officially a hostile takeover until the board recommends against it, and Twitter’s board hasn’t said anything yet about whether or not they’ll give this cash offer, which represents a 20% premium over the close price on Thursday, the thumbs up. The company has adopted a “poison pill” shareholders rights plan, which effectively allows a board to buy some time if the bidder gets more aggressive, but that’s just good governance and standard operating procedure. The market clearly has initial doubts about this bid, the TWTR shares closing well shy of the offer price Thursday ($45.08).

Y’all do, anyway. I’m over it.

Funding Secured?

Takeover bids aren’t generally launched by private individuals. Certainly not for companies of this size. Musk has been the richest man in the world for long enough now that the bid isn’t being laughed out of the room, but he’s been too loud about his wealth for it to be taken entirely seriously. He’s likely good for the $43 billion, even if he isn’t liquid for $43 billion. Selling some Tesla (NASDAQ: TSLA) or SpaceX or borrowing against it is basically a banking exercise, and he could always take on a partner. The part that doesn’t add up is Elon’s assertion that this isn’t about the money.

Musk told Bloomberg on Thursday that:

“I could technically afford it. But this is not a way to sort of make money. It’s just that I think this is – my strong intuitive sense is that having public platform that is maximally trusted and broadly inclusive is extremely important to the future of civilization. I don’t care about the economics at all.”

This notion of altruism is a theme that runs through all of Musk’s investments. Emissions reduction, space exploration, relief of traffic congestion, and neural computer interfaces are all vitally important to humanity, and Musk is developing them out of a sense of civic duty. The economics are the least of his concern. Yet, somehow… they always make him richer. That “somehow,” is arguably Twitter.

Controlling the means of production

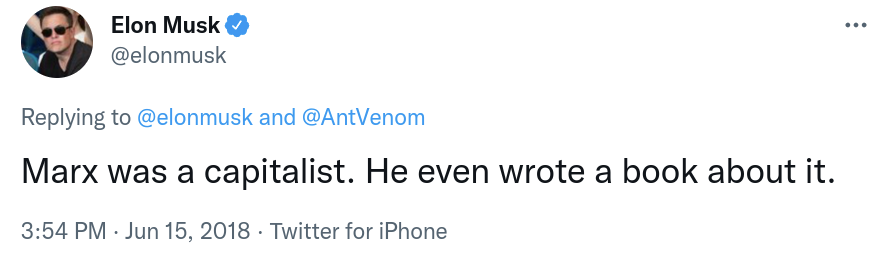

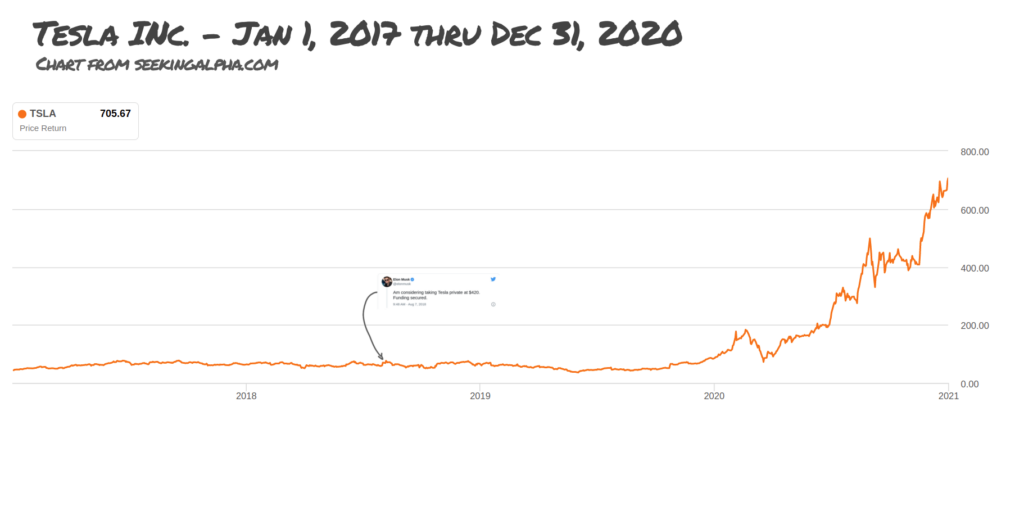

Capital markets are all about mass appeal, mass appeal is about controlling the narrative, and the best way to control the narrative is to suck up all of the bandwidth. The last time Musk tried something like this was in 2018, when he infamously represented that he had the backers to take Tesla Inc. (NASDAQ:TSLA) private at $420/share.

The tweet kicked off weeks of speculation about how he planned to pull it off. The Tesla board of directors disavowed any knowledge of the plan almost immediately. Bankers and law firms were hired by the dozens to handle it, and the business media just kept cranking out stories about the deal itself, Musk’s apparent disconnect with his own board, and the rumored involvement of the Saudi royal family.

When the idea was eventually abandoned with no actual evidence of funding having ever been secured, it forced the SEC to pretend there were consequences to representing a $70 billion order that one doesn’t have for the purposes of moving a stock. The stunt cost him and Tesla $20 million each in fines, and he promised not to do anything like that ever again.

Musk couldn’t have known what the SEC was or wasn’t going to do when he made the bluff, but he likely guessed that any trouble he got into would be trouble he could handle. It wasn’t like he was going to sell stock into any kind of lift he created, he just needed the conversation to be about something other than the short selling piranhas nipping away at TSLA, so that they didn’t have a chance to gain any more momentum.

Revenge on the nerds

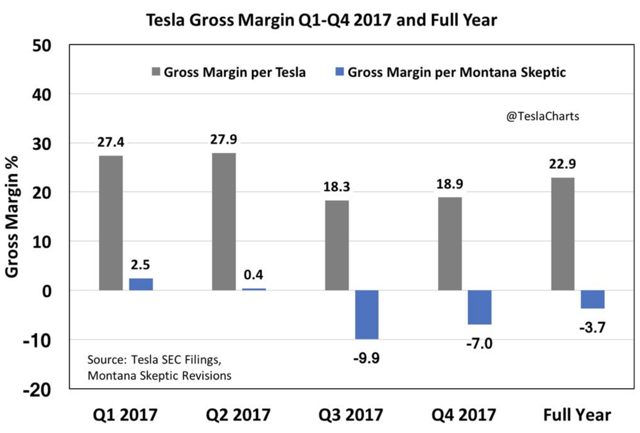

2018 ended up being the peak of TSLAQ: an organic movement of research-oriented short sellers who were ready to tell anyone who would listen that Tesla Motors was an over-valued collapse-waiting-to-happen. It wasn’t just one thing, it was all of the things. The cars were death traps! The books were being cooked right in everyone’s face! The company was only cash flow positive because they could trade in tax credits! This starry-eyed California electric car company, who was making 1/1000th as many cars as GM or Ford was not supposed to be worth half as much as those legacy automakers who move units. The market was over-blown and had to come back to earth. The nerds were adamant about it. They had charts!

“It sounds like somebody‘s got a case of the s’postas…”

It all made sense on paper, and it’s satisfying to be right, so the concept that Tesla’s stock was going to crash like a Model S on autopilot grew among the nerds who had the patience to pay attention to those charts. But there are a lot more nerds who don’t have the patience, and appealing to them gave Elon the volume to control the narrative.

Between 2018 and 2020, a small army of Tesla super fans emerged with youtube channels and twitter accounts chronicling their journeys as Tesla owners and Tesla investors. Very few knew much of anything about equity investing, but that was practically an asset. It made them relatable to a millennial professional class who was just figuring out what to do with their money. Teslas were great cars that everyone was going to want; cutting edge tech was eventually going to make them drive themselves, and help the earth avoid a climate catastrophe. That sounds like a terrific way to get rich. To the extent that these chart nerds could be heard over the music being bumped at the non-stop Tesla party, they sounded like real buzz kills.

By 2020, the Tesla collapse had become one of those things that was always just around the corner, but never materialized. The market hivemind had bought in to Tesla’s perpetually moving version of the future so consistently that the short sellers’ Chicken Little story was being loudly mocked by the nuveau-riche, starry-eyed millennial dreamers who had just taken their money. Elon took a moment to shift the focus of his considerable media footprint to the fact that he was now, technically, a few hundred million times better at capitalism than those TSLAQ dorks.

It’s likely that Musk hasn’t thought this takeover through any more than he did his plan to take Tesla private in 2018, because there isn’t a lot to think through. Social media is the most important information medium of this era, and Twitter is arguably the most relevant platform. There’s seldom a news broadcast that doesn’t have a story built around someone’s tweet, or that doesn’t use tweets to gauge public sentiment on whatever it’s reporting. It’s as important to modern robber barons like Elon Musk as newspapers and radio stations were to William Randolph Hearst and Howard Hughes. In a sense, Elon is telling the truth. It isn’t about the money. It’s about control.

The mechanics of the algorithms that govern what Twitter shows its users, which tweets are pushed up in the mix and which ones are buried, are a mystery to Twitter’s users and the general public. “Shadow bans” are a common complaint of serial posters who just can’t get any traction, and only the algorithm knows if those posts are being intentionally sandbagged by the platform for any specific reason, or if they just plain suck. Deep Dive contributor Michael Miller once floated the idea that the algorithms governing a platform’s display rankings ought to be public information. That would go a long way towards making Twitter the free information agora that Musk says he wants, but don’t count on it.

Organic posts carry more gravity than ads, because ads… are ads. The users who don’t ignore them process them with the knowledge that they’re a message from a sponsor. That’s why most successful campaigns use the concerted efforts of high-value accounts instead of or in addition to paid ads. The ability to throttle and de-throttle posts is arguably worth more than any amount of out-loud ads at any price. If the method by which it’s happening is public knowledge, those throttled posts lose their organic status.

Information for this story was found via Edgar and the other sources mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.