On June 22, Else Nutrition (TSX: BABY) announced that it raised $7.29 million by selling 6,940,000 units at a price of $1.05 per unit. Each unit is comprised of one common share and one warrant, exercisable at $1.25, and is valid for 60 months.

Else Nutrition says that this capital will be used “to fund research and development including clinical studies, fund sales and marketing, acquire inventory, establish a manufacturing facility, and for general corporate purposes.”

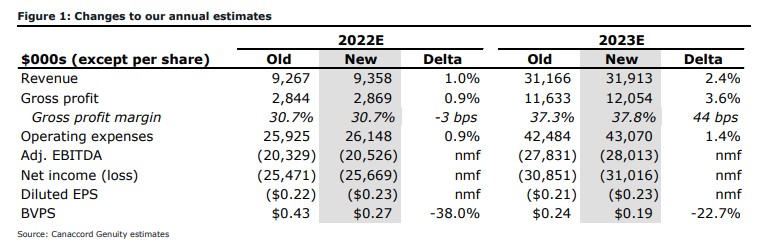

In Canaccord Genuity’s note on the financing, they reiterate their speculative buy rating but slash their 12-month price target to C$2.00 from C$2.50, saying that they estimated the net proceeds from this raise to be $6.6 million after backing out 7% in broker commission and roughly $0.25 million in offering expenses.

Else notes that of this $6.6 million, $2.4 million will go to sales and marketing initiatives, $2.0 million will go to R&D, $1.3 million will go to the acquisition of 3-6 months worth of inventory and the last $0.9 million will go to general corporate and working capital purposes.

Else Nutrition also announced that it will be entering the Canadian market next month with a plan to launch all three of its U.S product lines in Canada. Canaccord says that this news does not even impact their near-term estimates, but they “view this as a positive development, reaffirming BABY’s focus on international expansion.” As the company can use these products to create, “a foundation on which BABY can establish brand recognition.”

Prior to this raise, Canaccord expected Else Nutrition to do a single $40 million raised during the fourth quarter of this year. Now they forecast that the company does two $30 million equity raises, one in the fourth quarter of 2023 and one in the fourth quarter of 2024.

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.