On June 24, Embark Trucks, Inc., a company that develops autonomous vehicle (AV) driving software for the U.S. trucking industry, announced it is merging with special purpose acquisition company (SPAC) sponsor, Northern Genesis Acquisition Corp. II (NYSE: NGAB). Upon merger close, which is expected to be in 3Q 2021, Embark Trucks will be a publicly listed company.

AV software for trucks represents an enormous market and is therefore a highly competitive business. Indeed, the American Trucking Association reports that the trucking industry generates more than US$700 billion in annual revenues. One of Embark’s peers, PlusAI Corp., reached a similar merger deal with SPAC sponsor Hennessy Capital Investment Corp. in May. Another competitor, TuSimple Holdings, raised more than US$1 billion in an IPO in April.

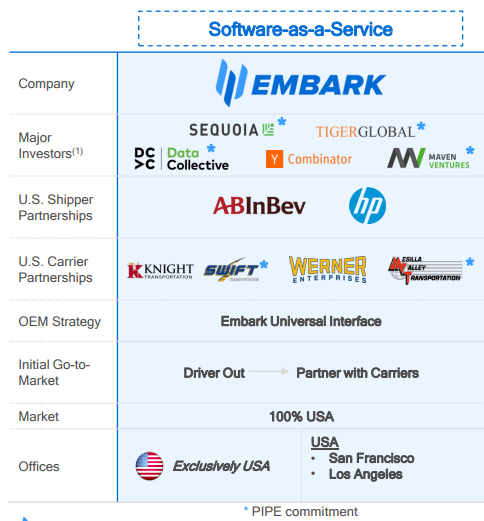

PlusAI and TuSimple have strong ties to China and plan to grow their business there. Embark’s focus, on the other hand, is on the U.S. market. Embark and either of these companies (or others) will ultimately need to raise substantial capital to build out their systems.

Embark’s system is currently employed by a relatively small number of trucks, but it has partnered with a number of major companies, including Knight-Swift Transportation Holdings Inc., the largest trucker in North America; the beer maker Anheuser-Busch InBev, and HP Inc. (Knight-Swift is expected to make a US$200 million private investment in Embark.) In addition, Amazon has utilized Embark for cargo hauling. Carriers pay a per-mile subscription fee for using Embark’s software.

The figure below depicts Embark’s most important relationships with shippers and carriers.

Embark’s system appears to be safe. Trucks equipped with the technology have so far travelled (with safety drivers on board) over one million miles without a U.S. Department of Transportation (DOT) reportable safety incident. The company plans to have no drivers in the cab in 2023 and to reach commercial scale in 2024.

Transaction Overview

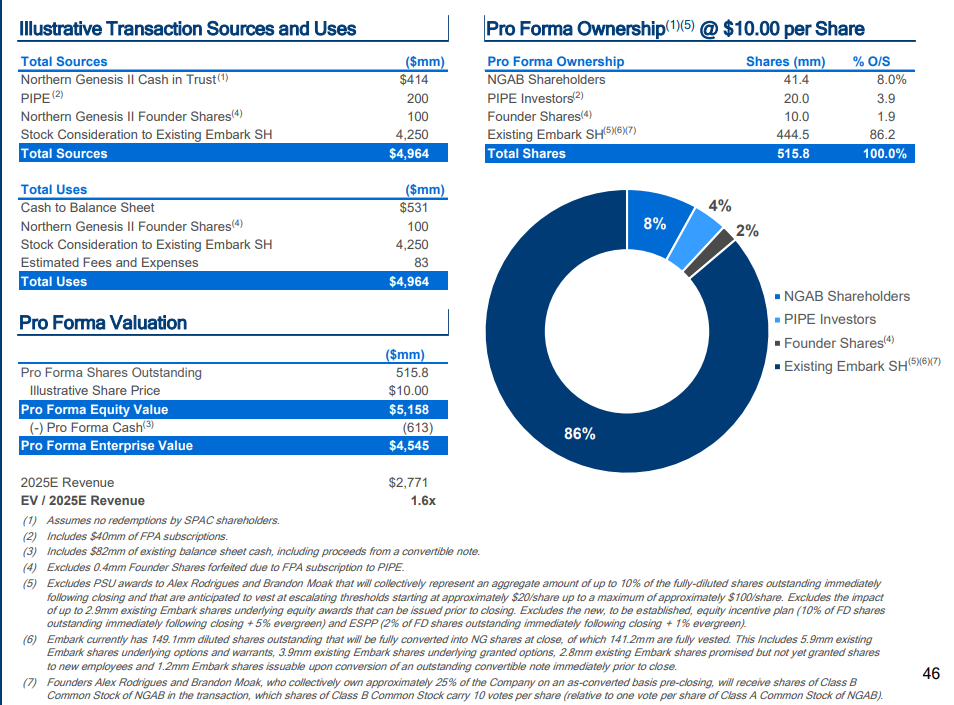

The Embark Trucks-Northern Genesis merger places a US$4.5 billion enterprise value on Embark. The company expects to have about US$600 million on its balance sheet as of merger close.

Financial Projections

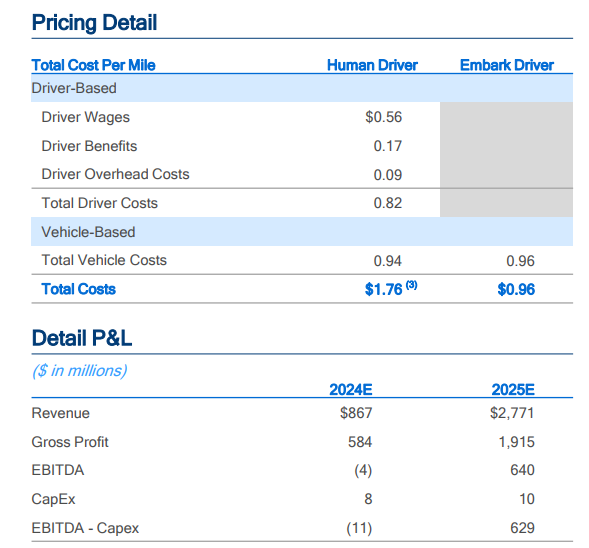

As Embark begins operating on a commercial scale, it expects substantial revenue and EBITDA growth from de minimis amounts today. Revenues and EBITDA are projected to reach US$2.8 billion and US$640 million, respectively, in 2025. One difference between Embark and the majority of announced electric vehicle (EV) SPAC combinations is that Embark’s enterprise value-to-projected out-year (~2025) EBITDA ratio is substantially smaller than the EV companies (7.0x versus well into double digits for the EV makers).

Embark faces a variety of risks. For example, if a truck using its technology were to cause a serious accident in the future, its growth prospects could be significantly affected. Also, the company faces a number of well-capitalized competitors, each of whom is hungry to gain market share.

Embark Trucks faces stiff competition in developing autonomous driving technology for trucks, but the potential rewards are substantial if its technology is judged to be superior versus its rivals. Furthermore, the company has reached important agreements with many major industry players, and its valuation on projected out-year — of course, possibly optimistic — EBITDA, is more modest than many electric vehicle manufacturers.

Northern Genesis Acquisition Corp. II last traded at US$9.91 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.