In early March, Energy Fuels Inc. (TSX: EFR) and Neo Performance Materials Inc. (TSX: NEO) announced a rare earth production initiative spanning North America and Europe. Energy Fuels will produce a mixed rare earth carbonate by April and ship a portion of that production to Neo’s rare earth separation facility in Estonia.

Neo will then process the rare earth carbonate into separated rare oxides, such as Neodymium (Nd) or Praseodymium (Pr) oxides that are used in magnets in electric vehicles, advanced optics, and computers, among other high-technology applications. As an example, the F-35 fighter aircraft contains about 1,000 pounds of rare earth materials.

Energy Fuels will produce the rare earth carbonate at its White Mesa Mill in the state of Utah from monazite sands supplied by The Chemours Company. The first shipment from Chemours arrived at Energy Fuels’ mill around March 7. Energy Fuels also plans to recover the uranium from the monazite sands for future export to nuclear generation facilities. Chemours’ monazite sands are a byproduct of its fertilizer production in the southeastern United States.

The key aspect of Energy Fuels’ initiatives is that investors are richly rewarding companies which plan to become important players in the production of rare earth carbonates and ultimately rare earth oxides. For example, MP Materials Cop. (NYSE: MP) owns the Mountain Pass rare earth deposit in the U.S. state of California. MP Materials currently produces a rare earth carbonate (which Energy Fuels plans to begin doing shortly) and expects to commence producing Nd and Pr oxides in 2022. Energy Fuels hopes to begin producing such products in 2023 or 2024.

MP Materials has announced a US$250 million adjusted EBITDA target for 2023. The company reported US$18 million of adjusted EBITDA in 4Q 2020 and US$43 million for the full year 2020. Based on these parameters, investors have accorded MP Materials a stock market valuation of nearly US$8 billion. Energy Fuels stock market capitalization of US$914 million is just over one-tenth of that figure. If it can successfully produce rare earth carbonates, the gap between the two companies’ valuations could narrow.

Energy Fuel’s Financials

A pre-revenue company, Energy Fuels’ quarterly cash flow deficit has averaged about US$9 million over the last five reported quarters. The company had cash of about US$28 million as of September 30, 2020 and around US$8 million of debt. Given its fairly modest net cash position and its commitment to building its rare earth business, Energy Fuels will likely have to raise equity fairly soon.

| (in thousands of US $, except for shares outstanding) | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($1,003) | ($9,348) | ($6,470) | ($7,806) | ($40,581) | ($8,832) |

| Operating Cash Flow | ($6,902) | ($9,446) | ($7,506) | ($8,324) | ($9,680) | ($11,706) |

| Cash – Period End | $22,415 | $28,122 | $28,317 | $25,969 | $17,648 | $22,504 |

| Debt – Period End | $289 | $8,179 | $16,504 | $15,766 | $17,912 | $17,754 |

| Shares Outstanding (Millions) | 134.3 | 130.3 | 120.5 | 114.9 | 100.7 | 99.2 |

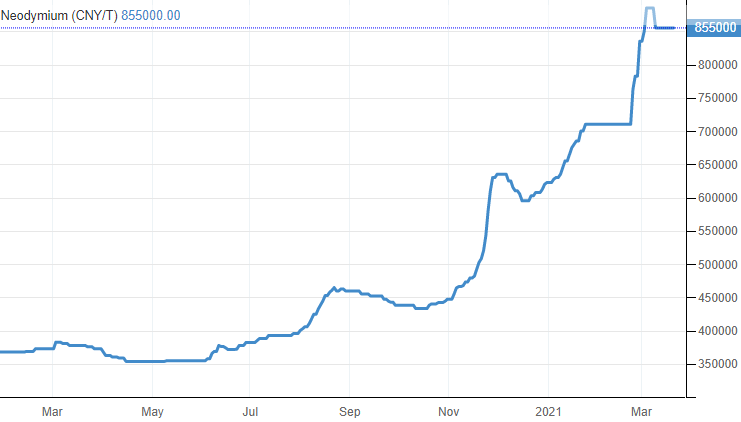

Rare earth materials prices have increased dramatically over the last nine months. See the price graph of Neodymium below. Naturally, if price trends were to reverse their recent momentum, Energy Fuels shares could suffer.

Energy Fuels is building its rare earth business, a business characterized by commodities in short supply, rising commodity prices, and high stock market valuations. The company has nearly a US$1 billion stock market capitalization, but if the company delivers on its business plan, that valuation could increase substantially.

Energy Fuels Inc. is trading at $7.52 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.