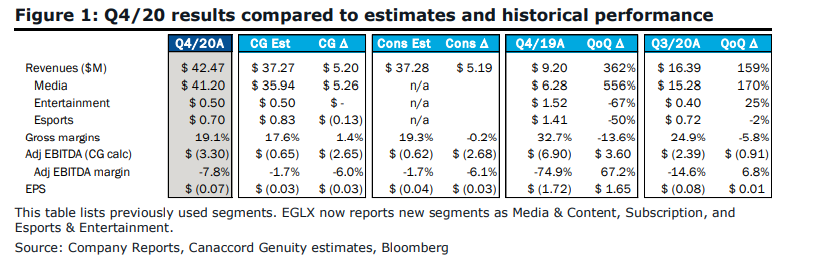

On March 22nd, Enthusiast Gaming (TSX: EGLX) released their fourth-quarter earnings and announced a partnership deal with TikTok. Enthusiast Gaming reported quarterly revenue of $42.5 million, with a gross profit of $8.1 million or a 19% margin. They meanwhile had a negative $6.9 million net income. For the year, total revenue equaled $72.76 million, with a gross profit of $18.67 million and a net loss of $26.9 million.

Enthusiast Gaming currently has six analysts covering the company with a weighted 12-month price target of C$12.33. This is up from the average before the results, which was C$7.92. Three analysts have strong buys while another three have buy ratings. Alliance Global Partners has the highest price target with a C$14 target, while B. Riley has the lowest at C$11.50.

Below are the most recent analyst changes after the companies earnings:

- Alliance Global Partners raises target price to C$14 from C$11

- Canaccord Genuity raises target price to C$12 from C$8.75

- Colliers Security raises target price to C$12 from C$6.50

In Canaccord’s note, Robert Young, their analyst, reiterated their buy rating and increased their 12-month price target from C$8.75 to C$12. Young headlines, “Direct sales acceleration evident in Q4; subscription poised to break out next.”

Below you can see how the company’s fourth-quarter/year-end held up against Canaccord’s estimates. Young says that the main reason for the beat is attributed to higher CPMs due to higher direct sales and improved viewer retention.

Young says that management’s soft guidance of +20% revenue in 2021 still remains on track. They expect that the company will have a rough first quarter due to seasonality and the loss of live events revenue, equaling about $2 million. Young writes, “We don’t expect large acquisitions like Omnia in the near term, but EGLX continues to see an opportunity to consolidate a fragmented video game lifestyle audience and will be as acquisitive as it can be.”

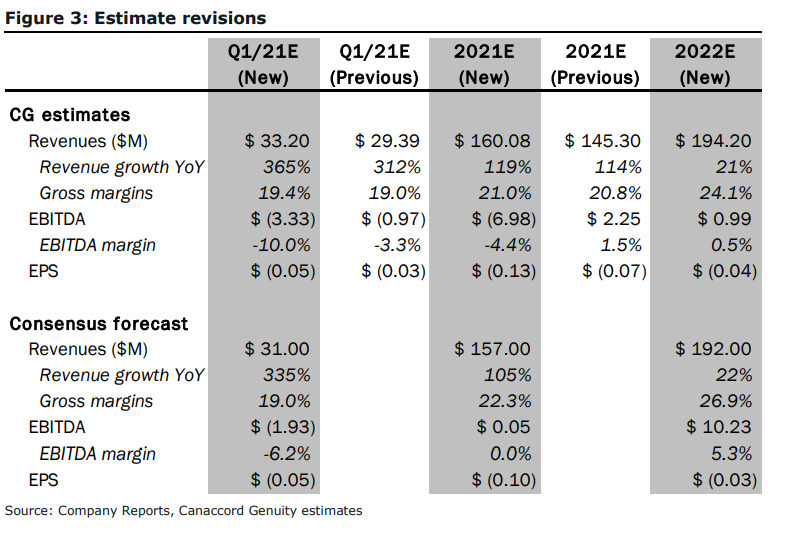

Below you can see updated estimates for the first quarter of 2021, as well as the full years 2021 and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.