On November 23rd, Enthusiast Gaming (TSX: EGLX) announced that they acquired Outplayed, Inc, the owners of U.GG which is a league of legends website. Enthusiast Gaming is paying $45 million with a potential $12 million in earnouts subject to certain performance milestones. The company is paying $7.5 million in cash, 5.2 million shares equal to $20.6 million, and two $8.5 million deferred payments paid on the first and second anniversary of the closing date.

Enthusiast Gaming currently has 9 analysts covering the stock with an average 12-month price target of C$10.04, or an 86% upside to the current stock price. Out of the 9 analysts, 3 have strong buy ratings and 6 have buy ratings. The street high sits at C$12 from Colliers Securities and the lowest price target is C$9 from 2 different analysts.

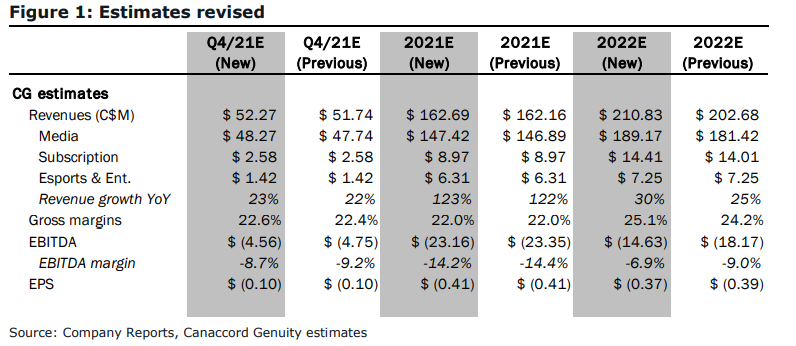

In Canaccord’s review, they reiterate their buy rating and C$9 price target, saying that the company has started to fill its League of Legends gap with this acquisition. They say that the acquisition was done at 5.6x Outplayed’s 2022 estimated sales, which Canaccord calls dilutive as Enthusiast trades at 3.3x. They do believe that Outplayed boasts 70-80% gross margins and 45-50% EBITDA margins which remain attractive for Enthusiast.

Canaccord warns of potential “cash outflow or share issuance” as the company has many upcoming earn-outs to pay out and notes that this should remain a headwind for the company. They write, “we believe Enthusiast is doing what it said it would do and with the underlying business momentum continuing.”

Canaccord believes that Outplayed’s main IP, U.GG remains under-monetized, writing, “we believe [it] could provide a strong platform to layer subscription, direct sales, and programmatic ad sales revenues.” U.GG currently has 8 million MAU’s with only 12 employees who are in engineering roles. They believe with Enthusiast now in control, U.GG has a higher growth profile than Enthusiast.

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.