On January 13th, Equinox Gold (TSX: EQX) reported their fourth quarter and full-year 2021 production results. The company announced that it produced 210,400 ounces of gold this quarter, coming in line with its full-year production guidance. The company previously guided for 560,000 to 625,000 ounces of gold production, with the final production total coming in at 602,100 ounces.

While most of the individual mines came in line with their guidance, Los Filos came in 100 ounces higher than the high end of the guidance. RDM’s production came in roughly 1,200 ounces below the lower end of guidance.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$14.27, or a 66% upside to the current stock price. Out of the 12 analysts, 1 has a strong buy rating, 9 have buys and 2 analysts have hold ratings on Equinox Gold. The street high sits at C$20 or a 133% upside, which comes from Stifel-GMP. The lowest 12-month price target sits at C$11.75.

In BMO Capital Markets’ note, they reiterate their C$14.50 12-month price target and outperform rating saying that the fourth-quarter results came in strong on high consensus estimates.

For the quarterly production, BMO expected Equinox to produce 193,800 ounces, primarily thanks to Los Filos, Mesquite, and Aurizona while RDM and Fazenda missed their estimates. BMO estimates that Los Filos produced 56,700 ounces in the fourth quarter beating their estimates by 26%, while Mesquite beat estimates by 10% and Aurizona beat by roughly 5%. RDM production missed BMO’s estimates by 14% while Fazenda missed by 6%.

Lastly, BMO says that Equinox Gold is heading into 2022 with a strong balance sheet, as they have more than $300 million in cash, $200 million available in a revolving credit facility as well as its receivable for the Mercedes sale. They write, “This will help with an ambitious 2022, which includes commencing production at Santa Luz (late Q1), advancing construction at Greenstone, and facilitating other exploration programs.”

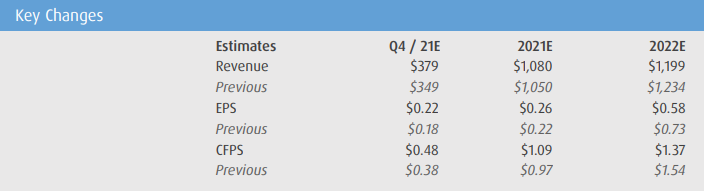

Below you can see BMO’s updated fourth quarter, full-year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.