Earlier this week, Equinox Gold Corp (TSX: EQX) announced the acquisition of Premier Gold Mines (TSX: PG). Each Premier shareholder will receive 0.1967 shares of Equinox Gold for each share held of Premier, which is the weighted 10-day volume-weighted average closing price.

Premier will also spin off its US-focused gold production and development company i-80 Gold Corp, while Equinox Gold will conduct a $75 million equity financing, fully underwritten by their Chairman, Ross Beaty.

Equinox Gold currently has ten analysts covering the company with a weighted 12-month price target of C$22.83. One analyst has a strong buy rating. The majority, eight, have buy ratings, and one analyst has a hold rating.

Here are the most recent analyst changes on Equinox Gold:

- National Bank of Canada cuts to sector perform from outperform, raises target price to C$18 from C$20.25

- TD Securities cuts target price to C$24 from C$27

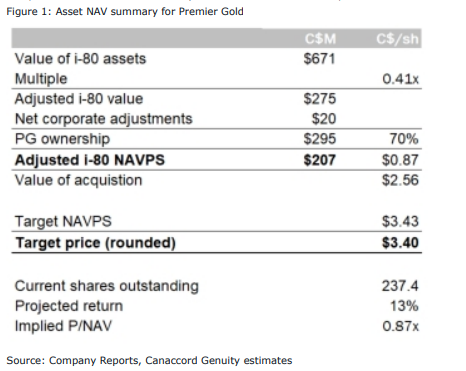

Firstly, lets look at a note issued by Canaccord on Premier Gold Mines. Tom Gallo, Canaccord’s analyst, downgraded their 12-month price target to C$3.40 from C$4.75 but reiterated their buy rating on the company. Gallo says, “We believe this transaction leaves Premier with a more focused vehicle that should allow it to advance its development properties while still having a cash flowing asset in South Arturo.”

Below you can see his asset net asset value (NAV) breakdown for Premier Gold.

Onto Canaccord’s coverage on Equinox Gold, Dalton Baretto kept their 12-month price target at C$22.50 and reiterated their buy rating.

Baretto says that they view this transaction as a positive for Equinox for multiple reasons. First, he says that this deal is “fully aligned with the stated strategy of being a million-ounce producer focused on the Americas.” The deal adds a producing asset in Mercedes that is good for ~50,000 ounces per annum, and adds 50% of a green-field project in Hardrock.

The second positive about this deal is that there is no premium, and that Equinox will hold a 30% interest in the i-80 asset spin-off. The last positive Baretto says about this deal is that this is NAV-accretive. They believe that Hardrock was an undervalued asset within Premier Gold’s portfolio.

Stifel GMP’s analyst Ian Parkinson also believes that this deal makes perfect sense, echoing that the Hardrock asset fits well with Equinox Gold’s strategy.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.