Netflix (NASDAQ: NFLX) is expected to report its third-quarter financials on today with a call after hours. BMO Capital Markets released a note reiterating their $700 price target and Outperform rating, showcasing their estimates for this quarter. The consensus revenue analyst estimate is $7.47 billion with a 45% gross margin and a net income of $1.15 billion.

Netflix currently has 45 analysts covering the stock with an average 12-month price target of $625.38. Out of the 45 analysts, 13 have strong buy ratings, 20 have buys, 8 have hold ratings, 3 have sells and 1 analyst has a strong sell on the stock. The street high sits at $971 from Elazar Advisors, while the lowest price target sits at $340.

In BMO’s note, they attribute the smash success of Squid Game for the reinvigoration of the stock and subscriber optimism. They write, “We think risk/reward tilts to the upside still, but we are moving the stock a notch down our pecking order owing to stock price performance.”

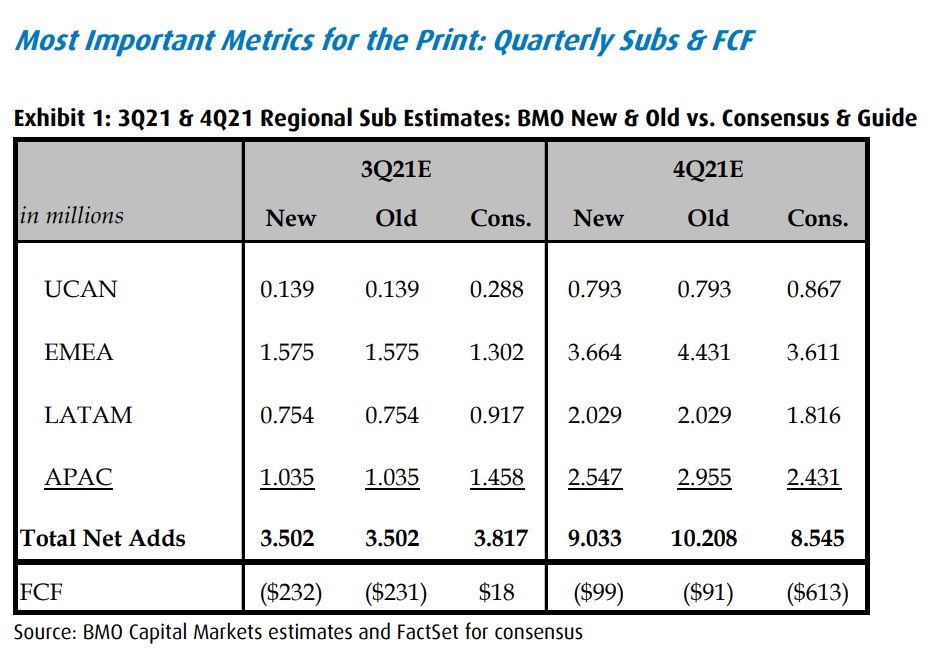

For subscribers, BMO estimates that they will get 3.5 million new adds for the quarter with Europe, Middle East, and Africa netting 1.575 million new adds and only 0.139 million new adds from Canada and the United States. This will bring Netflix’s total subscribers to 212.68 million. BMO has elected to lower fourth quarter new additions to 9.033 million from 10.208 million.

Lastly, BMO expects that Netflix will start to generate free cash flow during 2021 and, “drive substantial growth through 2030.” They expect free cash flow to reach $24.7 billion, while in the near term they expect free cash flow of $4 million, growing to $1.1 billion in 2022. They expect $600 million in buybacks during the third quarter, $800 million next quarter, and $3.5 billion for the full year 2022.

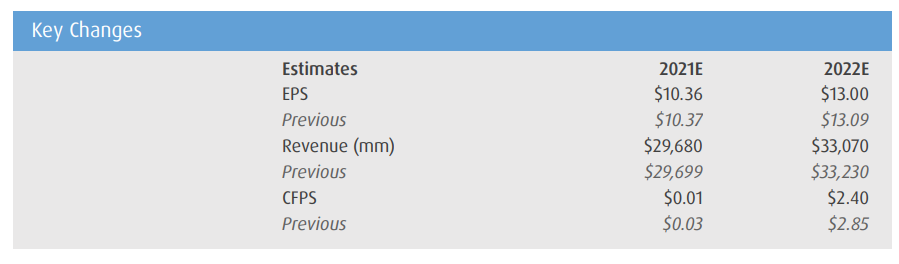

Below you can see BMO’s 2021 and 2022 estimates below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.