Several well-informed sources, including a researcher at the highly regarded Ethereum Foundation, have said that the methodology for mining Ethereum may soon change. The change will see the second-largest cryptocurrency by market cap shift to an environmentally friendly Proof-of-Stake (PoS) system, from an electricity usage-intensive Proof-of-Work (PoW) algorithm.

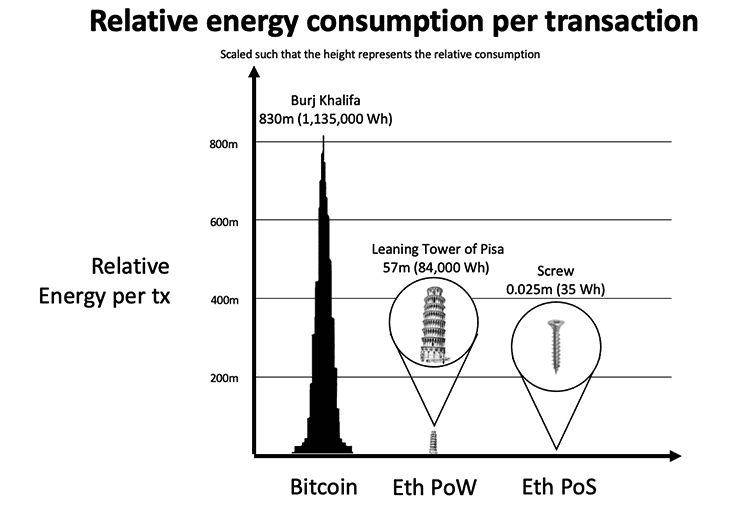

When this change is made, the magnitude of the reduction in energy usage is startling: PoS mining is perhaps ~2000x more efficient than PoW mining. (Bitcoin is mined via a PoW system.)

Given the financial markets’ laser focus on the electricity consumption linked with cryptocurrency mining, particularly Bitcoin mining, Ethereum’s transition to a PoS system could translate into strong relative price performance versus Bitcoin. In the same vein, it is possible that investors could favor cryptocurrency miners which mine a larger percentage of Ethereum. Of the miners, Hive Blockchain Technologies Ltd. (TSXV: HIVE) has allocated more mining capacity to digital currencies other than Bitcoin than its peers.

Proof-of-Work (PoW) Versus Proof-of-Stake (PoS) Cryptocurrency Mining Models

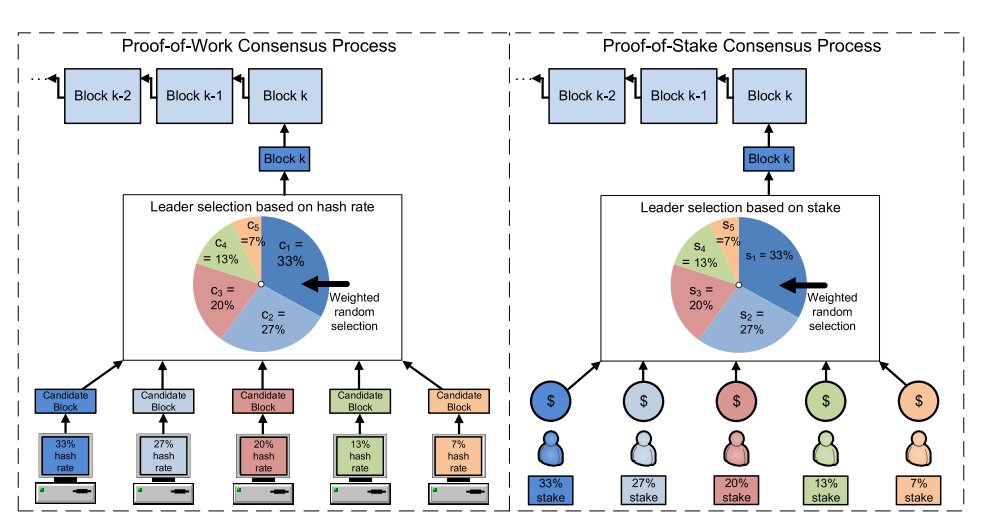

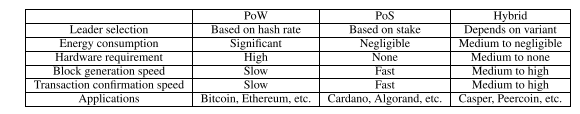

Bitcoin and Litecoin (and currently Ethereum) miners mine their respective digital currencies via electricity-intensive PoW algorithms. In all these cases, mining is performed at the nodes of a network where powerful computers solve extremely complex math problems. Indeed, the answer to such a problem is a long string of numbers called a hash, or proof of work. A slight change to any part of the input data would create a useless, unrecognizable hash.

The networks adjust the difficulty of the mathematical problem so that a valid hash is generated — thereby enabling a block to be added to the blockchain — on a preset schedule. Of course, many miners simultaneously compete to determine the correct hash. The first miner to do so receives the block award. Note that there is a significant amount of trial and error in the computational process to determine the correct hash so that luck, not just possessing the fastest computers, plays a role in determining which miner wins the rewards.

In a Proof of Stake (PoS) system, a miner is limited to mining a percentage of transactions that equates to its ownership stake. In other words, a miner which owns 2% of all available crypto-coins can mine only 2% of the blocks. In a PoS system, blockchain validators are a group of miners chosen at random by an algorithm. Two thirds of the validators must agree on the state of the block, and their decision is considered final. If the validators are found to have colluded, they are stripped of their entire cryptocurrency stake. Miners in a PoS network require far less computing capacity than in a PoW network.

Not only is the PoS framework considered much more energy efficient than a PoW system, it is also less vulnerable to a cyberattack. The cryptocurrencies XRP, Cardano and Nxt use the PoS framework.

In summary and phrased slightly differently, a miner in a PoS system need not spend large amounts of capital to buy a suite of state-of-the-art computing equipment, nor consume huge amounts of electricity to prosper — unlike a miner operating in a PoW system.

If Ethereum can successfully — and, based on a number of reports, fairly quickly — transition to a PoS system, it seems reasonable that cryptocurrency investors could increasingly support it over the much larger capitalization Bitcoin. This could in theory cause Ethereum to rally relative to Bitcoin and prompt stock investors to favor cryptocurrency miners better prepared to mine Ethereum as opposed to its larger peer.

Ethereum and Bitcoin last traded at US$2,275 and US$34,505, respectively.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.