Natural gas prices across Europe have been sent skyrocketing as of late, amid a combination of low storage volumes, cooler weather, and bureaucratic setbacks.

European gas prices have surged into hyperinflationary territory, sparking mass protests across the bloc area on a daily basis. Indeed, it appears that the cost of living across Europe will especially erode at pocketbooks this winter, as gas prices hit a multi-year high of nearly $970 per 1,000 cubic meters as of Wednesday, with no sign of receding anytime soon.

Simultaneously, other energy sources such as carbon and coal have been sent skyrocketing to record-highs, as low wind generation, lack of nuclear plant availability, and a reduction in emission credits by the European Union have cut back overall energy supply across the continent.

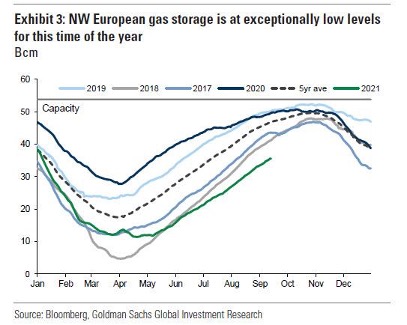

So, how did Europe get wedged between such a rock and a hard place to begin with? In short, blame a perfect storm of adverse weather, low LNG supplies, and of course geopolitical tensions with Russia. As Goldman Sachs explains, gas inventories across Europe’s Northwest have been drawn down about 24% below average, and have remained constrained all throughout summer, following an unexpected cold weather snap in April and May. Then, gas balances were further inhibited amid mediocre LNG imports from Russia and Australia, coupled with a sudden demand from South Africa that diverted shipments otherwise slated for Europe.

To further add to Europe’s growing headache, and remind the bloc of who literally keeps the lights on at night, Russia has reduced its pace of natural gas shipments to Europe due to an array of contested reasons, mostly being the country’s need to refill its own storage, and to persuade European governments to approve the controversial Nord Steam 2 pipeline.

In early September, Gazprom, Russia’s monopoly gas exporter, announced the completion of the Nordstream 2 pipeline between Russia and Germany, as US sanctions caused a plethora of delays. In the meantime, shipments of gas through the Mallnow compressor station have drastically plummeted since August, suggesting that Russia has tightened the taps to Europe until squabbling European countries are forced to approve the heavily contested gas line— which could still take several months.

Concurrently, Europe has been been adamantly phasing out coal plants over the past several years in an effort to abate climate change, which in turn has curbed the opportunity to quickly switch fuels when prices do skyrocket. But it appears that the door-slamming-in-your-face realization has finally hit: when the wind stops blowing, there is no energy.

While the European Union has been trudging full steam ahead with its obsession to achieve a green agenda, an increasing number of lower income households are set to face an even higher energy cost incidence this coming winter. But as they say, every crisis also presents an opportunity, as some are already in the midst of prepping their pocketbooks for hefty profits.

At the end of its lengthy report, Goldman Sachs advised European “gas consumers” on how to “protect themselves” from the eye-watering natural gas prices. This is certainly entertaining because the likelihood that a European gas consumer will read a Goldman Sachs note is close to zero, therefore it is safe to assume that the note is predominantly aimed at hedge funds and institutional commodity funds, who will ecstatically take Goldman’s guidance to heart.

“We continue to recommend that gas consumers protect themselves via out-of-the-money calls for this winter. Further, we strongly recommend that European consumers in particular hedge their gas exposure further out the curve, where TTF appears especially underpriced relative to coal,” read the note.

So what does that mean for out-of-this-exosphere gas prices? The hyperinflationary trajectory will spiral into even higher prices, because as they say, the best cure for high prices is more high prices! As the old proverb of commodity markets dictates, demand will eventually subside, new supply will arise, and prices will descend back to equilibrium. But what does this all mean for European consumers in the meantime?! you are likely asking. Well, in short, a long, cold winter.

Information for this briefing was found via Goldman Sachs and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.