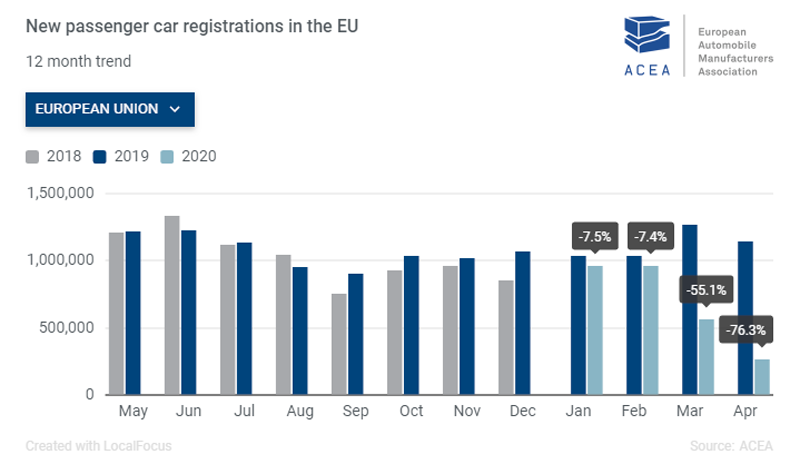

It appears that vehicle sales are not only struggling in the US amid the coronavirus pandemic, but in Europe as well. Back in March, new vehicle sales decreased by 55% in the EU: but April’s data is proving to be much worse.

Many car dealerships were forced to close their doors to customers in mid-March, as European governments introduced strict lockdown measures as a means of mitigating the spread of the deadly virus. Now with new April data pouring in, the effects of the lockdowns and infection rates are painting a more grim image of the damage sustained to the auto industry. According to the European Automobile Manufacturers Association, new vehicle registrations dropped by 76.3% for the month of the April, compared to the same time a year prior.

Italy, which has been hit the hardest by the deadly pandemic, has recorded a decline of 97.6% in new vehicle registrations, followed by Spain which saw a drop of 96.5%. France also suffered a significant decline in new vehicle sales, with a contraction of 88.8% in April. Meanwhile the United Kingdom, which although is no longer included in EU calculations, nevertheless saw a decrease of 97.3% in new vehicle registrations.

Germany, who’s car manufacturing industry had suffered several setbacks even before the pandemic, is not faring very well either. According to the April data, the country’s new vehicle registrations declined by 61.1% and even though it is not as significant as some of EU’s other countries, Germany’s auto sector does account for a significant portion of the economy.

Although German auto manufacturers have appealed to Chancellor Angela Merkel for financial aid, it appears that their pleas have fallen on deaf ears. As of current, Merkel is not giving in to the auto industry’s demands, even though the sector accounts for approximately 80,000 jobs.

Information for this briefing was found via CNBC and the European Automobile Manufacturers Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.