In a significant economic retaliatory measure against Russia’s decision to invade eastern Ukraine, Germany halted the certification of Russia’s giant Nord Stream 2 natural gas pipeline on February 22. Germany’s decision not to certify the US$11 billion, 5.3 billion cubic feet per day (Bcf/d) capacity pipeline means that gas cannot flow through the 750 miles of pipeline from Narva Bay in Russia to Lubmin, Germany.

Pipeline construction was completed in September 2021, and Gazprom, the Russian state-owned builder of Nord Stream 2, has been awaiting German regulatory certification since then.

The economic implications to Russia of no gas flowing through Nord Stream 2 and no money flowing to Russia are significant. Even if the gas were priced at a comparatively low US$4 per thousand cubic feet (Mcf), Russia would miss out on daily cash flow of about US$21 million (5.3 million Mcf per day times US$4.00 per Mcf) until the gas begins to flow.

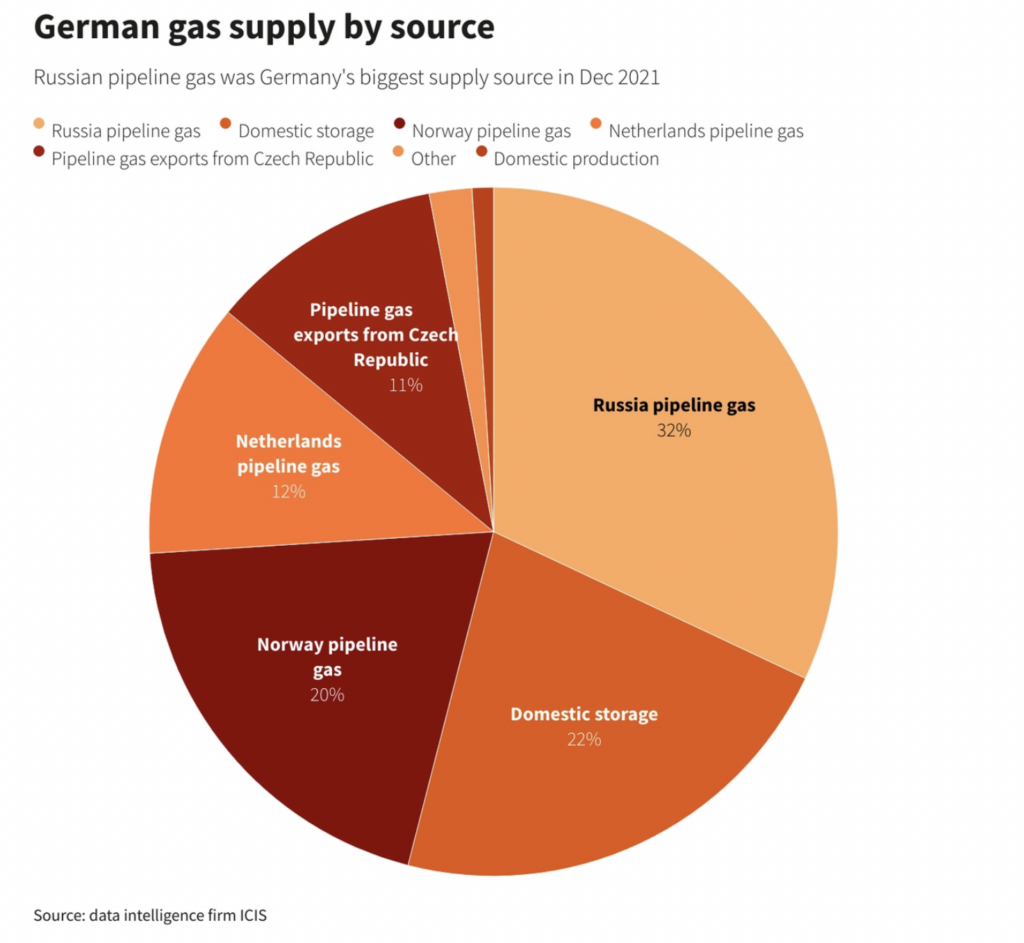

Germany’s move is courageous from the standpoint of its energy resources and needs, particularly in the winter months. According to the data compilation firm Independent Commodity Intelligence Service, Russian pipeline gas (other than Nord Stream 2) supplied nearly a third of the country’s natural gas in December 2021. If Russia were to reduce or cut that gas flow in protest, Germany could suffer. Excluding Lubmin, Germany for Nord Stream 2, the three main entry points in Europe for Russian pipeline gas are Kondratki, Poland; Greifswald, Germany; and Velke Kapusany, Slovakia.

As a side note, Germany’s actions relative to Nord Stream 2 stand in contrast to recent criticism it has received that it was not doing enough to help Ukraine. Indeed, Germany, the world’s fourth largest exporter of weapons (to only the U.S., Russia and France) has refused to send arms to Ukraine, citing the country’s strict arms control laws that only allow weapons sales to NATO and European allies. (Germany did loosen these rules in 2014 when it sent weapons to Kurdish forces in Iraq.)

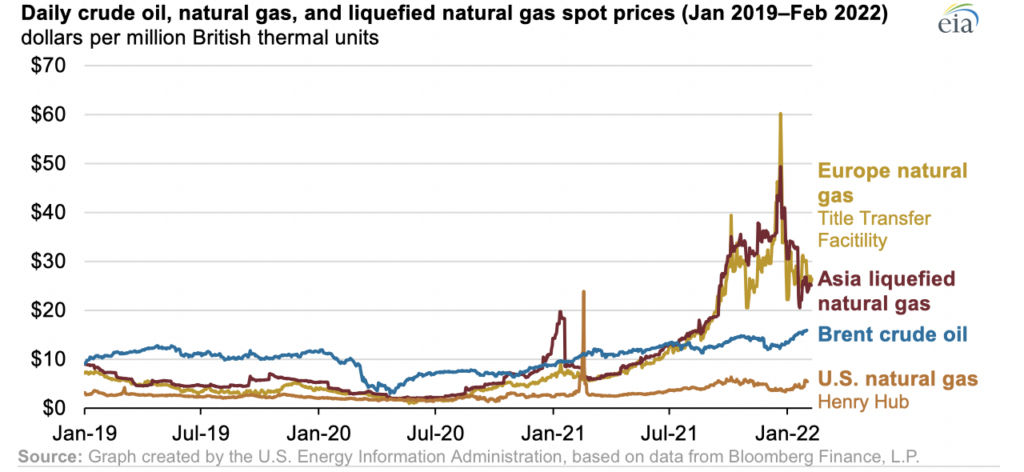

The price of European natural gas jumped on the Nord Stream 2 decertification news. Dutch natural gas futures, the European benchmark — much like Henry Hub futures is the U.S. natural gas price standard — rose 7% to 79.4 euros per Megawatt-hour. This price is approximately equivalent to a staggering US$26 per Mcf.

To put this into perspective, two points seem especially significant: 1) March 2022 natural gas at Henry Hub currently trades at about US$4.58 per Mcf; and 2) European natural gas prices averaged just over US$9 from January 2021 through August 2021.

Of course, global oil and European liquefied natural gas (LNG) prices may likewise be greatly affected by any Russian action to curtail supply. Such curtailments could be in response to Germany’s Nord Stream 2 move and/or to further economic sanctions imposed on it by the West. Russia supplies about 10% of the world’s oil and around 20% of Europe’s LNG.

Note especially in the graph above that European natural gas prices in the mid-US$20 per Mcf range are trading about in line with Asian LNG prices.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.