On September 22, European natural gas prices closed at a one-month high of 40.17 euros per megawatt-hour, which equates to a price of about US$12.55 per thousand cubic feet (Mcf) of natural gas. Prices rose more than 10% just this week.

For perspective, the benchmark price of natural gas in the U.S. at the Henry Hub location in Louisiana is US$2.63 per Mcf. Remarkably, European prices trade at these levels despite robust conditions at natural gas storage facilities, which were 94.4% full as of September 20, well above the five-year average mark of 85.5%.

Several key factors have been found to be pushing European prices higher.

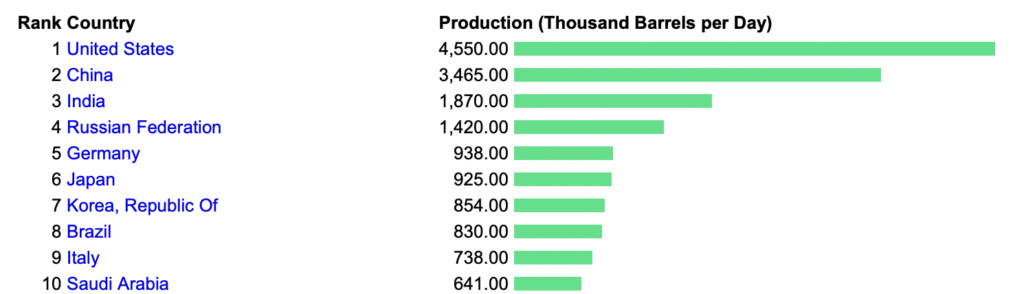

For instance, Russia’s September 21 decision to “temporarily” ban the export of diesel fuel and gasoline to most countries may limit the quantity of fuel supplies available to Europe just ahead of winter and adds to fears of eventual potential global shortages. The Russian ban has no stated end date. Russia is the world’s fourth largest producer of diesel fuel.

Russia currently supplies less than 10% of Europe’s natural gas, down from around 40% before the start of the Russia-Ukraine war. The Russian decree did not discuss any further gas curtailments to the continent, but the September 21 announcement rekindled such fears for both utilities and investors.

Outages at U.S. liquefied natural gas (LNG) export terminals meanwhile have limited the potential supply of this fuel to Europe. Specifically, Cheniere Energy, Inc.’s (NYSE: LNG) Louisiana-based Sabine Pass LNG Terminal, by far the largest such facility in the U.S., has recently operated at a reduced rate; and the Cove Point Terminal in Maryland, which is 75% owned by Berkshire Hathaway Inc. (NYSE: BRK-B), has halted production for four weeks for seasonal maintenance. In turn, two LNG vessels have delayed their arrival to northwest Europe until the middle of October, according to marketnews.com.

European natural gas prices have largely ignored a significant piece of news what would normally have pushed prices lower. On September 22, an Australian union alliance agreed to end its 1+ month-long strike against the Chevron Corporation (NYSE: CVX)-owned Wheaton and Gorgon LNG facilities in that country. These plants produce around 7% of the world’s LNG.

Information for this story was found via Bloomberg, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.