China Evergrande Group has been handed a liquidation order by a Hong Kong court, initiating a complex process to dismantle one of the largest casualties of the ongoing property crisis in China. The ruling, delivered by Hong Kong judge Linda Chan on Monday, adds another layer of complexity to Evergrande’s tumultuous journey from a property boom success to a poster child for the market’s decline, with liabilities exceeding $300 billion.

Before trading in its shares was halted on Monday, Evergrande’s market valuation had plummeted over 99% from its peak, standing at a mere $275 million. This collapse is the most significant in a crisis that has not only impacted China’s economic growth but has also led to a record number of defaults by various developers. The liquidation process will serve as a litmus test for the legal authority of Hong Kong courts over assets primarily located in mainland China, where Evergrande holds the majority of its assets.

Global investors are closely monitoring this development, given the ongoing concerns about an uneven playing field for foreign capital in China. President Xi Jinping’s tightening grip on the economy has prompted investors to withdraw billions of dollars from mainland China. Policymakers face the delicate task of restoring investor confidence while addressing the challenges of completing unfinished homes and maintaining financial system resilience in the face of the property industry’s woes.

Lance Jiang, a restructuring partner at law firm Ashurst, highlighted the importance of the liquidators’ actions, stating, “The market will pay close attention to what the liquidators can do after being appointed, especially whether they can achieve recognition from any of the three designated PRC courts.” This underscores the potential challenges in enforcing decisions on onshore assets in mainland China.

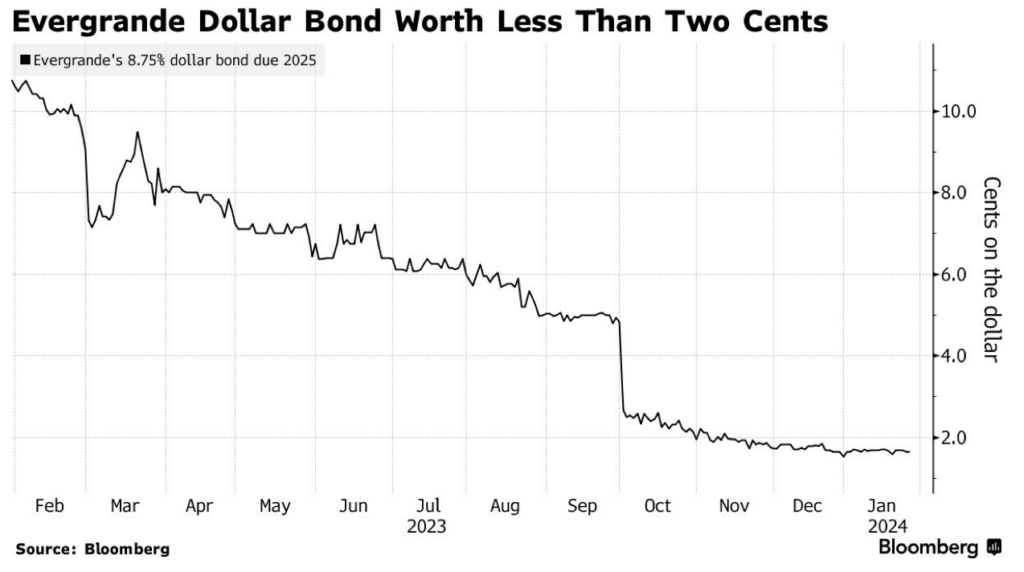

Despite Hong Kong courts issuing wind-up orders for other Chinese developers since the crisis began in 2021, none compares to the complexity, asset size, and stakeholder involvement seen in Evergrande’s case. The limited recognition of Hong Kong’s insolvency proceedings in China raises questions about the claims available for holders of Evergrande’s $17 billion in dollar bonds.

Evergrande’s Chief Executive Officer, Shawn Siu, expressed regret over the winding-up order, stating, “The company has made all efforts possible and is sorry about the winding-up order.” Siu assured that the company would ensure home deliveries and strive to maintain normal operations. The liquidation process, initiated by a petition filed in June 2022, will be closely monitored, and global investors remain watchful of the outcomes.

The complexities of Evergrande’s situation extend to its founder and chairman, Hui Ka Yan, who was placed under police control in September on suspicion of committing crimes. This, coupled with the intricate structure of Evergrande’s local units operating most projects, poses challenges for any court-appointed liquidator.

The broader impact of Evergrande’s troubles on China’s property market is evident, with a Bloomberg gauge of Chinese developers showing a 59% decline in the past year. Analysts suggest that while the macroeconomic impact may be limited, sentiment could worsen as investors fear a potential snowball effect on other pending cases within the battered property sector.

Evergrande was just ordered to sell it all! Incoming Chinese property market price discovery.🚨🚨🚨 https://t.co/BeKTMUdUU0

— Nobody Special (@JG_Nuke) January 29, 2024

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.