Falcon Gold Corp (TSXV: FG) announced this morning that it has recently secured a diamond drill contractor for the first phase of exploration in 2020. The drill program will see 1,000 meters of drilling occur at the firms Central Canada mineralized structure.

Initial drilling that occurred on the property by Terra-X Minerals in 2012 resulted in surface samples returning values of up to 39.6 grams per tonne of gold. Subsequent drilling conducted by the firm revealed gold mineralization values intersecting 10.61m @ 1.32 g/t gold. More recent drilling conducted by Interquest Resource Corp had mineralization intersecting over 1 meter @ approximately 30 g/t gold in diamond drill core and 23.3 meters @ 0.83 g/t gold.

Furthermore, trenching work conducted on the property in 2011 indicated significant gold mineralization south of the historic Sepawa Mine, with samples indicating up to 6.7 g/t gold along a strongly mineralized shear zone.

The Sepawa Gold Mine represents the closest nearby deposit to Falcon’s current property. The mine was active in 1995, when it milled 33,103 tonnes of ore which resulted in 4,547 oz of gold and 1,315 oz of silver. The mine had an unclassified resource of 528,614 tonnes at 0.31 oz/t gold as per Sepawa.

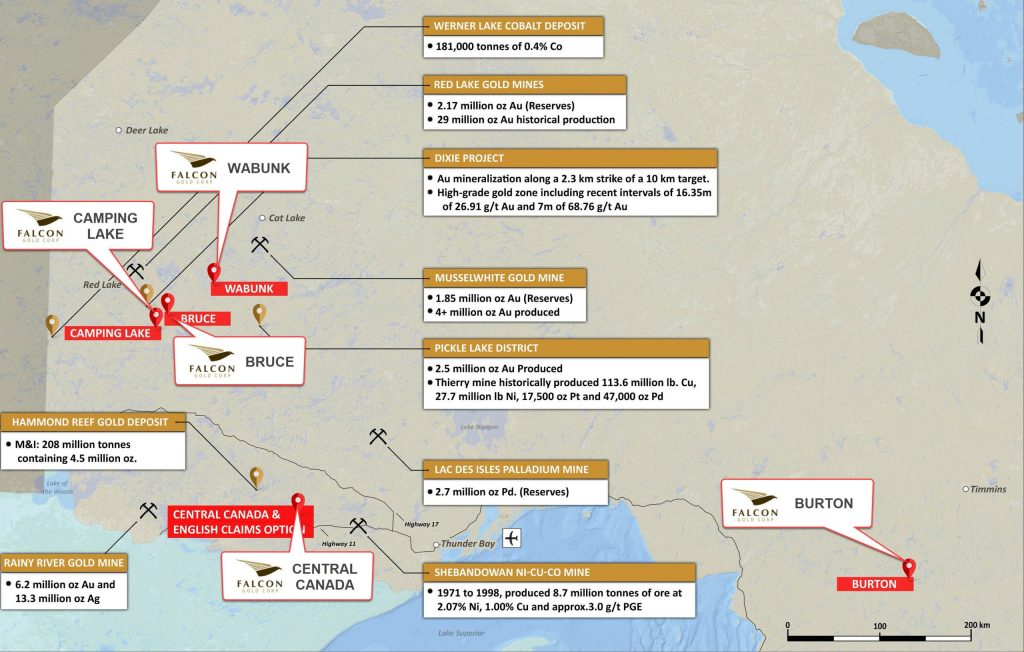

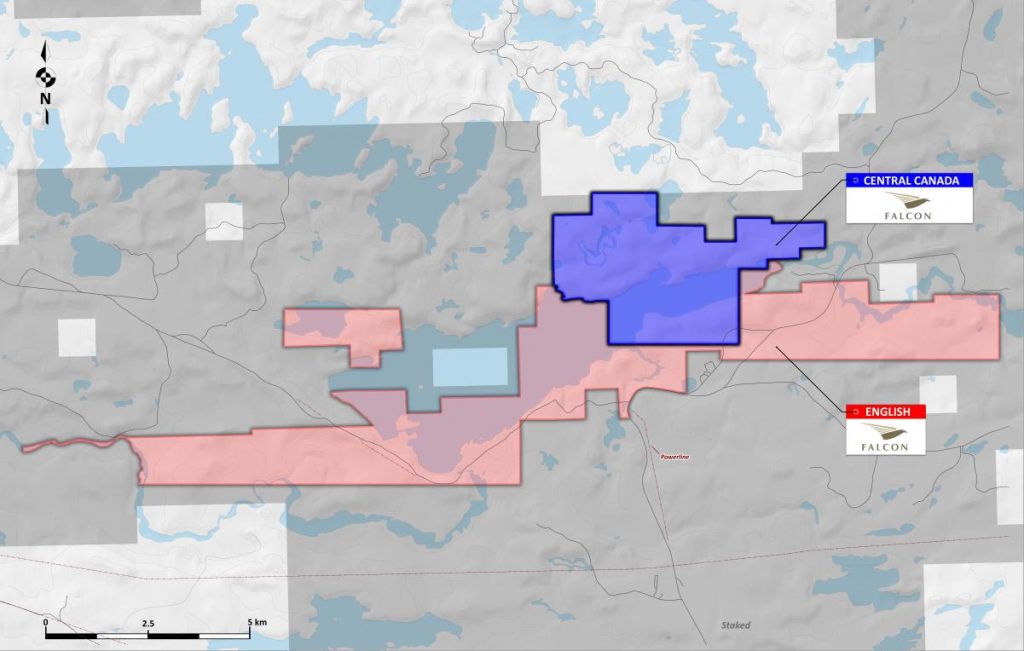

Falcon’s Central Canada property lies 21.5 km east of Atitokan, and is approximately 160 km west of Thunder Bay. The property is accessible via highways and a mine road that leads to the property. The company in total has 13 claims on the property, while also covering a historic producer with a shaft and well site.

The southern portion of the property is covered by Sapawe Lake and is underlain by an iron formation and greenstone rock, while the north portion is underlain by Archean age greenstone rocks that include mafic volcanic flows, gabbroic intrusions and quartz feldspar porphyries in which the gold mineralization is hosted..

Falcon Gold last traded at $0.04 on the TSX Venture.

FULL DISCLOSURE: Falcon Gold is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Falcon Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.