In July, many stock markets posted their best monthly results since November 2020, and in the process defied the generally downbeat predictions of many analysts and economists. Indeed, the S&P 500 Index and the TSX composite index gained 9.1% and 4.4%, respectively. What is especially remarkable about these performances is that very few macro indicators of growth or inflation showed improvement during the month, even though many nations are facing their worst inflationary conditions in 40 years.

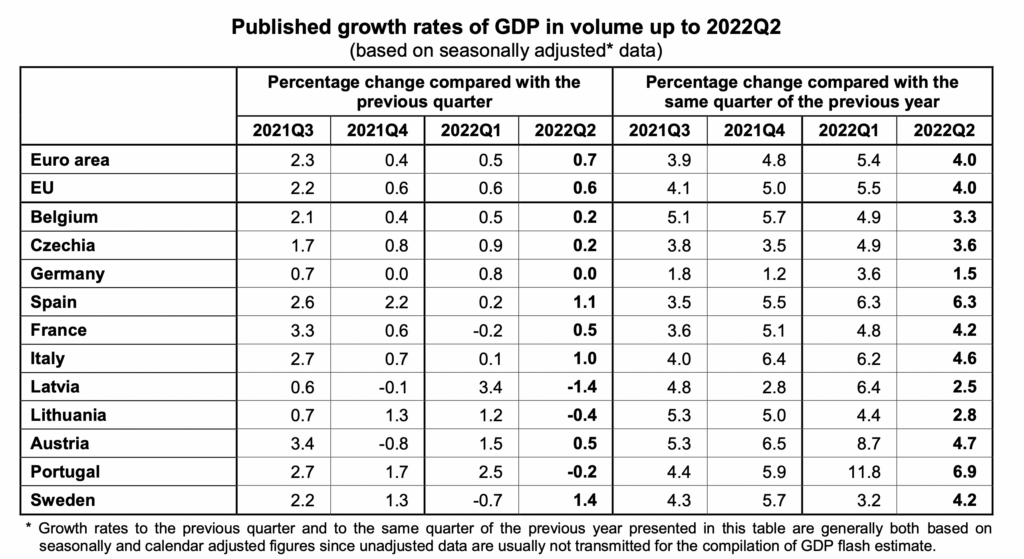

Counterintuitively, it appears growing fears that much of Europe faces a potentially sharp economic downturn beginning either later this year or in 2023 may be the key impetus for the July stock market rallies across the globe. More specifically, the economy in Germany, Europe‘s biggest and the fourth largest in the world, registered zero growth in 2Q 2022 after being hit with both the threats and the reality of successively smaller levels of Russian natural gas imports throughout the period.

In turn, investors sought safety in 10-year German government bunds, cutting its yield more than in half from 1.76% on June 20 to 0.83% on July 29. A similar dynamic has played out in other European countries; the yield on a British 10-year gilt plummeted to 1.87% on July 29 from 2.64% on June 20.

Remarkably, this is all happening while inflation continues to accelerate not only in Europe but in the U.S. and Canada too. On July 29, the European Union statistics agency announced that inflation in the eurozone’s 19 countries rose to 8.9% in July from 8.6% in June.

| Feb-22 | Mar-22 | Apr-22 | May-22 | Jun-22 | Jul-22 | |

| European Union | 5.9% | 7.4% | 7.4% | 8.1% | 8.6% | 8.9% |

| United States | 7.9% | 8.5% | 8.3% | 8.6% | 9.1% | (A) |

| Canada | 5.7% | 6.7% | 6.8% | 7.7% | 8.1% | (B) |

(A) To be released August 10, 2022. (B) To be released August 16, 2022.

Given the rapid way in which inefficiencies are exploited in global capital markets, investors bought 10-year U.S. Treasuries with abandon as well, pushing the yield down 80+ basis points to 2.66% on July 29 from 3.48% in mid-June. This extraordinary reduction in required yield has played a key role in the S&P 500’s reclaiming the 4100 level. Based on analysts’ consensus estimates for the next twelve months of about US$239.50 per S&P 500 share, the market now trades at about 17.5x forward earnings.

The issue in all this — and the piece which potentially does not fit into a completely virtuous puzzle — is these low U.S. and European bond yields apparently presume that inflationary pressures will ebb soon from historically very high levels, even though central banks have so far raised overnight night rates to only fairly modest levels.

The Federal Reserve’s benchmark overnight borrowing rate is 2.25%-2.50%, and the Bank of Canada’s is just 2.25%. Furthermore, the European Central Bank’s deposit interest rate is 0%, and the Bank of England’s main Bank Rate is set to only 1.25%. It does not seem likely that that such modest overnight interest rate levels can bring 8%-9% inflation rates to much lower levels as rapidly as equity markets are currently pricing in.

Information for this briefing was found via Edgar, Bloomberg, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.