It appears that the Canadian federal government’s stimulus spending has persevered the economy through the worst of the pandemic after all. According to recent data released by the Royal Bank of Canada (RBC), consumer spending has shown a significant rebound since April, when it was down approximately 30%. Within the first half of June however, consumerism was only down 13% compared to the same time a year prior.

According to the RBC data which was then shared with Bloomberg, the main reason behind the sudden uptake in consumer spending can be attributed to the Canadian Emergency Response Benefit program (CERB). Canadians that have lost their source of income due to the coronavirus pandemic were eligible to receive $2,000 per month; as a result, once CERB payments were distributed, recipients saw a 16% increase in available income, which in turn increased their spending by 5%.

Conversely, those Canadians that did were not eligible for the CERB program or did not apply saw the disposable income fall by 4% throughout the pandemic, which ultimately decreased their spending by approximately 10%. Thus, the CERB recipients stimulated the economy by spending more of their stimulus money rather than saving it.

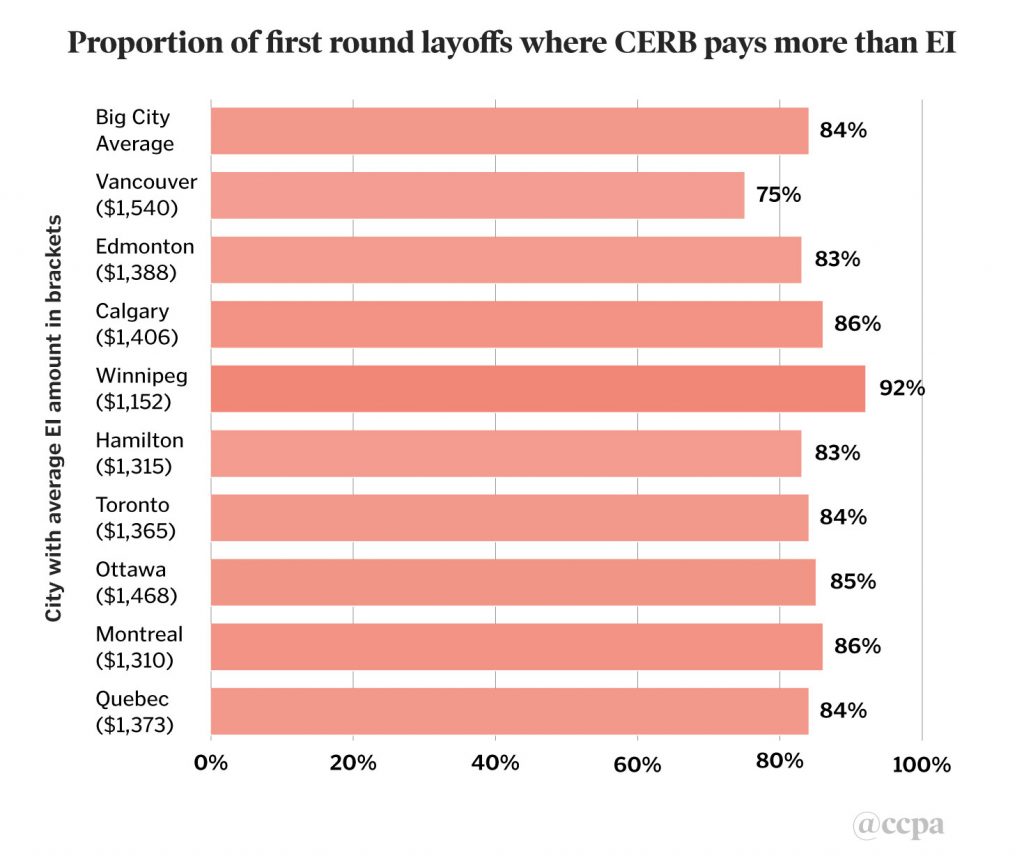

There are however, several criticisms mounting with regards to the CERB program. According to RBC’s Chief Executive Officer Dave Mckay, the $2,000 per month is more than some Canadians make at their regular place of employment, and are thus deincentivized to return to work once conditions permit. Therefore, McKay feels that it is time to put significantly more emphasis towards the federal government’s wage subsidy program as a means of getting Canadians back to work.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.