On January 19th, Filo Mining (TSX: FIL) reported their assay results from hole FSDH054. The drill hole reported 1,224 metres of 1.25% copper equivalent from a depth of 146 metres, which included 592.0 metres of 2.04% copper equivalent and 171.5 metres of 3.22% copper equivalent.

Filo Mining currently has 10 analysts covering the stock with an average 12-month price target of C$18.27, or a 20% upside to the current stock price. Out of the 10 analysts, 1 has a strong buy rating and the other 9 have buy ratings. The street high sits at C$30, which represents a 96% upside while the lowest 12-month price target sits at C$6.50.

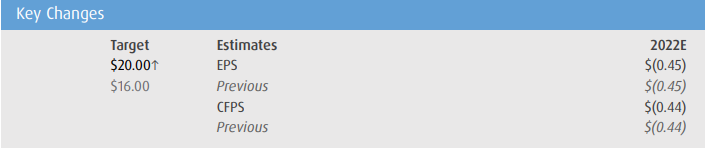

In BMO Capital Markets’ note, they reiterate their outperform rating and raised their 12-month price target from C$16 to C$20, saying that Filo, “continues to highlight success with the drill bit, especially with its long intersections, and as it better defines the structure.”

BMO says that Filo is looking to add additional rigs and is looking into the feasibility of drilling deeper. They believe that due to the significance of the precious metal content at the mine, they “continue to monitor the potential for index inclusion.”

They add that Filo has named the higher-grade portion of the trending structure the “Aurora Zone.” This zone stretches at least 700 meters, which contains Breccia 41, which is what these drill results highlight. They leave the note off by saying that Filo Mining is “full steam ahead” and by mid-year, they expect to see 11 rigs drilling at the mining site.

Below you can see BMO’s updated full-year 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.