FULL DISCLOSURE: This is sponsored content for First Majestic Silver Corp.

First Majestic Silver (TSX: AG) (NYSE: AG) has released its production and cost guidance for 2025, marking the first year that the Cerro Los Gatos Silver Mine will be included within its production lineup.

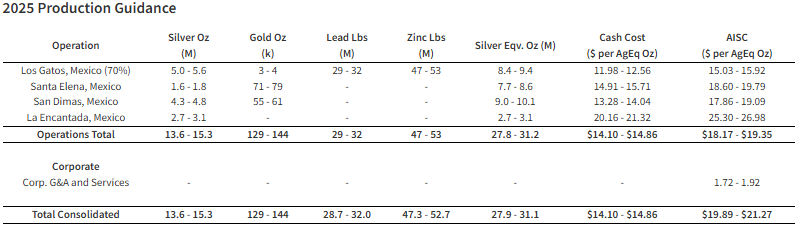

Guidance was provided for four operating mines, which also include the Santa Elena Silver/Gold Mine, the San Dimas Silver/Gold Mine and the La Encantada Silver Mine. Total production across all four mines in 2025 has been guided to be within a range of 27.8 to 31.2 million silver equivalent ounces (a 36% increase compared to 2024), which includes 13.6 to 15.3 million silver ounces (72% increase compared to 2024). Those ounces are expected to be produced at an all in sustaining cost of $19.89 to $21.27 per silver equivalent ounce.

Production in 2025 is expected to be boosted by the addition of Cerro Los Gatos, as well as improved silver production from Santa Elena and La Encantada. 2025 will also see the addition of lead and zinc to First Majestic’s production mix, with the attributable production from Cerro Los Gatos expected to be 29 to 32 million pounds of lead and 47 to 53 million pounds of zinc.

Capital expenditures meanwhile are expected to amount to $182 million, of which $80 million has been allocated to sustaining expenditures and $102 million has been allocated to expansionary expenditures.

Exploration is expected to makeup a sizeable portion of capital expenditures in 2025, with $49 million allocated to the cost center. Current plans call for 270,000 metres of drilling this year, as compared to the 182,932 metres drilled in 2024. That plan will see 112,000 metres allocated to San Dimas, 57,000 metres allocated to Santa Elena, 76,000 metres allocated to Cerro Los Gatos, and 18,000 metres allocated to Jerritt Canyon.

A conference call for the 2025 production and cost guidance, as well as the 2024 production results, is scheduled for 8:30 a.m. (PT) on February 20, 2025.

First Majestic Silver last traded at $8.12 on the TSX.

FULL DISCLOSURE: First Majestic Silver Corp. is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of First Majestic Silver Corp. The author has been compensated to cover First Majestic Silver Corp. on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.

One Response

Looking forward to seeing how the Cerro Los Gatos mine impacts production!