On November 30th, First Majestic Silver Corp. (TSX: FR) priced their convertible senior notes due in 2027. The company announced that it will be issuing US$200 million in notes. The notes will bear a cash interest semi-annually at 0.375% per annum and the conversion will be 60.3865 common shares per US$100 principal. The company said it intends to use C$164.9 million to repurchase $125.2 million aggregate principal of its 1.875% convertible senior note.

First Majestic Silver currently has 5 analysts covering the stock with an average 12-month price target of C$20.34, or a 46% upside to the current stock price. Out of the 5 analysts, 2 analysts have to buy ratings and 3 have hold ratings. The street high sits at C$31.27 from H.C Wainwright while the lowest price target sits at C$13.25.

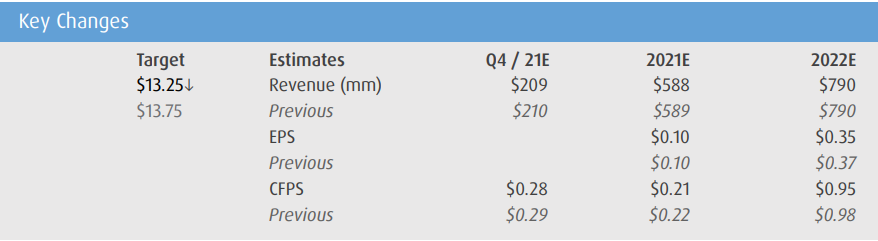

After the news, BMO Capital Markets resumed their coverage of First Majestic Silver with a C$13.25 price target, lowering it from the C$13.75 they had on the company beforehand. They also reiterated their market performance rating on the stock.

BMO says that they had a period of research restriction due to the senior note offering but since the deal has been priced they are now able to resume. They add that after using $164.9 million of the proceeds to repurchase the existing 1.875% notes, those notes will have roughly $31.1 million remaining and expect the remaining to be converted into 3.3 million shares.

Below you can see the updated BMO’s updated.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.