Deputy Prime Minister and Finance Minister Chrystia Freeland presented the fall economic statement on Tuesday, revealing a plan that aims to address pressing challenges facing the Canadian economy.

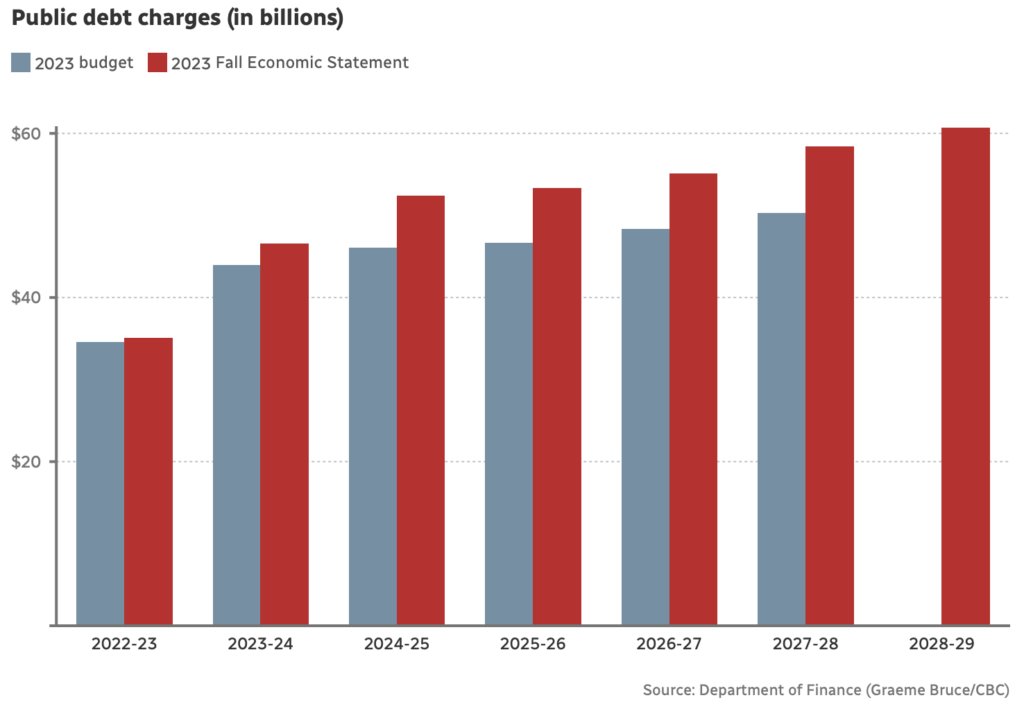

The statement anticipates a spike in the cost of servicing the government’s substantial debt load in the coming years. Despite this, Freeland emphasized the government’s commitment to fiscal prudence, assuring Canadians that the plan aims to strike a balance between addressing immediate concerns and maintaining long-term economic sustainability.

“Our economic plan is about building a strong economy that works for everyone, and this Fall Economic Statement is the next phase of our plan. With a focus on supporting the middle class and building more homes, faster, we are taking action on the priorities that matter most to Canadians today—and we will continue doing everything we can to deliver for Canadians from coast to coast to coast,” Freeland said in a statement.

The economic statement projects a slowdown in economic growth, with unemployment expected to rise by nearly a percentage point in the next year. Freeland announced an additional $20.8 billion in spending over the next six years, primarily directed towards new housing initiatives and climate-friendly projects. The focus on housing includes low-cost loans for builders and support for affordable housing, with the goal of constructing 101,000 new homes by 2031-32.

The government’s debt servicing costs have surged, reaching $46.5 billion in the current fiscal year, a significant increase from $20.3 billion in 2020-21. With debt service charges forecasted to climb to $60.7 billion in 2028-29, it has become one of the most costly items in the federal budget. This surpasses expenditures on key areas such as the Canadian Armed Forces, the Canada Child Benefit, and the employment insurance program.

It's official, next year the Liberal government will spend more on interest on the debt than what it will send the provinces for healthcare.

— adam chambers (@adamchamb) November 21, 2023

The "interest rates are so low, we must spend" bet was a massive misjudgment.

This fall economic statement really feels like microwaving leftover promises at the affordable cost of billions.

— Jennifer Elle (@jenniferelle_) November 21, 2023

Kevin Page, former parliamentary budget officer, noted the inevitability of rising debt servicing costs due to the substantial increase in debt during the COVID-19 pandemic. The federal debt has doubled since 2015-16, reaching $1.2 trillion last year and projected to rise to $1.4 trillion by 2028-29. This limits the government’s fiscal flexibility to address issues like the housing supply crunch.

Despite the challenging economic outlook, Freeland expressed optimism, citing decreasing inflation, rising wages, and private sector economists predicting the avoidance of a post-pandemic recession. However, the economic statement also acknowledged potential downside scenarios, including the risk of a recession, higher deficits, and increased unemployment.

However, during her presentation of the economic statement, as she described it to be a “responsible fiscal plan,” her remarks were met with laughter.

"The foundation of our Fall Economic Statement is our responsible fiscal plan."

— HoCStaffer (@HoCStaffer) November 21, 2023

**chuckles** pic.twitter.com/9gescID5tn

In response to criticisms from Conservative Leader Pierre Poilievre and NDP Leader Jagmeet Singh, Freeland defended the government’s measures, highlighting the urgency of addressing housing and affordability issues. The economic plan includes initiatives such as a new “Apartment Construction Loan Program,” an additional $1 billion for affordable housing, and a crackdown on short-term rentals.

Poilievre criticized the statements, calling it “disgusting” because it calls for more spending, saying “With this $20 billion of costly new spending, this update can be summed up very simply: prices are up, rent up, debt up, taxes up, time’s up.”

“Common sense Conservatives will vote no confidence on this disgusting scheme. After eight years of this prime minister, he is not worth the cost. And today he’s adding another $20 billion to inflation, which will put pressure on interest rates.”

Conservative Leader Pierre Poilievre reacting to the Liberal government’s Fall Economic Statement: “With this $20 billion dollars of costly new spending…. Conservatives will vote non-confidence on this disgusting scheme.” pic.twitter.com/xUNuZ40V1X

— Paul Mitchell (@PaulMitchell_AB) November 21, 2023

Meanwhile, Singh, the leader of the New Democratic Party (NDP), voiced criticism against the government, arguing that the document falls short of expectations. According to Singh, it is not even a “mini budget” but rather characterized as a “microbudget.” He asserted that the economic plan fails to address the urgency of the challenges Canadians are currently facing and does not adequately meet their needs.

However, Singh promises to still support the statement, marring the Conservatives’ move to vote no confidence in the ruling Liberal party’s initiative.

Breaking…

— Paul Mitchell (@PaulMitchell_AB) November 21, 2023

NDP Leader Jagmeet Singh promises he will support the Liberal government’s Fall Economic Statement, which means the Conservative’s vote of non-confidence is doomed to fail and the Trudeau Liberals will remain in power.

What are your thoughts on sellout-Singh? https://t.co/GsiPR0Z4Wj pic.twitter.com/ovCAUGjO2R

The economic statement also outlines several commitments, including investments in housing, support for labor mobility, and measures to address short-term rentals. Freeland introduced the “Canadian Mortgage Charter” to provide relief for homeowners facing mortgage renewals and outlined efforts to tackle hidden bank fees.

The fiscal update projects a deficit of $40 billion in 2023-24, with subsequent deficits higher than those forecasted in the spring 2023 federal budget. The government’s fiscal anchor, traditionally focused on reducing the net debt-to-GDP ratio, is adjusted to allow for a temporary increase. Freeland emphasized the government’s commitment to maintaining a declining deficit-to-GDP ratio and deficits below one percent of GDP in the coming years.

“Canada is not and has never been broken,” Freeland said, addressing one of Poilievre’s favourite talking points. “We are the imperfect but remarkable creation of generations of Canadians who did their part to build a better country — in good times and in tough times, calloused hand by calloused hand. And generations of Canadians who believed — just as I do, today — that better is always possible.”

Some desperation seems to be surfacing. Actually the Ortis case points to some very deep seated and longstanding concerns in Canadian banking and FI and terror financing, expect to hear more from US nat sec community soon https://t.co/ztz9f4QXEn

— Sam Cooper (@scoopercooper) November 21, 2023

The economic plan also drew reactions from various sectors, with the Federation of Canadian Municipalities expressing reservations about the feasibility of new housing measures, and the Canadian Federation of Independent Business expressing disappointment over the lack of measures to support small businesses.

Information for this briefing was found via CBC, Reuters, CTV, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.