Galaxy Digital (TSX: GLXY) filed their S-4 in respect to their acquisition of Bitgo Holdings in late January. A Form S-4 is required by an acquirer as the company completes its merger or acquisition of a company. If the merger or acquisition is material to the company, they have to file an S-4, which discloses a number of items. In this case, Galaxy provided additional U.S GAAP pro-forma results.

On February 21st, BMO released a note providing their takeaway after reading through the note, saying that the pro-forma GAAP numbers are better than expected and “supports our premium valuation multiple,” though providing a disclaimer that the S-4 has not been declared effective. Therefore, things can be amended and changed before a final version is filled.

Galaxy Digital currently has 3 analysts covering the stock with an average 12-month price target of C$41.67, or a 175% upside to the current stock price. Out of the 3 analysts, 1 has a strong buy rating, 1 has a buy rating and the last analyst has a hold rating on the stock. The street high price target sits at C$48, which represents a 216% upside to the current stock price.

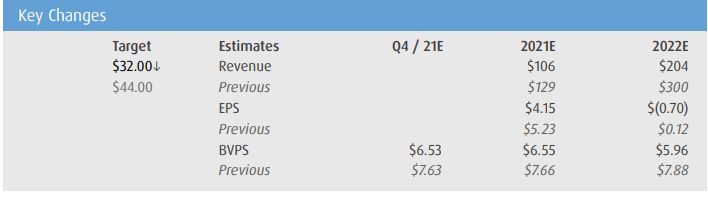

In BMO’s note, they reiterate their outperform rating on the stock but lower their 12-month price target on Galaxy Digital to a C$32 from C$44. This price target reduction looks to be because of the switch from Canada’s IFRS to U.S GAAP.

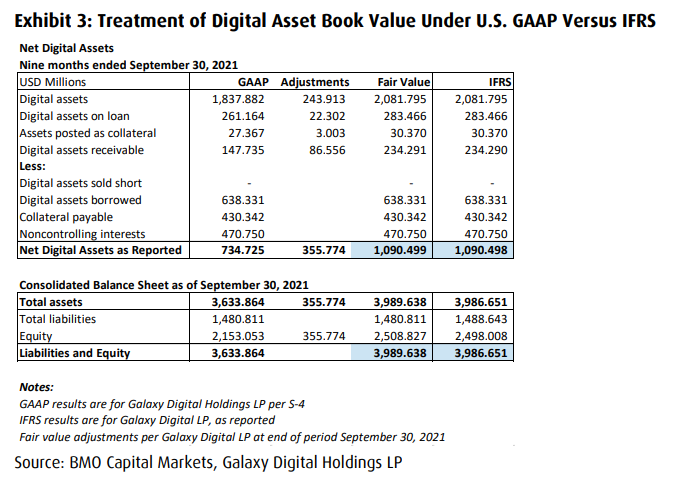

This impacts the company directly as there are very limited precedents for digital asset accounting and no official guidance by the SEC. Under IFRS, Galaxy was able to treat digital assets like commodities and would report them as inventory. This means the company was able to record the digital assets at fair market value. They would be able to report changes in fair value, impacting the net profit/loss of the company heavily in this case.

Under U.S GAAP, digital assets are treated as indefinite-lived intangible assets and not financial instruments. This means that the companies record the asset at cost, and if the asset goes below the carrying value then they have to impair it. This does not work in the opposite way, where if the asset gains value, there is no gain recorded unless the asset gets sold.

BMO says that because of this accounting change, it puts Galaxy in an interesting position and says, “As a result, we continue to see uncertainty and risk that changes to regulations or accounting changes could once again change Galaxy’s financial reporting.”

Outside of this accounting change, the pro-forma results reported in the S-4 show that BitGo’s monetization rate has been exceeding their expectations. BitGo’s financial statements show that on a 9-month basis, the company saw operating revenue of $70 million, up 221% year over year.

Below you can see BMO’s updated full-year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.