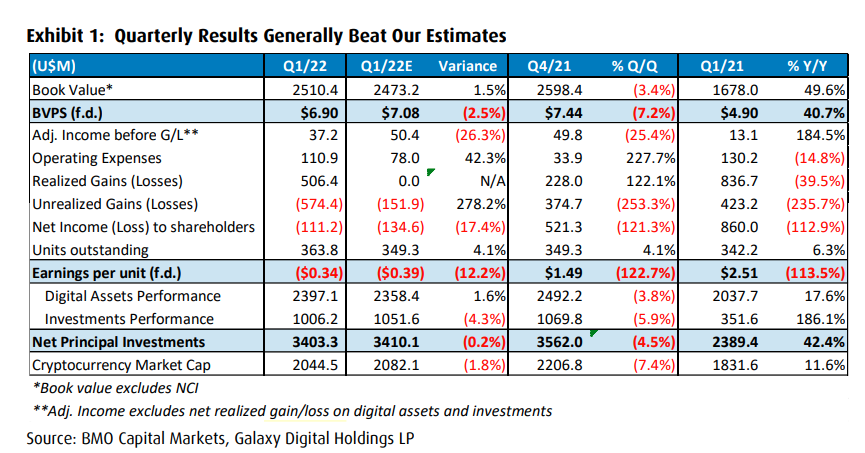

Galaxy Digital (TSX: GLXY) reported its first quarter financial results on Monday. The company said it reported a total income of $543.56 million, which included $11.87 million in advisory and management fees, up from $1.9 million a year ago. While the company reported $354.98 million in net realized gains on its digital asset portfolio, this is roughly half of what it was a year ago, as crypto has followed the equity market in shedding some previous gains. The company also saw its net gain on investments go from $151.14 million to $69.44 million.

Though the company reported unrealized losses in both its digital assets and investments for a total of roughly $575 million. This brought the company’s net income to ($111.2) million or earnings per share of ($0.34).

The company ended the quarter with $2.265 billion worth of digital assets on its balance sheet, not including roughly $233 million of digital asset receivables. They note that their trading business saw 50 new counterparties onboard to their trading platform, while on a sequential basis the counterparty trading volume is down 30%, but on a year-over-year basis its up 50%.

Galaxy Digital currently only has 3 analysts covering the stock with an average 12-month price target of C$24.33, which represents a 131% upside to the current stock price. Out of the analysts, 1 has a strong buy rating, 1 has a buy rating and the last analyst has a hold rating on the stock. The street high price target sits at C$37, which is a 260% upside to the current stock price.

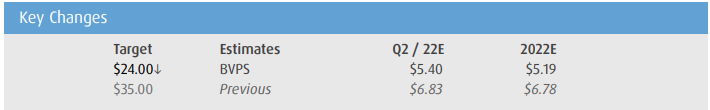

In BMO Capital Markets’ note on the results, they reiterate their outperform rating but lower their 12-month price target from C$35 to C$24, saying the price target now reflects a market correction and introduces recession risks. Though they write, “We continue to take a long-term view on cryptocurrencies and blockchain with Galaxy our top public market play.”

The biggest takeaway from the company’s financial results and earnings call is that Galaxy’s management team expects a recession and for market weakness to stay around for a number of quarters. The company’s CEO said that he believes the “difficult market environment” will continue for a number of quarters and eventually head into a recession, though he believes Bitcoin will see support at US$30,000 and ether at US$2,000.

Despite the management commentary, BMO says that Galaxy has seen continued support in its asset management business as more institutional investors take a chance on Web 3.0 and the Metaverse. The company also saw its venture franchise AUM grow to $735 million while its Vision Hill Venture Fund of Funds II closed its first $70 million raise.

BMO expects that Galaxy’s US listing to be delayed until after the mid-term elections, though they note that this is most likely a crypto-wide delay and not Galaxy specific in this case. As BMO notes that other companies like Bullish, eToro, and Circle have all seen delays in their U.S listing applications.

On the results, BMO says that they were mainly in line with how the entire crypto market did in the first quarter. They say that the results were driven by a 7% quarter-over-quarter decrease in the crypto market while the book value of their digital assets was down 3% during the same period. They have calculated that book value per share is down 7% quarter over quarter to $6.90.

Below you can see BMO’s updated estimates on Galaxy.

Information for this briefing was found via Sedar and Shopify. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.