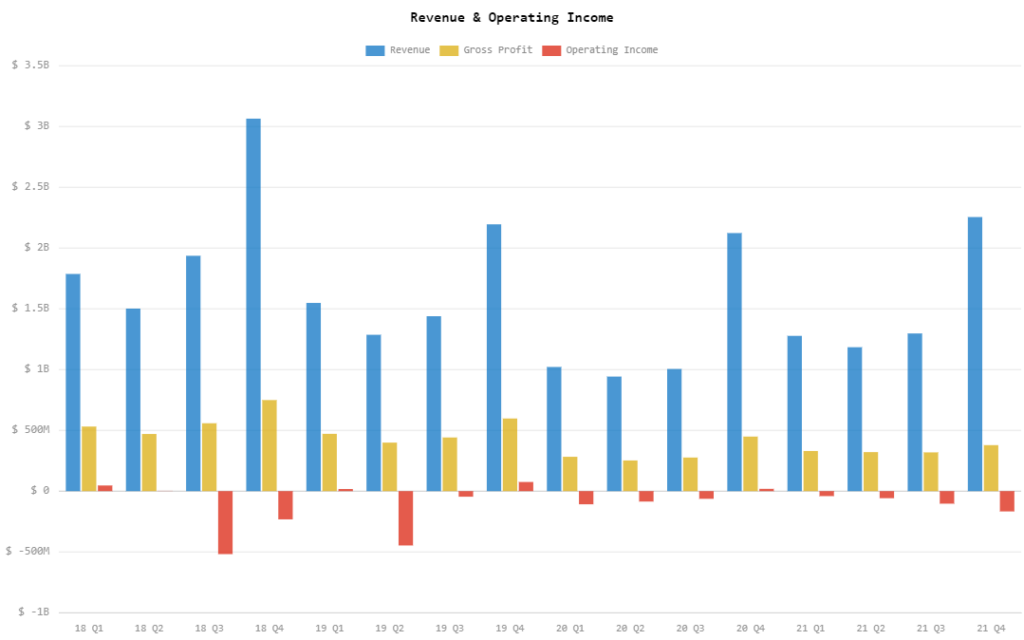

GameStop Corp (NYSE: GME) last night released its financial results for Q4 and full-year 2021. While the firm beat the consensus for revenue estimates, it pretty much missed everything else.

For the quarter, the company recorded US$2.25 billion, beating the consensus US$2.16 billion and also an increase from Q3 2021’s US$1.30 billion and Q4 2020’s US$2.12 billion.

However, gross margin came down to 16.8% this quarter from last quarter’s 24.6% and last year’s 21.1%. This also missed the consensus of 24.6%.

$GME Actuals vs. Consensus pic.twitter.com/v5AzSQySiW

— Consensus Gurus (@ConsensusGurus) March 17, 2022

The largest misses came in at the bottom line. While the consensus projected an operating income, the firm recorded an operating loss of US$166.8 million.

Following the earnings release, the firm’s shares dropped by as much as 15% post-closing bell on Thursday, but some are still wondering why.

"No reason", other than the fact that the company just shat the bed on its quarterly results. 🤡 https://t.co/rEWsLKkMMO

— Keubiko🇺🇦 (@Keubiko) March 17, 2022

Further down, the company ended the quarter with a net loss of US$147.5 million, down from the US$105.4 million net loss last quarter and the US$80.5 million net income for the same comparable period last year. The quarterly loss translates to US$1.94 per share.

Calibrating for financial items, the firm’s adjusted EBITDA came in at a loss of US$126.9 million, missing the consensus of a positive figure at US$92 million.

For fiscal year 2021, the firm also increased its revenue to US$6.01 billion from 2020’s US$5.09 billion. However, it also recorded a wider net loss of US$381.3 million from last year’s net loss of US$215.3 million.

Adjusted EBITDA for the year also came in at a loss of US$236.9 million, down from a loss of US$149.4 million last year.

The company ended the quarter with US$1.27 billion in cash and cash equivalents. This puts the balance of the current assets at US$2.60 billion while current liabilities ended at US$1.35 billion.

Apes, you have to do your duty and move up Gamestop on nothing!!!

— Jim Cramer (@jimcramer) March 17, 2022

In October 2021, the company terminated its chief operating officer Jenna Owens just 7 months into the position. The role is said to be absorbed by other members of the management team.

GameStop last traded at $87.70 on the NYSE.

Information for this briefing was found via Edgar and GameStop Corp. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The Economy That Cried Wolf (Of Wall Street)

(title card concept stolen from Martin Scorsese and Jesse Hawken) This past March, when the...