There wasn’t a lot of new information in last week’s news about fraud charges against Gary Ng; former Chairman of PI Financial. The charges of fraud over $5,000 and money laundering are related to IIROC findings in November of 2020 that Mr. Ng’s 2018 all-cash purchase of PI was made with the proceeds of loans he obtained by falsifying the documents that demonstrated the collateral for the loans.

And, despite extensive reports from IIROC and PriceWaterhouseCoopers, there are still some massive gaps in our understanding of how all of this happened and the broader impacts it might have on the market and the economy. The one revelation that Globe and Mail‘s Greg McArthur was apparently able to drag out of the RCMP’s Integrated Market Enforcement Team (IMET), is that the firms who now own PI; Vancouver’s RCM Capital, and Miami’s HIG Capital, are the same two firms that were the alleged victims of Ng’s fraud.

Deep Dive searches of Ontario court registries were unable to locate any information on the criminal charges against Ng, or related civil charges against commercial lender Bridging Finance Inc. The Globe and Mail is reporting those charges based on a statement made by the RCMP.

Outside of The Globe, who have been all over it, Ng and Bridging have seen very little coverage in the mainstream press, and almost none in the mainstream financial press. Bloomberg BNN’s item about the fraud charges consists of a re-ran clip of Andrew Bell that appears to have been produced in November of 2021, shortly after the IIROC findings dropped.

Bell seemed perplexed at how the young wunderkind, who had been on BNN a few times since his $100 million purchase of PI, could stand accused by IIROC of obtaining and laundering $172 million through fraud. The station couldn’t be bothered to produce a new segment about the fraud charges, and running the old one telegraphs the notion that Ng is old news, and it’s time to move on.

But around the time Ng was aggressively buying Canadian financial institutions, he was given prime billing on BNN, and came off like a living representation of the opportunity available in this great meritocracy. He was cheerful and polite, with a winning smile and some polished nonsense about how full service brokers had to compete with the big banks by offering custom solutions to clients, etc., etc.

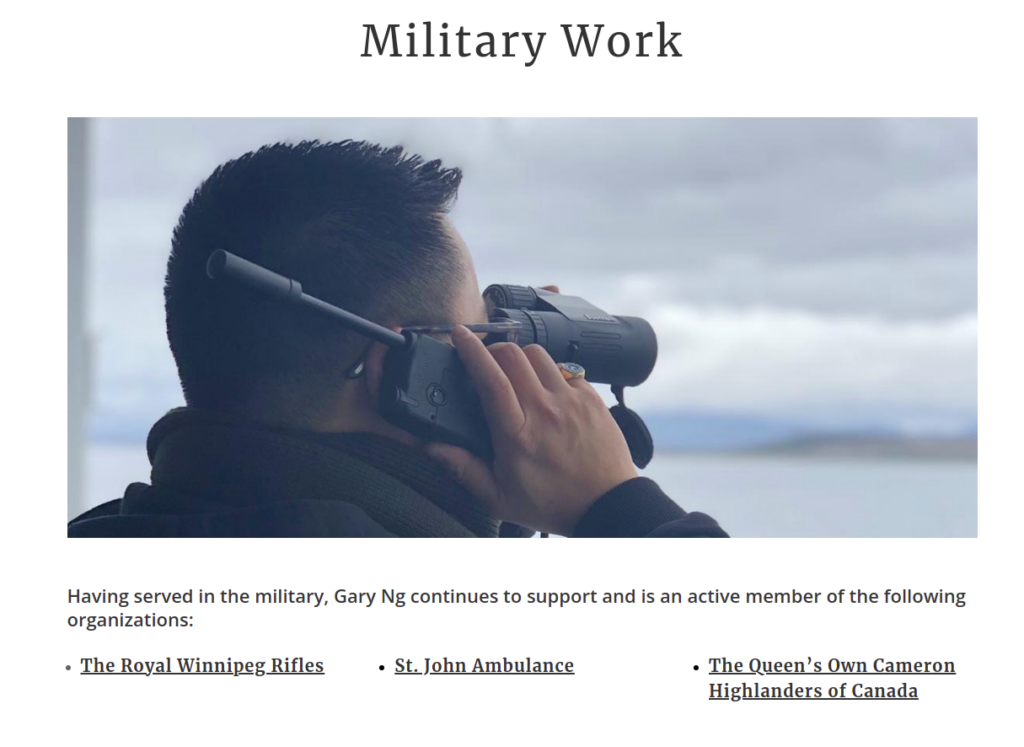

His website (still available here) is a shameless self-showcase with the sort of fininspirational garbage that is generally produced by your standard LinkedIN / Instagram clout-chasing, self-described “entrepreneur,” and a questionable claim of military service for good measure.

But when someone shows up with $100 million in cash to buy a full service brokerage firm, nobody cares if he’s cringe.

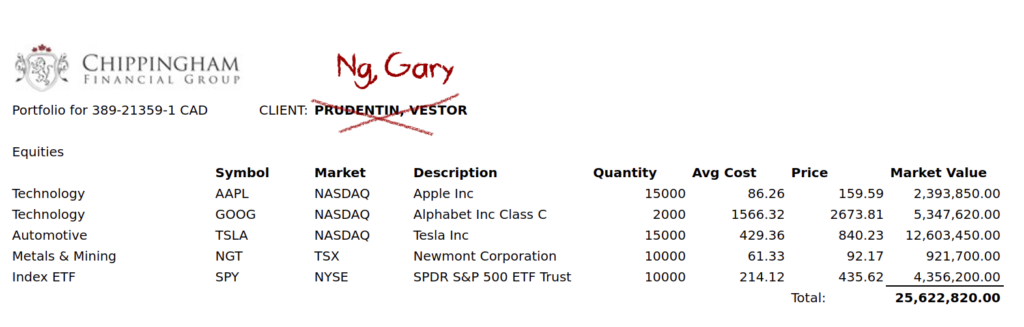

The timeline of events in the IIROC findings that led to Ng losing his securities license in November of 2020 start in November of 2018, when Ng borrowed $80 million from “Lender One.” As collateral, Ng pledged the securities in a personal securities account that he held at his own securities firm, Chippingham Financial. The account had an approximate market value of $27 million.

Around the same time, Ng borrowed $20 million from “Lender Two,” against the same accounts. He then used the $100 million in loan proceeds to buy PI Financial from its employees, who owned it at the time, became the firm’s Chairman, and started going on TV.

Manifesting $100 million in loans from $27 million worth of securities is a crafty feat of entrepreneurship, but it’s pedestrian compared to the fact that the $27 million in securities didn’t even exist.

Ng had doctored screenshots of client accounts that did hold securities valued in the $20 millions to look like they were his own accounts, and pledged those accounts as collateral against both loans. With the alleged help of another Chippingham (and later PI) Executive, Donald Metcalfe, Ng kept up the charade by emailing updated “account statements” to the lenders on request. The statements showed fluctuations in the value of the securities between $20 million and $27 million as one might expect out of a real account.

A full service brokerage firm like PI, with $4.5 billion of assets under management, and access to the base layer of the Canadian capital markets, could surely generate enough income to its sole owner that he could make the payments on that $100 million in loans, affording a borrower an opportunity to close out the loan before anyone found out he had invented the collateral. But anyone who expected young Mr. Ng to quit while he was ahead just doesn’t understand the aggressive stance that an entrepreneur needs to have if he’s going to seize opportunity.

Ng spent the next few months in a convoluted scheme with Bridging Finance that saw him borrowing another $52 million or so from the commercial lender, and using part of it to buy a 50% stake in Bridging itself. The documents being produced by Bridging’s in-process receivership are the best window any civilian has into all of this, and The Dive will have a whole lot more on Bridging in a coming post, so stay tuned.

Here in this post, it’s July of 2019, and Lender Two is emailing Gary Ng to ask him if he could please explain why a search of Manitoba Personal Properties Security Act (PPSA) records shows the same two securities accounts that Gary Ng pledged against the $20 million they loaned him to buy PI pledged to another lender?

Woops! Must be some mistake, says Ng. You see… when all these Chippingham accounts were moved over to PI, the accounts’ numbers were… um… they aren’t the same anymore… and that pledge is… um… let’s just get that taken care of!

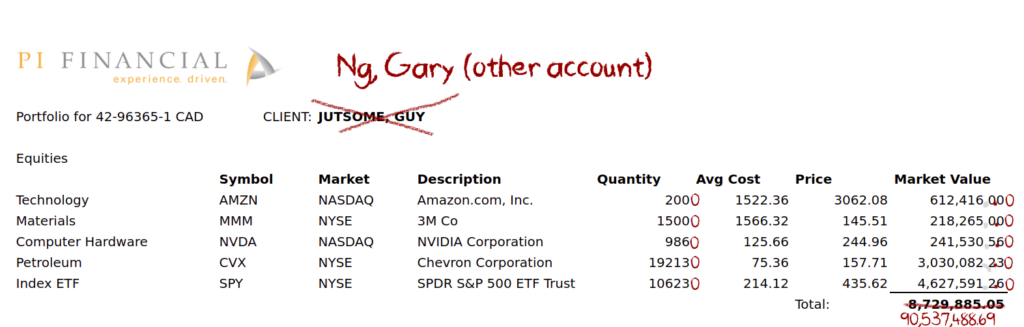

Ng sent a newly-doctored set of account statements to Lender Two who, presumably, thought that it all looked on the up and up, because they proceeded to lend him another $20 million to buy the aforementioned 50% stake in Bridging, against the collateral in “his other account,” a PI trading account with a market value of $90.5 million.

The account actually had $8.6 million in it, and didn’t belong to Ng, who presumably doctored the account’s sums as well this time, not just the names. According to IIROC, he continued to email these doctored statements to both Lender One and Lender Two on a monthly basis, neither of whom found any problem with any of this.

“Carol, could you please go into the files and get the Ng proof-of-collateral and the Lindbergh baby?”

Lenders aren’t forensic accountants, but they presumably employ due diligence teams, who presumably received monthly updates on these collateral accounts from Ng and Metcalfe without any complaint. A real account with a changed name is an easy fake to keep up. So long as the account’s real owner doesn’t liquidate or run into some bad luck, a scammer an entrepreneur can just keep changing the name on the statement from the real account to his own every month.

But an account with doctored totals takes a lot of upkeep. Ng and Metcalf couldn’t have just changed the total on an $8.6 million account to $90.5 million, because the value of the individual securities in the account wouldn’t have added up. Changing the line items or share totals would have made it add up at first, but the wholesale changes that kept the “account” consistent from month to month in a way that could fool even the most basic examination of one month against the next is more work than we could reasonably expect out of Ng, so the amount of due diligence being done on the tens of millions that these firms invested in Ng is something we’re curious about.

But whatever Ng and Metcalfe cooked up as proof of collateral was good enough for Lender Two, who backed Ng’s purchase of half of Bridging which, as we mentioned, is a related mess that we’ll be covering soon. Ng got pretty quiet in February of 2020, when Bridging suspended redemptions. His name next popped up in July of 2020, when PI Financial was acquired from the Ng Group of Companies by H.I.G. Capital and RCM Capital Management, under terms that were not disclosed.

The Globe and Mail story about fraud charges against Ng identifies H.I.G. Capital and RCM Capital as the Lender One and Lender Two referred to in the IIROC report, and PricewaterhouseCoopers’ receivership reports from the Bridging case confirm that RMC and H.I.G. made the loans that enabled Ng’s “all cash” purchase of PI Financial, that they would later buy back off of Ng for terms undisclosed, six months before he was accused of fraud this past January.

RMC Capital in particular played an aggressive role in the later stages of Bridging’s demise, after finding itself in a position of incredible leverage following the February 2020 revelations that Ng’s collateral wasn’t what he said it was. We’ve gone through the material and are ready to lay it all out in a linear narrative, so keep it locked on The Dive.

Information for this story was found via the Globe and Mail, BNN Bloomberg and the other sources mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

The Trustee has uploaded some updates including two civil cases that against Ng.

The Deep Dive could not ascertain if this “screencap from Gary.ng shows Admiral Ng calling in an air strike… or an application for a loan.”. This was classic. I laughed so hard

Thanks for reading!

great story thanks